Taxpayer Over 65 Standard Deduction 2025: Comprehensive Guide

Related Articles: Taxpayer Over 65 Standard Deduction 2025: Comprehensive Guide

- Best NFL QB Prospects For 2025: A Comprehensive Analysis

- When Is The Cannes Film Festival 2025?

- 2025 Mazda CX-5 Hybrid: A Symphony Of Power And Efficiency

- Abbott Pointe East Lansing: A Luxury Apartment Community In The Heart Of Michigan

- Jaguar Cars 2025 Models: A Glimpse Into The Future Of British Luxury

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Taxpayer Over 65 Standard Deduction 2025: Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Taxpayer Over 65 Standard Deduction 2025: Comprehensive Guide

Taxpayer Over 65 Standard Deduction 2025: Comprehensive Guide

Introduction

As you approach retirement, understanding the tax implications becomes increasingly important. One significant tax deduction available to senior citizens is the standard deduction. This deduction reduces your taxable income, potentially saving you a substantial amount of money on your taxes.

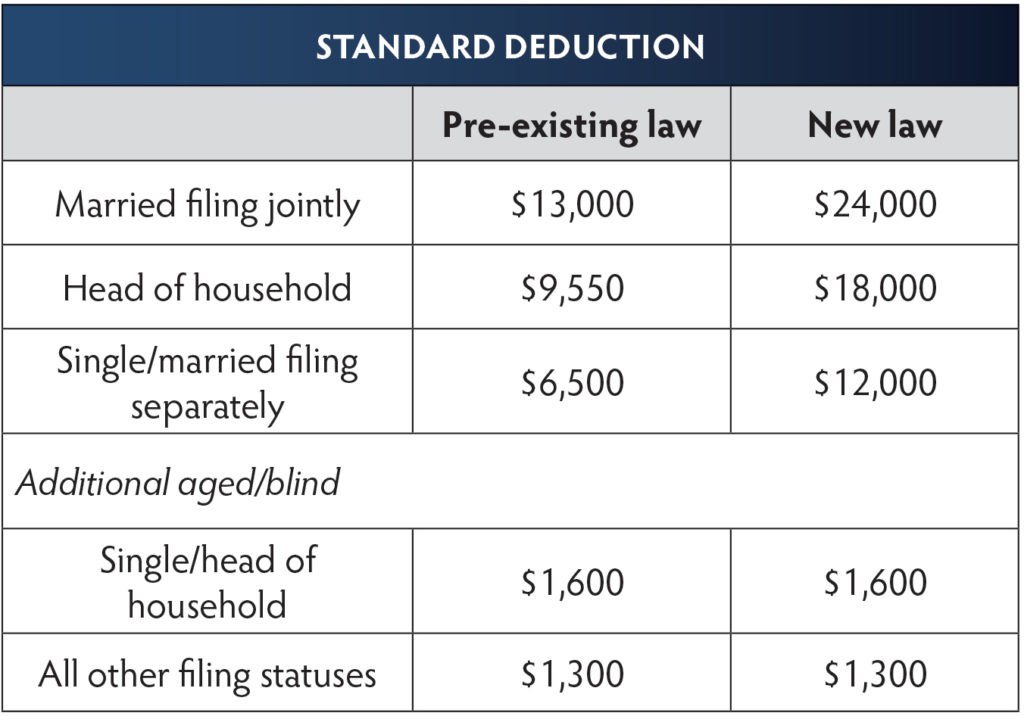

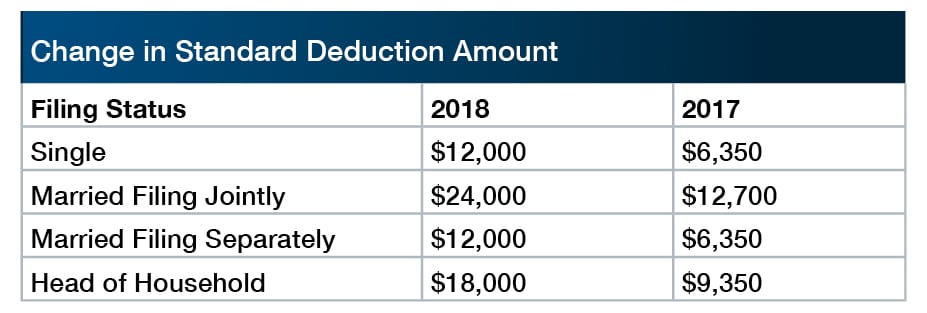

For taxpayers over the age of 65, the standard deduction is higher than for younger taxpayers. In 2023, the standard deduction for taxpayers over 65 is $14,700 for single filers and $25,900 for married couples filing jointly.

In this article, we will explore the taxpayer over 65 standard deduction for 2025, including its amount, eligibility requirements, and how it can affect your tax liability.

Standard Deduction Amount for Taxpayers Over 65 in 2025

The standard deduction for taxpayers over 65 is adjusted annually for inflation. The exact amount for 2025 has not yet been determined, but based on historical trends, it is estimated to be:

- Single filers: $15,500

- Married couples filing jointly: $27,300

These amounts are significantly higher than the standard deduction for younger taxpayers, which is estimated to be $13,850 for single filers and $27,700 for married couples filing jointly in 2025.

Eligibility Requirements

To qualify for the taxpayer over 65 standard deduction, you must meet the following requirements:

- You must be at least 65 years old on the last day of the tax year.

- You must not be claimed as a dependent on someone else’s tax return.

If you meet these requirements, you can claim the higher standard deduction even if you do not itemize your deductions.

How the Standard Deduction Affects Your Tax Liability

The standard deduction directly reduces your taxable income. By lowering your taxable income, you may move into a lower tax bracket, resulting in lower tax liability.

For example, let’s say you are a single taxpayer over 65 with a taxable income of $30,000 in 2025. Without the standard deduction, you would be in the 12% tax bracket and owe $3,600 in taxes. However, with the estimated standard deduction of $15,500, your taxable income would be reduced to $14,500, placing you in the 10% tax bracket. As a result, you would only owe $1,450 in taxes, saving you $2,150.

Additional Considerations

- Itemizing Deductions: If you have significant itemized deductions that exceed the standard deduction, you may want to consider itemizing instead. Itemized deductions include expenses such as medical expenses, charitable donations, and mortgage interest.

- Phase-Out of Itemized Deductions: For high-income taxpayers, the standard deduction is phased out. This means that the standard deduction is gradually reduced as your income increases.

- Social Security Benefits: Social Security benefits are not included in taxable income. However, if you have substantial Social Security benefits, they may reduce your standard deduction.

Conclusion

The taxpayer over 65 standard deduction is a valuable tax break for senior citizens. By understanding the amount, eligibility requirements, and how it affects your tax liability, you can maximize your tax savings and plan for a more secure financial future.

As the standard deduction is adjusted annually for inflation, it is important to stay informed about the latest changes. By consulting with a tax professional or using online tax resources, you can ensure that you are claiming the correct standard deduction and taking advantage of all available tax benefits.

Closure

Thus, we hope this article has provided valuable insights into Taxpayer Over 65 Standard Deduction 2025: Comprehensive Guide. We appreciate your attention to our article. See you in our next article!