Tax Brackets After 2026: A Comprehensive Guide

Related Articles: Tax Brackets After 2026: A Comprehensive Guide

- Winter Classic 2025: A Historic Event On The Frozen Frontier

- IR 2025 Data Limit: A Comprehensive Guide

- Honda Civic 2025: A Glimpse Into The Future Of Compact Cars

- 2025 Atlas: A Comprehensive Guide To The Future Of Mapping

- Jeep Renegade 1 3 150 Hp 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Tax Brackets After 2026: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Tax Brackets After 2026: A Comprehensive Guide

Tax Brackets After 2026: A Comprehensive Guide

The Tax Cuts and Jobs Act (TCJA) of 2017 made significant changes to the federal income tax system, including adjusting the tax brackets. These changes were initially set to expire in 2025, but the Consolidated Appropriations Act of 2023 extended them through 2026. However, the future of tax brackets beyond 2026 remains uncertain.

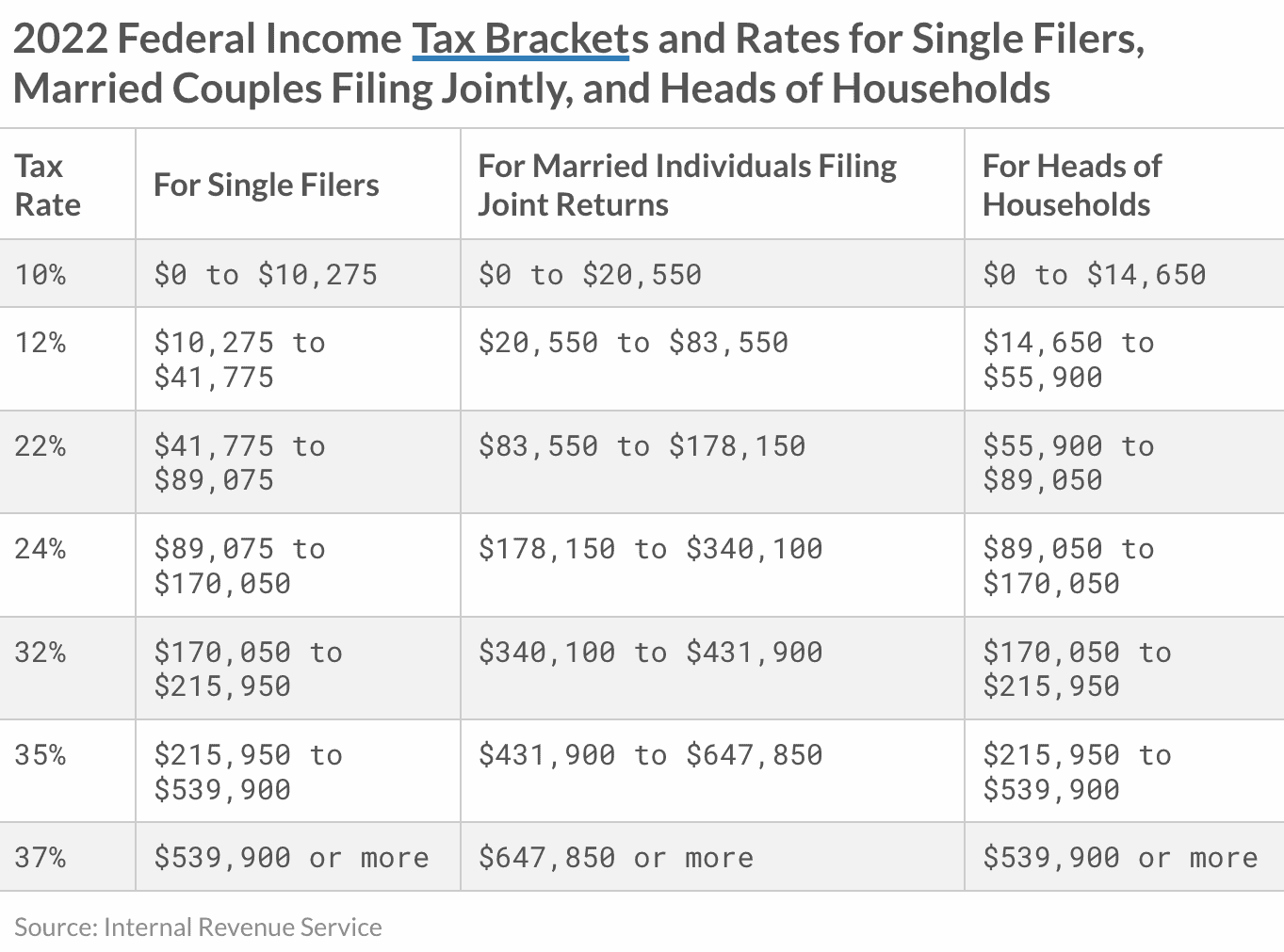

Current Tax Brackets (2023-2026)

