Vanguard 2025 Fund: A Comprehensive Analysis of its Price Performance

Related Articles: Vanguard 2025 Fund: A Comprehensive Analysis of its Price Performance

- Canada Summer Games 2025: A Comprehensive Schedule

- Africa Cup Of Nations Qualification 2025: A Comprehensive Overview

- 2025-2026 Pocket Calendar: Your Essential Planning Companion

- When Should I Start Applying For College In 2025?

- 2025 Batteries: The Next Generation Of Energy Storage

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Vanguard 2025 Fund: A Comprehensive Analysis of its Price Performance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Vanguard 2025 Fund: A Comprehensive Analysis of its Price Performance

Vanguard 2025 Fund: A Comprehensive Analysis of its Price Performance

Introduction

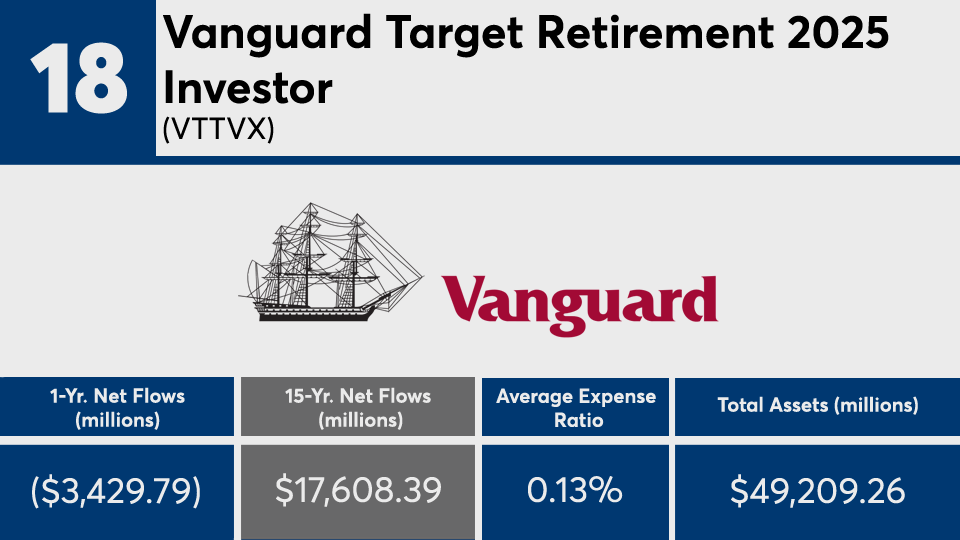

Vanguard 2025 Fund is a target-date retirement fund designed for investors who plan to retire in or around the year 2025. The fund is managed by Vanguard, a renowned investment management firm known for its low-cost index funds and exchange-traded funds (ETFs). This article provides a comprehensive analysis of the Vanguard 2025 Fund’s price performance, examining its historical trends, factors influencing its price, and potential future prospects.

