Target-Date Funds: A Comprehensive Guide to the 2025 Target

Related Articles: Target-Date Funds: A Comprehensive Guide to the 2025 Target

- When Is The Boston Marathon 2025?

- Project 2025: Empowering A Sustainable And Equitable Future

- Electronic Diversity Visa Entry Form 2025: A Comprehensive Guide

- 2025-2026 Pocket Calendar: Your Essential Planning Companion

- Diwali 2025: A Resplendent Celebration Of Lights And Festivities

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Target-Date Funds: A Comprehensive Guide to the 2025 Target. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Target-Date Funds: A Comprehensive Guide to the 2025 Target

Target-Date Funds: A Comprehensive Guide to the 2025 Target

Introduction

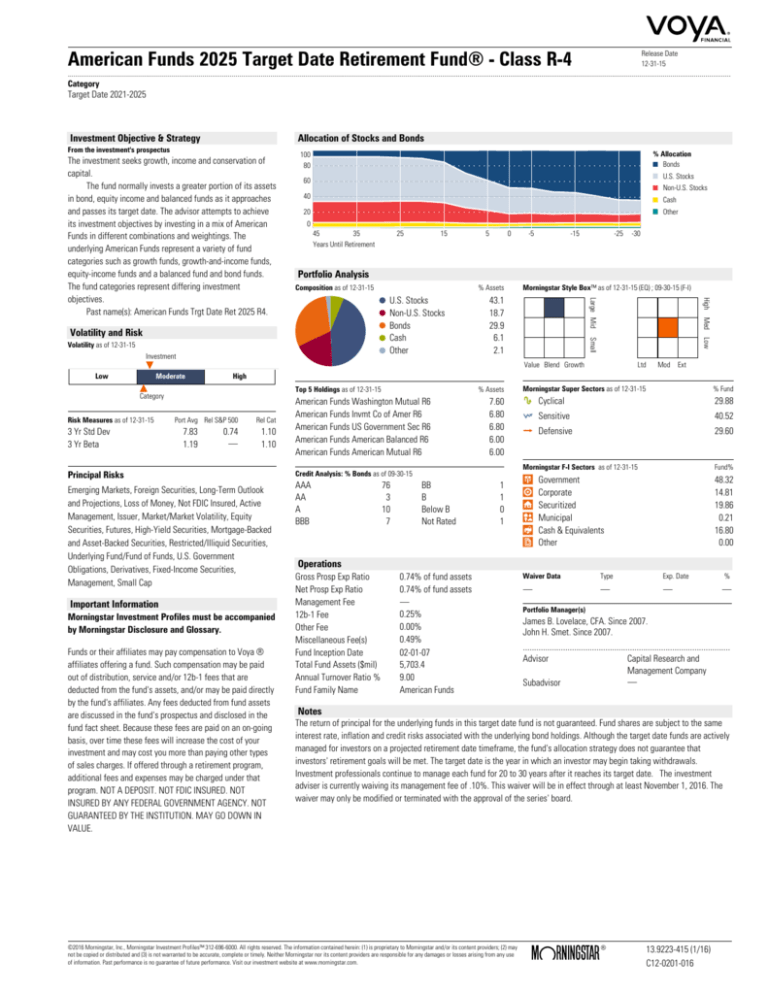

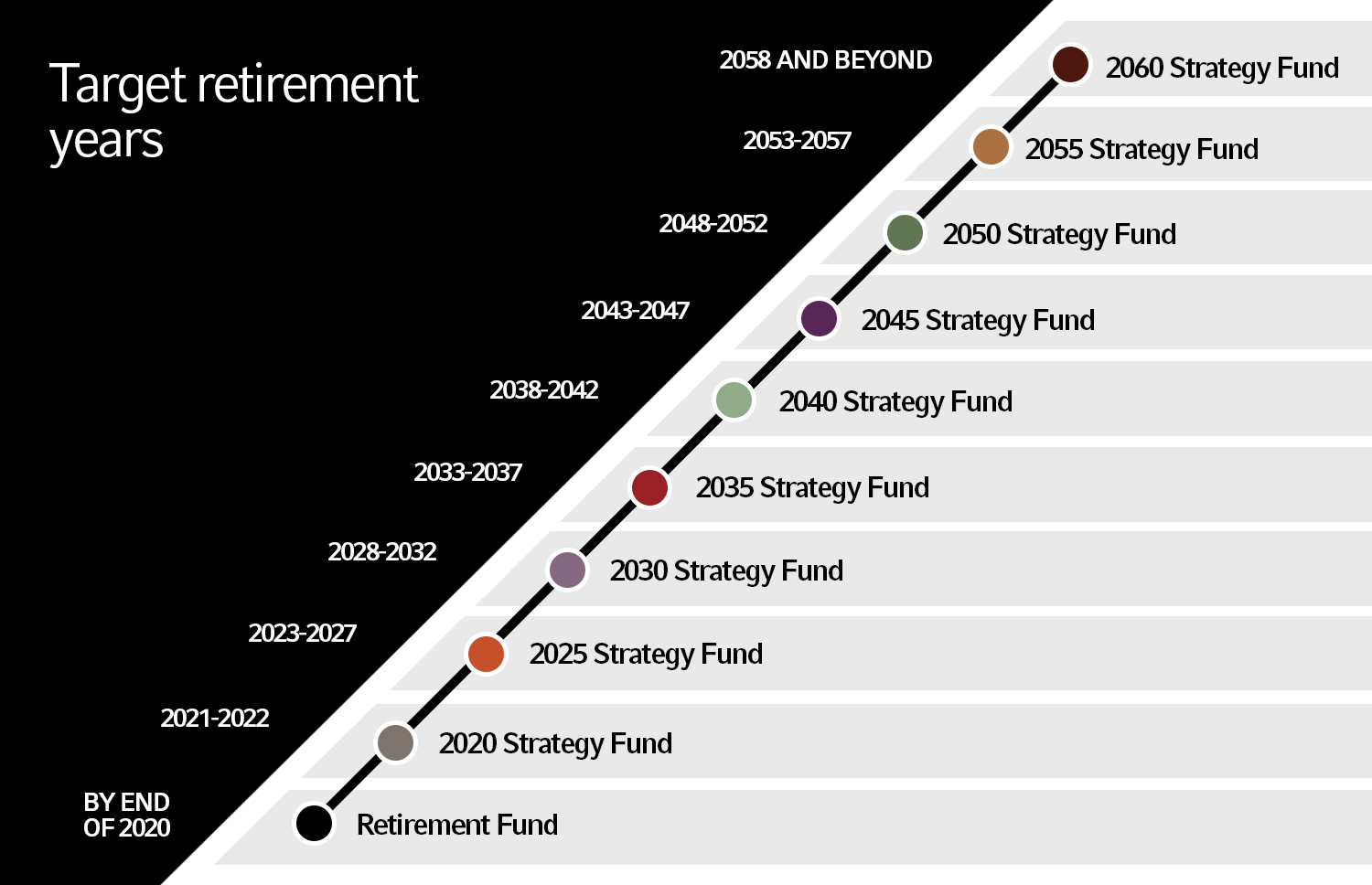

