Will the Standard Deduction Change in 2025?

Related Articles: Will the Standard Deduction Change in 2025?

- 2025 Chevrolet Equinox: A Comprehensive Overview Of The Redesigned SUV

- Super Bowl 2024: How To Watch The Big Game For Free

- The All-New BMW X3: A Symphony Of Luxury, Performance, And Technology

- Jeep Wrangler 2025: The Future Of Off-Roading

- Hyundai Tucson Limited Tech 2025: The Pinnacle Of Automotive Innovation

Introduction

With great pleasure, we will explore the intriguing topic related to Will the Standard Deduction Change in 2025?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Will the Standard Deduction Change in 2025?

Will the Standard Deduction Change in 2025?

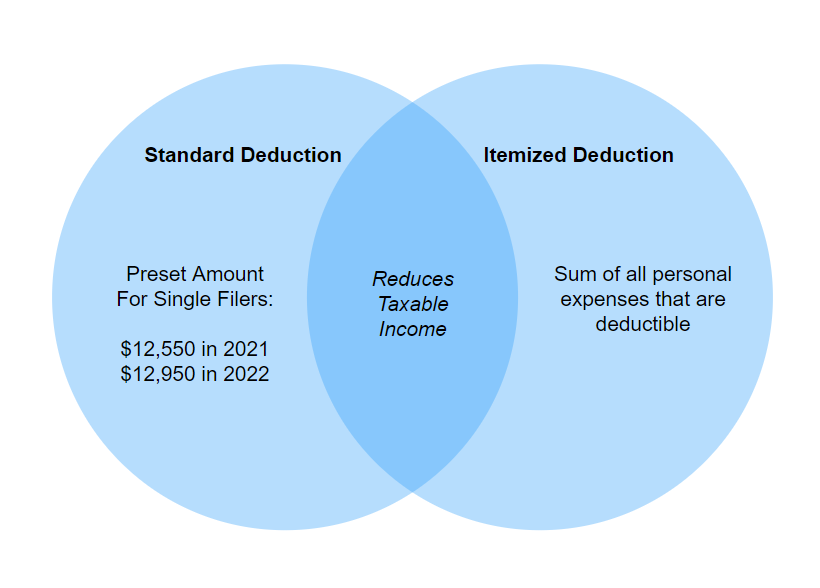

The standard deduction is a specific amount that you can deduct from your taxable income before you calculate your taxes. It is a dollar-for-dollar reduction, meaning that it reduces your taxable income by the full amount of the deduction. The standard deduction varies depending on your filing status and is adjusted annually for inflation.

For 2023, the standard deduction amounts are as follows:

- Single: $13,850

- Married filing jointly: $27,700

- Married filing separately: $13,850

- Head of household: $20,800

The standard deduction is a valuable tax break, as it can significantly reduce your taxable income. However, the standard deduction is not available to everyone. If you itemize your deductions, you cannot also claim the standard deduction.

Will the Standard Deduction Change in 2025?

