The IRMAA Brackets for 2025: Understanding the Medicare Income-Related Monthly Adjustment Amount

Related Articles: The IRMAA Brackets for 2025: Understanding the Medicare Income-Related Monthly Adjustment Amount

- Dodge Charger Price 2025: A Comprehensive Analysis

- Vanguard 2025 Fund: A Comprehensive Analysis Of Its Price Performance

- Celebrity Ascent 2025: The Future Of Fame And Influence

- 2025 50th St N: A Modern Masterpiece Residing In The Heart Of Sarasota

- Washington Huskies Football Schedule 2025: A Season Of Challenges And Opportunities

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The IRMAA Brackets for 2025: Understanding the Medicare Income-Related Monthly Adjustment Amount. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about The IRMAA Brackets for 2025: Understanding the Medicare Income-Related Monthly Adjustment Amount

The IRMAA Brackets for 2025: Understanding the Medicare Income-Related Monthly Adjustment Amount

Introduction

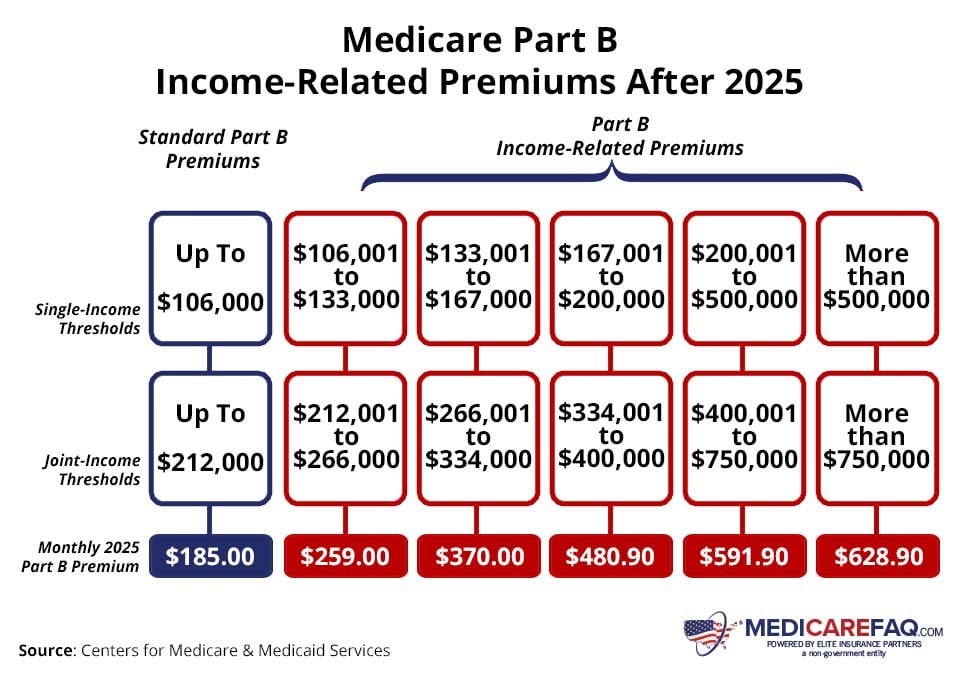

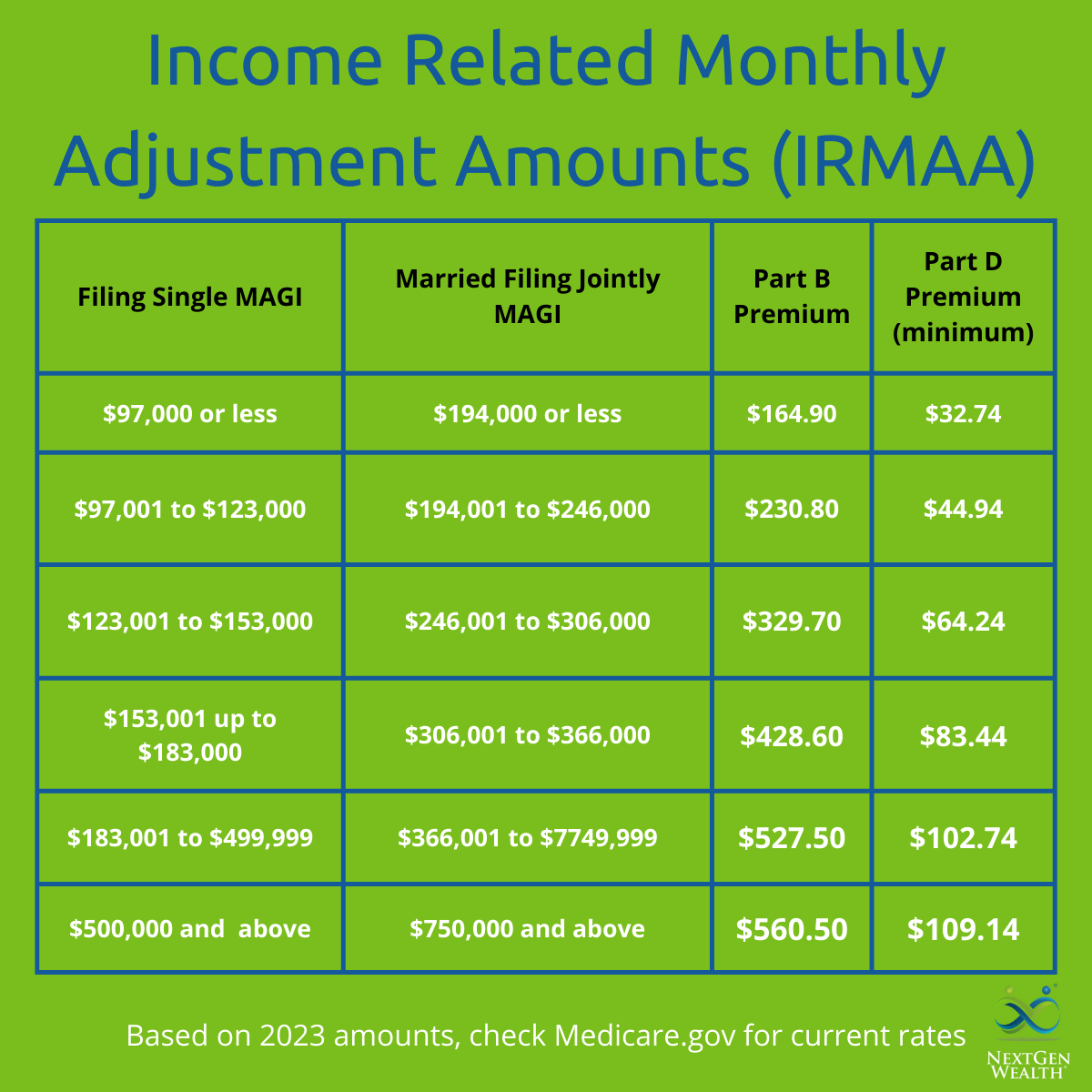

The Medicare Income-Related Monthly Adjustment Amount (IRMAA) is an additional premium that high-income Medicare beneficiaries must pay for their Part B (medical insurance) and Part D (prescription drug coverage) plans. The IRMAA brackets are adjusted annually to reflect changes in the cost of living. For 2025, the IRMAA brackets have been updated, and it is important for beneficiaries to understand how these changes may affect their Medicare premiums.

What is IRMAA?

IRMAA is a surcharge that is added to the standard Medicare Part B and Part D premiums for individuals with higher incomes. The purpose of IRMAA is to ensure that beneficiaries who can afford to pay more contribute their fair share to the Medicare program.

Who is Subject to IRMAA?

IRMAA applies to individuals who are enrolled in Medicare Part B and/or Part D and whose income exceeds certain thresholds. These thresholds are based on the beneficiary’s modified adjusted gross income (MAGI). MAGI is a measure of income that includes certain adjustments, such as tax-exempt interest and half of Social Security benefits.

IRMAA Brackets for 2025

The IRMAA brackets for 2025 are as follows:

| Filing Status | MAGI Threshold | IRMAA Surcharge |

|---|---|---|

| Single | $97,000 | $56.00 |