Target-date funds (TDFs) are a type of mutual fund designed to provide investors with a diversified portfolio of assets that automatically adjusts over time to become more conservative as the investor approaches a specific target date, typically their expected retirement date. Target-date funds are often used as a core holding in 401(k) and other retirement accounts.

Understanding Target-Date Funds

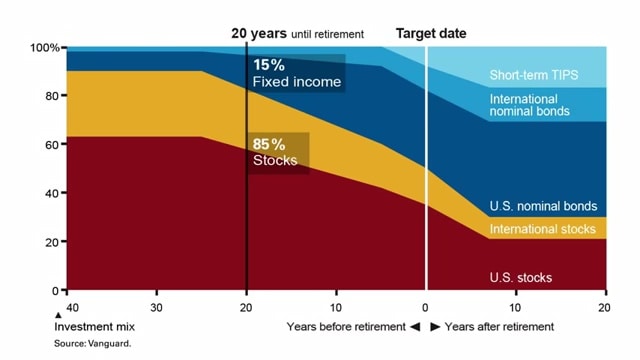

Target-date funds are designed to simplify retirement investing by providing a single fund that automatically adjusts its asset allocation based on the investor’s age and risk tolerance. The asset allocation of a target-date fund typically starts out with a higher percentage of stocks and gradually shifts to a more conservative mix of bonds and cash as the investor approaches their target date.