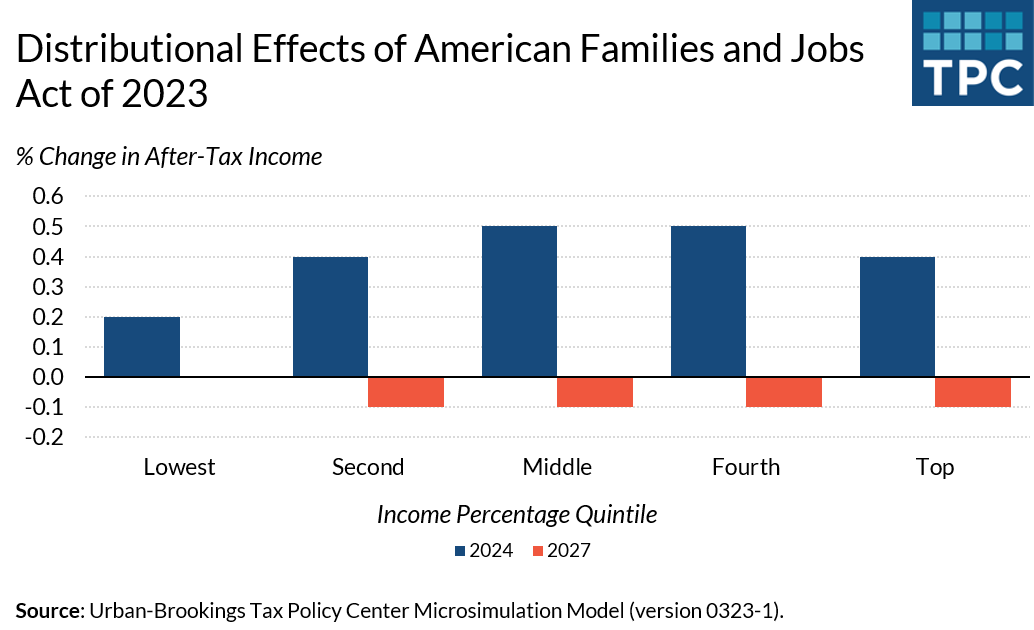

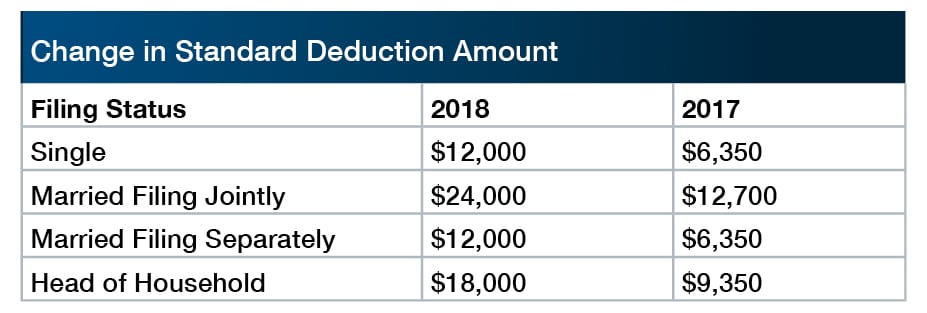

The standard deduction is set to change in 2025. The Tax Cuts and Jobs Act of 2017 (TCJA) temporarily increased the standard deduction amounts for 2018 through 2025. However, the TCJA did not make these increased amounts permanent.

As a result, the standard deduction amounts are scheduled to revert to their pre-TCJA levels in 2026. This means that the standard deduction for 2026 will be:

- Single: $12,950

- Married filing jointly: $25,900

- Married filing separately: $12,950

- Head of household: $19,400

This change could have a significant impact on your taxes. If you are currently claiming the standard deduction, you may want to consider itemizing your deductions in 2026 to see if you can save more money on your taxes.

What Can You Do to Prepare for the Change?

If you are concerned about the impact of the standard deduction change, there are a few things you can do to prepare:

- Review your itemized deductions. Determine which deductions you are currently itemizing and whether you will still be able to itemize them in 2026.

- Estimate your taxable income. Calculate your estimated taxable income for 2026, both with and without the standard deduction. This will help you determine how much the change will affect your taxes.

- Consider making changes to your financial plan. If you are planning to retire in 2026 or later, you may want to consider making changes to your financial plan to account for the lower standard deduction.

The standard deduction is a valuable tax break, but it is important to be aware of the changes that are scheduled to take effect in 2026. By planning ahead, you can minimize the impact of these changes on your taxes.

Additional Resources:

- IRS Publication 501: Exemptions, Standard Deduction, and Filing Information

- IRS Topic No. 152: Standard Deduction

- Tax Foundation: Standard Deduction

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg)

Closure

Thus, we hope this article has provided valuable insights into Will the Standard Deduction Change in 2025?. We hope you find this article informative and beneficial. See you in our next article!