| Married Filing Jointly | $194,000 | $112.00 |

| Married Filing Separately | $97,000 | $56.00 |

| Head of Household | $133,000 | $84.00 |

Calculating Your IRMAA Surcharge

To calculate your IRMAA surcharge, you will need to determine your MAGI. This information can be found on your tax return. Once you have your MAGI, you can compare it to the IRMAA brackets to determine if you are subject to the surcharge. If your MAGI exceeds the threshold for your filing status, you will need to pay the corresponding IRMAA surcharge.

Example

Consider a single individual with a MAGI of $100,000. According to the IRMAA brackets for 2025, this individual is subject to an IRMAA surcharge of $56.00. This means that they will need to pay an additional $56.00 per month for their Medicare Part B and Part D premiums.

Impact on Medicare Premiums

The IRMAA surcharge can have a significant impact on Medicare premiums. For 2025, the standard Medicare Part B premium is $164.90 per month. For individuals subject to the IRMAA surcharge, the Part B premium will be increased by the corresponding amount. For example, a single individual with a MAGI of $100,000 will pay a Part B premium of $220.90 per month ($164.90 + $56.00).

Avoiding IRMAA

There are a few strategies that beneficiaries can use to avoid or reduce their IRMAA surcharge. These strategies include:

- Delaying Retirement: Working longer can reduce your MAGI and potentially make you ineligible for IRMAA.

- Reducing Income: Contributing to tax-advantaged retirement accounts, such as 401(k)s and IRAs, can lower your MAGI.

- Itemizing Deductions: Itemizing deductions on your tax return can reduce your MAGI.

Conclusion

Understanding the IRMAA brackets for 2025 is essential for Medicare beneficiaries with higher incomes. By knowing the thresholds and calculating their potential surcharge, beneficiaries can plan accordingly and take steps to minimize the impact on their Medicare premiums. It is important to consult with a tax professional or Medicare expert for personalized advice on how IRMAA may affect your specific situation.

Closure

Thus, we hope this article has provided valuable insights into The IRMAA Brackets for 2025: Understanding the Medicare Income-Related Monthly Adjustment Amount. We hope you find this article informative and beneficial. See you in our next article!