Target-Date Fund 2025

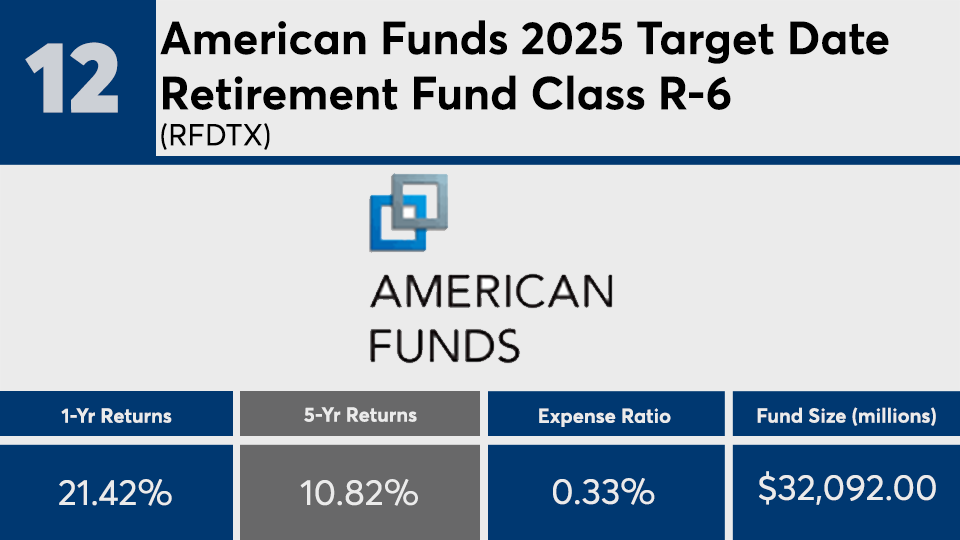

Target-date fund 2025 is a fund designed for investors who plan to retire around 2025. The asset allocation of this fund will gradually shift from a more aggressive mix of stocks to a more conservative mix of bonds and cash over the next several years.

