The 2025 Lifetime Gift Tax Exclusion: A Comprehensive Guide

Related Articles: The 2025 Lifetime Gift Tax Exclusion: A Comprehensive Guide

- Color Of The Year 2025: Unveiling The Hues That Will Define The Future

- Hyundai Ioniq 5 2024: A Revolution In Electric Vehicle Technology

- When Is GATE 2025: Important Dates And Application Process

- Hockey World Cup 2023: A Thrilling Tournament With Unforgettable Moments

- Should I Buy A Home In 2024? A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The 2025 Lifetime Gift Tax Exclusion: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about The 2025 Lifetime Gift Tax Exclusion: A Comprehensive Guide

The 2025 Lifetime Gift Tax Exclusion: A Comprehensive Guide

Introduction

The gift tax exclusion is a critical aspect of estate planning, allowing individuals to transfer assets to loved ones without incurring gift taxes. The lifetime gift tax exclusion amount is adjusted periodically to keep pace with inflation, and the current exclusion for 2023 and 2024 is $12.92 million per individual. However, in 2025, the lifetime gift tax exclusion is scheduled to revert to its pre-2018 level of $5 million, adjusted for inflation. This significant reduction in the exclusion amount could have a substantial impact on estate planning strategies.

Understanding the Gift Tax Exclusion

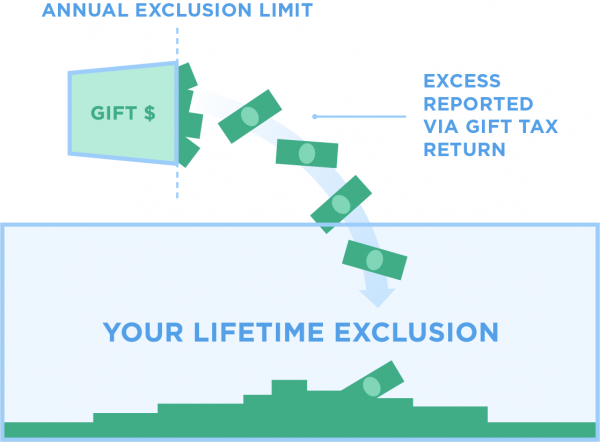

The gift tax exclusion allows individuals to gift a certain amount of money or property to others without paying gift taxes. The exclusion applies to lifetime gifts, as well as gifts made at death. The lifetime gift tax exclusion is a cumulative limit, meaning that the total amount of gifts made over an individual’s lifetime is subject to the exclusion. Once the lifetime gift tax exclusion is exceeded, gift taxes are imposed on the excess amount.

The 2025 Lifetime Gift Tax Exclusion

The Tax Cuts and Jobs Act of 2017 temporarily doubled the lifetime gift tax exclusion to $11.7 million, adjusted for inflation, for 2018 through 2025. However, the exclusion is scheduled to revert to its pre-2018 level of $5 million, adjusted for inflation, in 2026. For 2023 and 2024, the lifetime gift tax exclusion is $12.92 million per individual.

Impact of the Reduced Exclusion

The reduction in the lifetime gift tax exclusion in 2025 could have a significant impact on estate planning strategies. Individuals who have already made substantial gifts may need to reconsider their plans to avoid exceeding the reduced exclusion amount. Additionally, those who are planning to make large gifts in the future may need to adjust their strategies to account for the lower exclusion.

Planning Strategies

There are several strategies that individuals can consider to mitigate the impact of the reduced lifetime gift tax exclusion:

- Make Gifts Before 2025: Individuals who are planning to make large gifts should consider doing so before 2025 to take advantage of the higher exclusion amount.

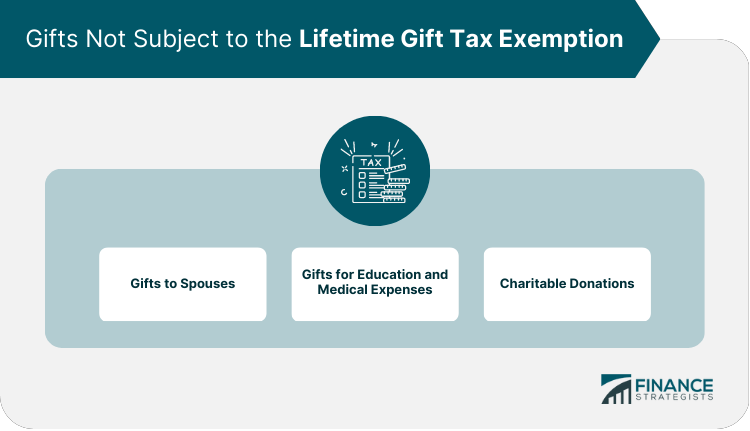

- Use the Annual Exclusion: The annual exclusion allows individuals to gift up to $17,000 per recipient per year without using any of their lifetime gift tax exclusion. Individuals can make multiple annual exclusion gifts to different recipients to reduce the overall impact of the reduced lifetime exclusion.

- Establish Trusts: Trusts can be used to shelter assets from the gift tax. Individuals can create irrevocable trusts that distribute assets to beneficiaries over time, allowing them to avoid exceeding the lifetime gift tax exclusion.

- Consider Life Insurance: Life insurance proceeds are generally not subject to gift or estate taxes. Individuals can purchase life insurance policies and name loved ones as beneficiaries to provide them with financial support without using any of their lifetime gift tax exclusion.

- Charitable Giving: Gifts to qualified charities are not subject to gift or estate taxes. Individuals can make charitable contributions to reduce their taxable estate and avoid exceeding the lifetime gift tax exclusion.

Conclusion

The reduction in the lifetime gift tax exclusion in 2025 is a significant change that could have a substantial impact on estate planning strategies. Individuals who are planning to make large gifts should carefully consider their options and consult with a qualified estate planning attorney to develop a plan that minimizes the impact of the reduced exclusion. By implementing appropriate strategies, individuals can ensure that their assets are transferred to their loved ones in a tax-efficient manner.

Closure

Thus, we hope this article has provided valuable insights into The 2025 Lifetime Gift Tax Exclusion: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!