The current tax brackets for 2023-2026 are as follows:

| Filing Status | Taxable Income | Marginal Tax Rate |

|---|---|---|

| Single | Up to $11,850 | 10% |

| Single | $11,851 to $44,725 | 12% |

| Single | $44,726 to $89,450 | 22% |

| Single | $89,451 to $178,900 | 24% |

| Single | $178,901 to $274,650 | 32% |

| Single | $274,651 to $518,400 | 35% |

| Single | Over $518,400 | 37% |

| Filing Status | Taxable Income | Marginal Tax Rate |

|---|---|---|

| Married Filing Jointly | Up to $23,700 | 10% |

| Married Filing Jointly | $23,701 to $89,450 | 12% |

| Married Filing Jointly | $89,451 to $178,900 | 22% |

| Married Filing Jointly | $178,901 to $274,650 | 24% |

| Married Filing Jointly | $274,651 to $518,400 | 32% |

| Married Filing Jointly | $518,401 to $622,050 | 35% |

| Married Filing Jointly | Over $622,050 | 37% |

| Filing Status | Taxable Income | Marginal Tax Rate |

|---|---|---|

| Head of Household | Up to $19,900 | 10% |

| Head of Household | $19,901 to $54,900 | 12% |

| Head of Household | $54,901 to $89,450 | 22% |

| Head of Household | $89,451 to $178,900 | 24% |

| Head of Household | $178,901 to $274,650 | 32% |

| Head of Household | $274,651 to $518,400 | 35% |

| Head of Household | Over $518,400 | 37% |

Tax Brackets After 2026

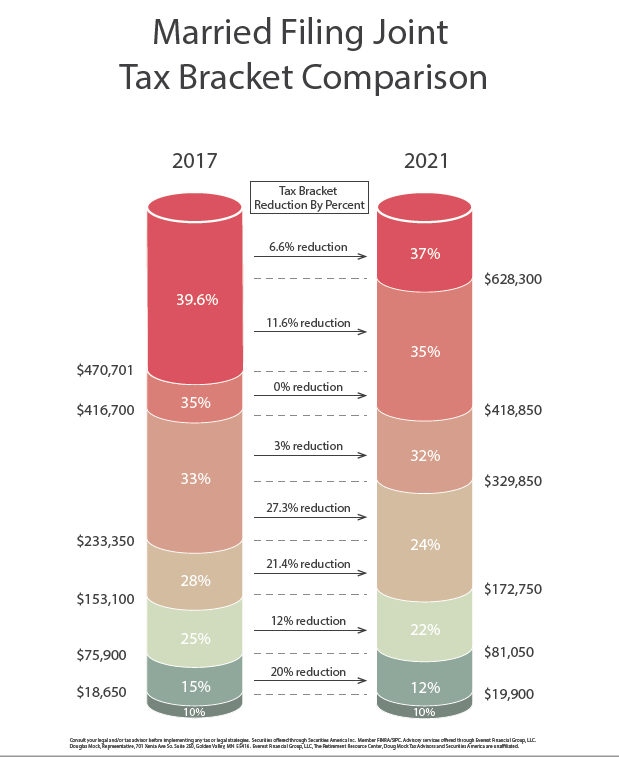

The future of tax brackets after 2026 is uncertain. The TCJA’s provisions that adjusted the tax brackets are set to expire, which would result in the reinstatement of the pre-2018 tax brackets. However, there is a possibility that Congress could extend or modify the current tax brackets beyond 2026.

If the current tax brackets are allowed to expire, the pre-2018 tax brackets would be as follows:

| Filing Status | Taxable Income | Marginal Tax Rate |

|---|---|---|

| Single | Up to $9,325 | 10% |

| Single | $9,326 to $37,950 | 15% |

| Single | $37,951 to $91,900 | 25% |

| Single | $91,901 to $191,650 | 28% |

| Single | $191,651 to $416,700 | 33% |

| Single | $416,701 to $418,400 | 35% |

| Single | Over $418,400 | 39.6% |

| Filing Status | Taxable Income | Marginal Tax Rate |

|---|---|---|

| Married Filing Jointly | Up to $18,650 | 10% |

| Married Filing Jointly | $18,651 to $75,900 | 15% |

| Married Filing Jointly | $75,901 to $153,100 | 25% |

| Married Filing Jointly | $153,101 to $233,350 | 28% |

| Married Filing Jointly | $233,351 to $416,700 | 33% |

| Married Filing Jointly | $416,701 to $470,700 | 35% |

| Married Filing Jointly | Over $470,700 | 39.6% |

| Filing Status | Taxable Income | Marginal Tax Rate |

|---|---|---|

| Head of Household | Up to $13,350 | 10% |

| Head of Household | $13,351 to $50,800 | 15% |

| Head of Household | $50,801 to $130,150 | 25% |

| Head of Household | $130,151 to $210,800 | 28% |

| Head of Household | $210,801 to $416,700 | 33% |

| Head of Household | $416,701 to $444,500 | 35% |

| Head of Household | Over $444,500 | 39.6% |

Implications of Tax Bracket Changes

The potential reinstatement of the pre-2018 tax brackets would have several implications for taxpayers:

- Increased Taxes: Taxpayers in all income brackets would generally pay more in taxes under the pre-2018 tax brackets.

- Narrower Tax Brackets: The pre-2018 tax brackets are narrower than the current brackets, which means that taxpayers could move into higher tax brackets more quickly as their income increases.

- Reduced Tax Savings: The standard deduction and child tax credit were increased under the TCJA. If the TCJA provisions expire, these tax savings would be reduced.

Conclusion

The future of tax brackets after 2026 is uncertain. The current tax brackets are set to expire, but Congress could extend or modify them. If the current tax brackets are allowed to expire, taxpayers would likely see higher taxes and narrower tax brackets. It is important for taxpayers to stay informed about potential changes to the tax code and plan accordingly.

Closure

Thus, we hope this article has provided valuable insights into Tax Brackets After 2026: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!