Asset Allocation of Target-Date Fund 2025

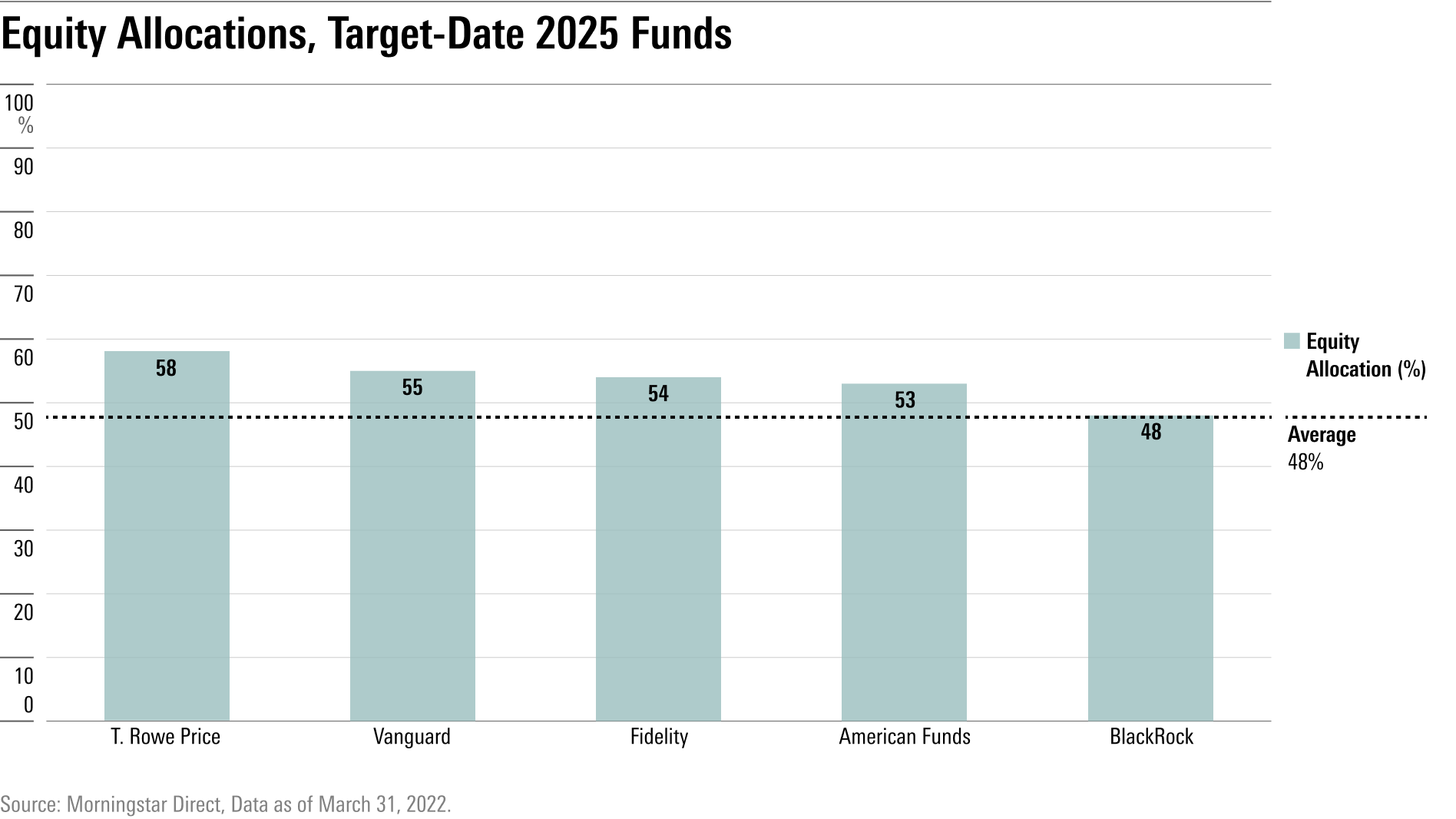

The specific asset allocation of target-date fund 2025 will vary depending on the fund provider. However, most funds in this category will have a similar overall asset allocation, with a higher percentage of stocks in the early years and a higher percentage of bonds and cash in the later years.

Benefits of Target-Date Funds

- Simplicity: Target-date funds offer a simple and convenient way to invest for retirement. Investors only need to choose a fund with a target date that matches their expected retirement date, and the fund will automatically adjust its asset allocation over time.

- Diversification: Target-date funds provide investors with a diversified portfolio of assets, which can help to reduce risk.

- Automatic Rebalancing: Target-date funds automatically rebalance their asset allocation over time, which helps to ensure that the fund remains aligned with the investor’s risk tolerance and investment goals.

Considerations for Target-Date Funds

- Fees: Target-date funds typically have higher fees than traditional mutual funds. Investors should consider the fees when choosing a target-date fund.

- Investment Horizon: Target-date funds are designed for investors who plan to retire around the target date. Investors who plan to retire earlier or later may want to consider a different type of fund.

- Risk Tolerance: Target-date funds are not suitable for all investors. Investors who are not comfortable with the level of risk associated with target-date funds should consider a more conservative investment option.

Target-Date Fund 2025: A Suitable Investment for 2023

Target-date fund 2025 is a suitable investment for investors who plan to retire around 2025. The fund’s asset allocation is designed to gradually shift from a more aggressive mix of stocks to a more conservative mix of bonds and cash over the next several years, which is appropriate for investors who are approaching retirement and want to reduce their risk exposure.

Conclusion

Target-date funds are a convenient and effective way to invest for retirement. Target-date fund 2025 is a suitable investment for investors who plan to retire around 2025. The fund’s asset allocation is designed to gradually shift from a more aggressive mix of stocks to a more conservative mix of bonds and cash over the next several years, which is appropriate for investors who are approaching retirement and want to reduce their risk exposure.

Closure

Thus, we hope this article has provided valuable insights into Target-Date Funds: A Comprehensive Guide to the 2025 Target. We hope you find this article informative and beneficial. See you in our next article!