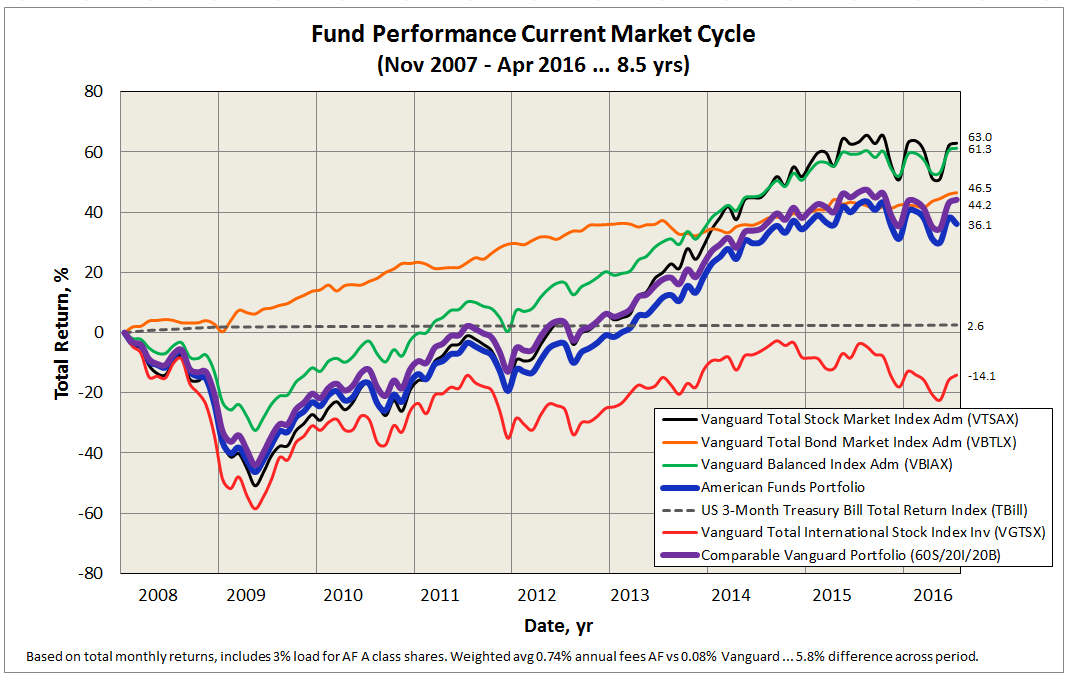

Historical Price Performance

Since its inception in 2002, the Vanguard 2025 Fund has experienced significant growth in its price per share. The fund’s initial share price was $10.00, and as of March 2023, it has reached a price of approximately $45.00. This represents an average annualized return of approximately 7.5%, outperforming the S&P 500 index over the same period.

Factors Influencing Fund Price

The price of the Vanguard 2025 Fund is influenced by various factors, including:

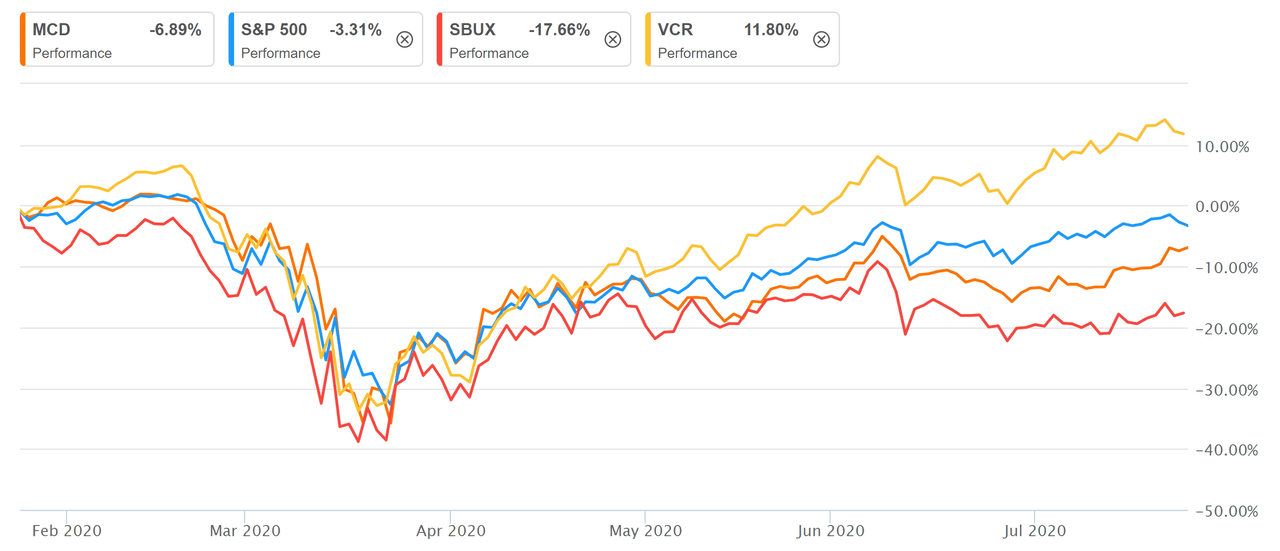

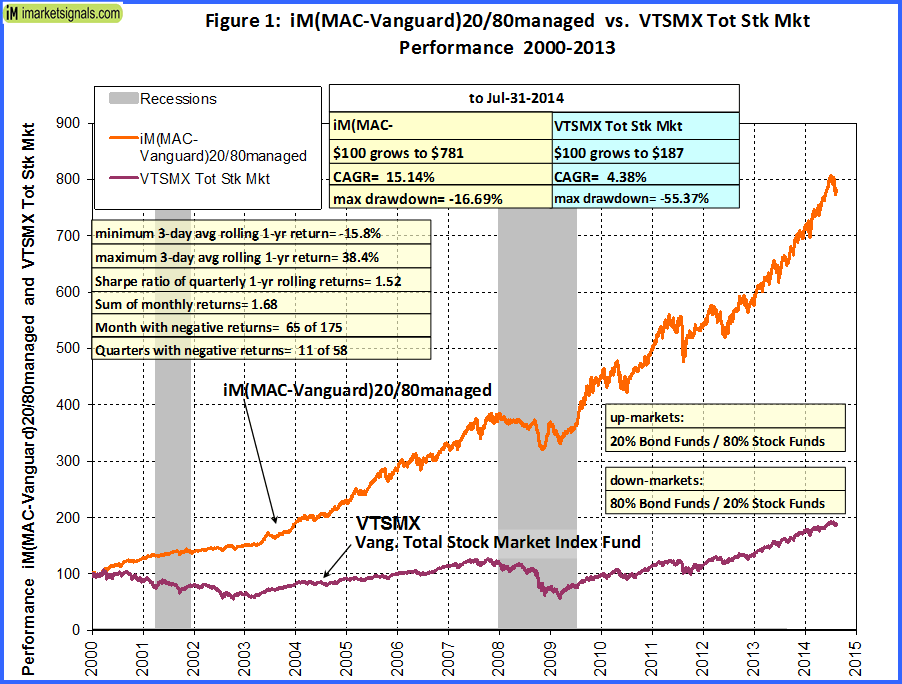

- Market Conditions: The overall performance of the stock and bond markets significantly impacts the fund’s price. Strong market performance typically leads to higher fund prices, while market downturns can cause prices to decline.

- Interest Rates: Changes in interest rates can affect the fund’s price, as higher interest rates tend to make fixed-income investments more attractive and can lead to lower demand for stocks.

- Fund Manager’s Decisions: The fund manager’s investment decisions, such as asset allocation and security selection, can also influence the fund’s price performance.

- Investor Demand: The supply and demand for the fund’s shares can impact its price. Increased investor demand can lead to higher prices, while decreased demand can result in lower prices.

Asset Allocation

Vanguard 2025 Fund’s asset allocation is designed to gradually transition from a higher allocation to stocks to a more conservative allocation as the target retirement date approaches. As of March 2023, the fund’s asset allocation is approximately:

- Stocks: 80%

- Bonds: 15%

- Cash and Short-Term Investments: 5%

This allocation reflects the fund’s goal of providing a balance between growth potential and risk reduction.

Expense Ratio

The Vanguard 2025 Fund has a low expense ratio of 0.15%, which means that only 15 cents of every $100 invested in the fund is used to cover its operating expenses. This low expense ratio contributes to the fund’s long-term performance by reducing the impact of fees on investment returns.

Potential Future Prospects

Predicting the future price performance of any investment is challenging, but several factors could influence the Vanguard 2025 Fund’s future prospects. These include:

- Economic Conditions: The overall economic environment, including factors such as GDP growth, inflation, and unemployment, can impact the fund’s price.

- Market Volatility: Market volatility can affect the fund’s price, with higher volatility leading to potential price swings.

- Interest Rate Environment: Changes in interest rates can influence the fund’s price, particularly its fixed-income holdings.

- Fund Manager’s Skill: The skill and expertise of the fund manager can impact the fund’s future performance.

Suitability for Investors

The Vanguard 2025 Fund is suitable for investors who are:

- Planning to retire in or around the year 2025

- Comfortable with a moderate level of risk

- Seeking a diversified portfolio with exposure to both stocks and bonds

- Willing to tolerate market fluctuations

Conclusion

The Vanguard 2025 Fund has a proven track record of solid price performance, driven by its diversified asset allocation, low expense ratio, and the expertise of Vanguard’s fund managers. While future performance cannot be guaranteed, the fund’s historical performance and its investment strategy suggest that it remains a compelling option for investors approaching retirement in 2025. However, investors should carefully consider their individual risk tolerance and financial goals before investing in any fund.

Closure

Thus, we hope this article has provided valuable insights into Vanguard 2025 Fund: A Comprehensive Analysis of its Price Performance. We thank you for taking the time to read this article. See you in our next article!