Vanguard Target Retirement 2025 TR II: A Comprehensive Guide

Related Articles: Vanguard Target Retirement 2025 TR II: A Comprehensive Guide

- Ash Wednesday 2024 In Australia: A Time For Reflection And Renewal

- Winter Classic 2025: A Spectacle On Ice

- 2025 9th Ave, 1U59: A Coveted Address In Seattle’s Vibrant University District

- 2025 World Masters Games: A Sporting Extravaganza For Athletes Of All Ages

- Fred The Groundhog Predicts Six More Weeks Of Winter In 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Vanguard Target Retirement 2025 TR II: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Vanguard Target Retirement 2025 TR II: A Comprehensive Guide

Vanguard Target Retirement 2025 TR II: A Comprehensive Guide

Introduction

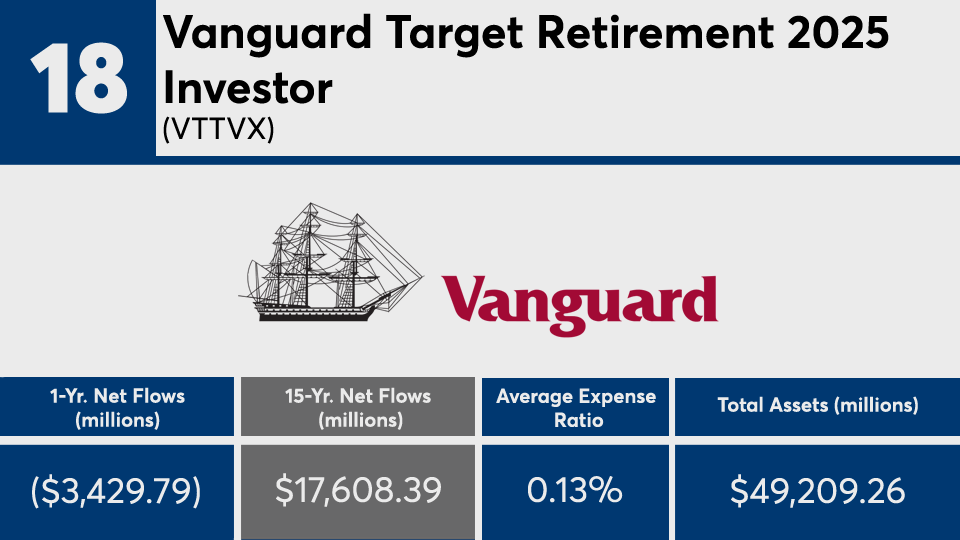

The Vanguard Target Retirement 2025 TR II (VTWNX) is a target-date fund designed for investors who plan to retire around 2025. This fund automatically adjusts its asset allocation over time, becoming more conservative as the target retirement date approaches. This makes it a convenient and hands-off option for investors who want a diversified portfolio that aligns with their retirement timeline.

Asset Allocation

As of March 31, 2023, VTWNX’s asset allocation is as follows:

- Stocks: 59.5%

- Bonds: 36.3%

- International Stocks: 28.1%

- US Stocks: 25.9%

- Cash and Equivalents: 4.2%

The fund’s stock allocation is diversified across a variety of sectors and industries. The largest sector allocations are:

- Information Technology: 19.8%

- Health Care: 14.3%

- Financials: 12.9%

- Consumer Discretionary: 11.4%

- Industrials: 10.2%

The fund’s bond allocation is primarily invested in US Treasury bonds and investment-grade corporate bonds.

Glide Path

VTWNX’s glide path is designed to gradually reduce the fund’s exposure to stocks and increase its exposure to bonds as the target retirement date approaches. The following table shows the fund’s expected asset allocation at various stages of the glide path:

| Year | Stocks | Bonds | International Stocks | US Stocks |

|---|---|---|---|---|

| 2023 | 59.5% | 36.3% | 28.1% | 25.9% |

| 2028 | 50.8% | 45.0% | 24.3% | 22.1% |

| 2033 | 42.1% | 53.7% | 20.5% | 18.3% |

| 2038 | 33.4% | 62.4% | 16.7% | 14.6% |

| 2043 | 24.7% | 71.1% | 12.9% | 11.0% |

Fees and Expenses

VTWNX has a net expense ratio of 0.15%. This means that for every $10,000 invested in the fund, you would pay $15 in annual fees.

Performance

VTWNX has a strong track record of performance. Over the past 10 years, the fund has returned an average of 7.5% per year.

Suitability

VTWNX is a suitable investment for investors who:

- Plan to retire around 2025

- Want a diversified portfolio that automatically adjusts over time

- Are comfortable with a moderate level of risk

- Are willing to pay a low expense ratio

Alternatives

There are several other target-date funds that investors may want to consider as alternatives to VTWNX. These include:

- Fidelity Freedom Index 2025 Fund (FDEWX)

- T. Rowe Price Retirement 2025 Fund (TRRIX)

- iShares Core Target Retirement 2025 ETF (IVV)

Conclusion

Vanguard Target Retirement 2025 TR II is a well-managed target-date fund that can provide investors with a convenient and hands-off way to prepare for retirement. The fund’s glide path is designed to gradually reduce risk as the target retirement date approaches, and its low expense ratio makes it an attractive option for cost-conscious investors.

Closure

Thus, we hope this article has provided valuable insights into Vanguard Target Retirement 2025 TR II: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!