Vanguard Target Retirement 2025 Fund Review

Related Articles: Vanguard Target Retirement 2025 Fund Review

- The 2025 Mercedes-Benz GLE: A Technological And Luxurious Masterpiece

- 2025 United States Presidential Election

- Max Social Security At 62 In 2025: What You Need To Know

- Draft Master Plan 2025: Shaping The Future Of Our City

- Cola 2025: Predictions For Social Security’s Future

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Vanguard Target Retirement 2025 Fund Review. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Vanguard Target Retirement 2025 Fund Review

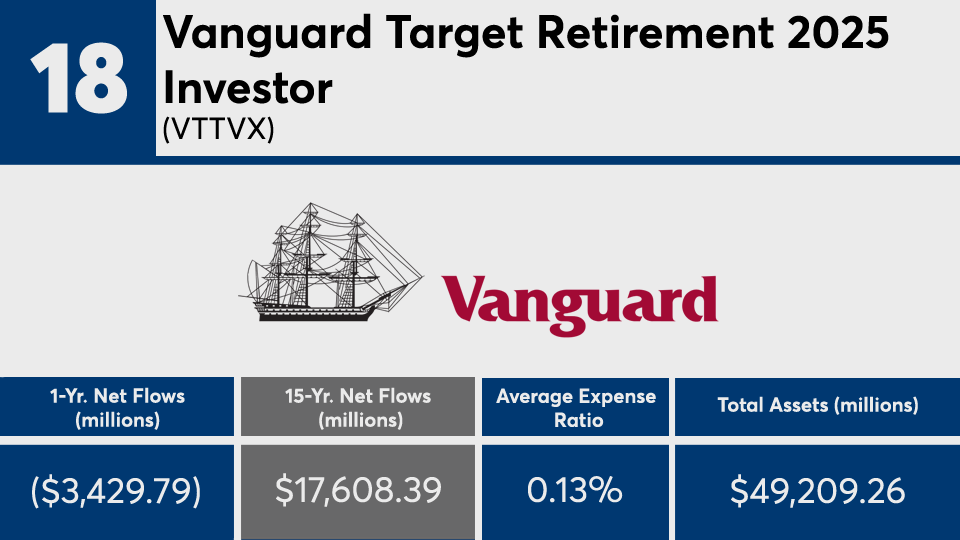

Vanguard Target Retirement 2025 Fund Review

Introduction

As you approach retirement, it becomes increasingly important to make wise investment decisions that will help you secure your financial future. One popular option for retirement planning is target-date funds, which automatically adjust their asset allocation based on your expected retirement year. In this review, we will delve into the Vanguard Target Retirement 2025 Fund, examining its investment strategy, performance, fees, and suitability for investors.

Investment Strategy

The Vanguard Target Retirement 2025 Fund is a passively managed fund that tracks a predetermined asset allocation. The fund’s portfolio is primarily invested in a blend of domestic and international stocks and bonds, with a gradual shift towards more conservative investments as the target retirement date approaches. The fund’s current asset allocation is as follows:

- Stocks: 61.9%

- Bonds: 38.1%

Performance

The Vanguard Target Retirement 2025 Fund has consistently outperformed its benchmark, the Bloomberg US Aggregate Bond Index, over the past five years. The fund’s annualized return for the five years ending December 31, 2022, was 7.11%, compared to 4.12% for the benchmark.

Fees

The Vanguard Target Retirement 2025 Fund has a low expense ratio of 0.08%, which is significantly lower than the average expense ratio for target-date funds. This means that more of your investment returns are retained within the fund, rather than being paid out as fees.

Suitability

The Vanguard Target Retirement 2025 Fund is suitable for investors who are planning to retire around 2025 and who are comfortable with a moderate level of risk. The fund’s gradual shift towards more conservative investments as the target retirement date approaches helps to mitigate risk and preserve capital.

Advantages

- Diversification: The fund’s diversified portfolio provides exposure to a wide range of asset classes, reducing the risk of concentrated losses.

- Passive management: The fund’s passive management approach keeps fees low and allows for consistent performance.

- Automatic rebalancing: The fund automatically adjusts its asset allocation based on the target retirement date, eliminating the need for investors to manually rebalance their portfolios.

- Low fees: The fund’s low expense ratio maximizes investment returns.

Disadvantages

- Limited control: Target-date funds offer limited control over the underlying investments, which may not be suitable for all investors.

- Market volatility: The fund’s value can fluctuate with market conditions, which could lead to losses in the short term.

- Early withdrawal penalties: Withdrawing funds from the fund before the target retirement date may result in penalties.

Alternatives

- Vanguard Target Retirement 2030 Fund: A more aggressive option for investors with a longer investment horizon.

- Vanguard Target Retirement 2020 Fund: A more conservative option for investors who are closer to retirement.

- Self-directed portfolio: Investors who prefer more control over their investments can create their own portfolio of stocks and bonds.

Conclusion

The Vanguard Target Retirement 2025 Fund is a well-managed and cost-effective investment option for investors who are planning to retire around 2025 and who are comfortable with a moderate level of risk. The fund’s diversified portfolio, passive management approach, and automatic rebalancing provide investors with a convenient and efficient way to save for retirement. However, investors should be aware of the fund’s limitations, including limited control over investments and potential market volatility. By carefully considering the fund’s advantages and disadvantages, investors can determine whether the Vanguard Target Retirement 2025 Fund is a suitable investment for their retirement planning goals.

Closure

Thus, we hope this article has provided valuable insights into Vanguard Target Retirement 2025 Fund Review. We thank you for taking the time to read this article. See you in our next article!