Standard Deduction for Seniors Over 65 in 2024: A Comprehensive Guide

Related Articles: Standard Deduction for Seniors Over 65 in 2024: A Comprehensive Guide

- Vanguard 2025 Fund: A Comprehensive Analysis Of Its Price Performance

- 2025-2026 Pocket Calendar: Your Essential Planning Companion

- When Is The Cannes Film Festival 2025?

- The 2025 Diversity Immigrant Visa Program: A Gateway To American Dreams

- Arctic Cat Canada Snowmobiles: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Standard Deduction for Seniors Over 65 in 2024: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Standard Deduction for Seniors Over 65 in 2024: A Comprehensive Guide

Standard Deduction for Seniors Over 65 in 2024: A Comprehensive Guide

The standard deduction is a specific amount that you can deduct from your taxable income before calculating your taxes. This deduction is available to all taxpayers, regardless of age. However, the standard deduction amount varies depending on your filing status and age.

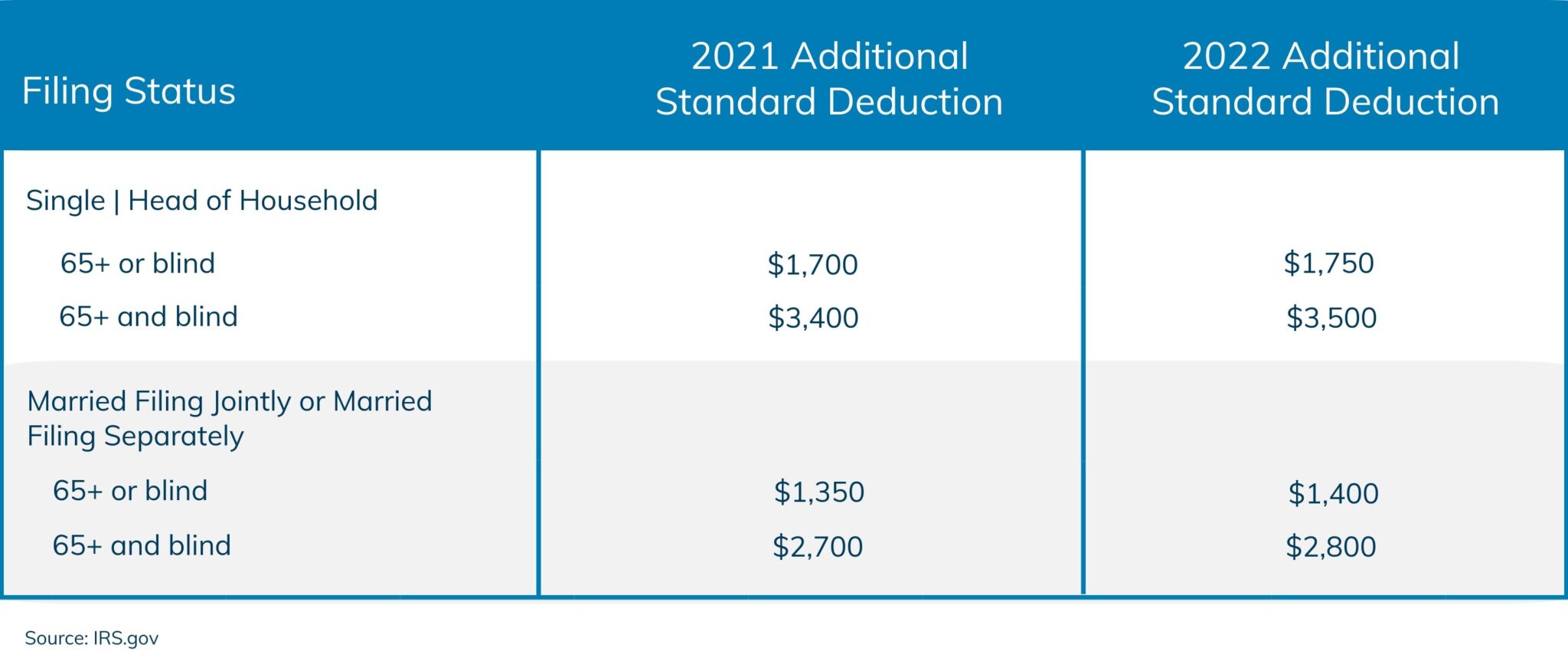

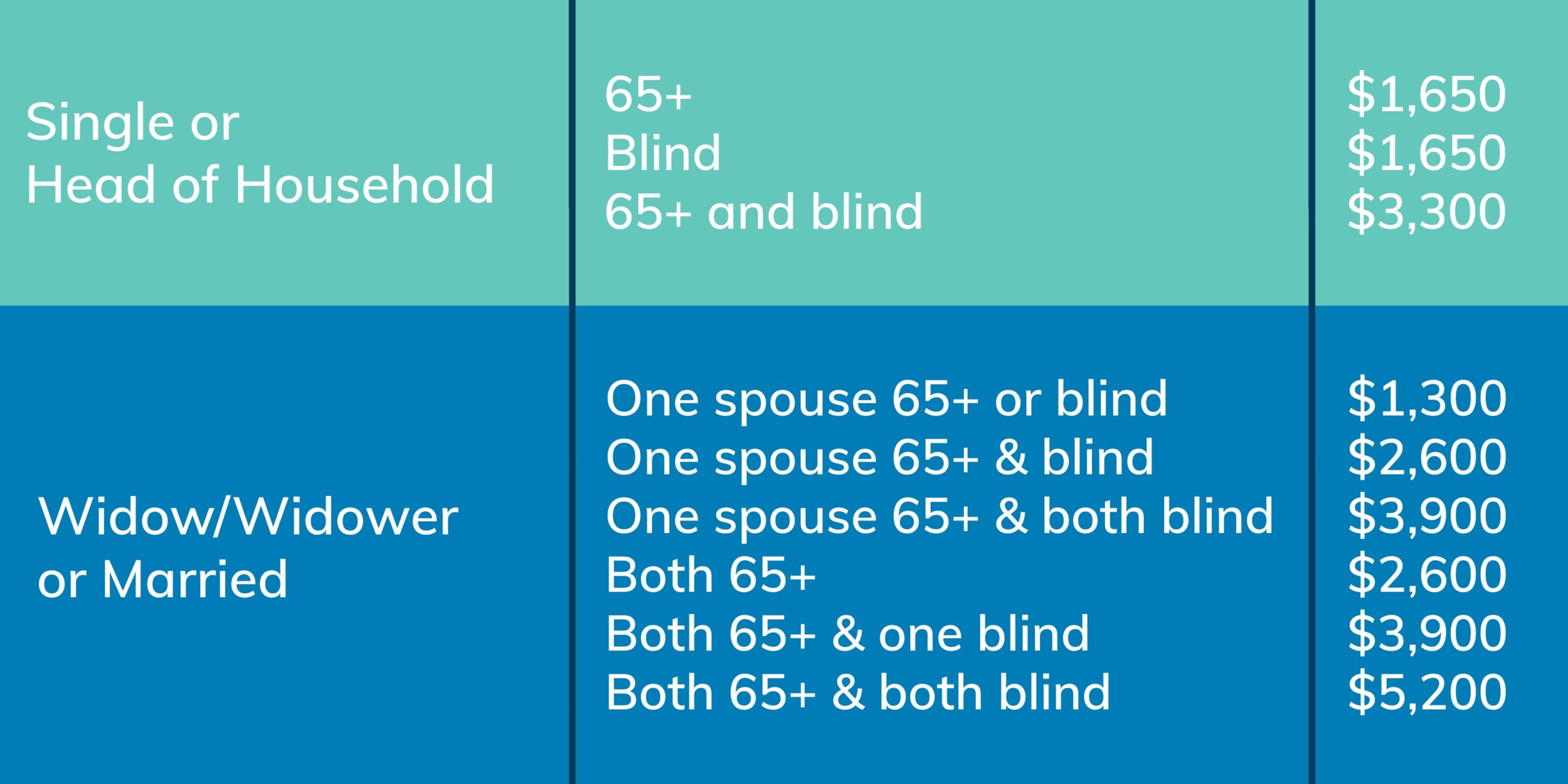

For seniors over 65, the standard deduction is higher than it is for younger taxpayers. This is because seniors are more likely to have higher medical expenses and other deductions.

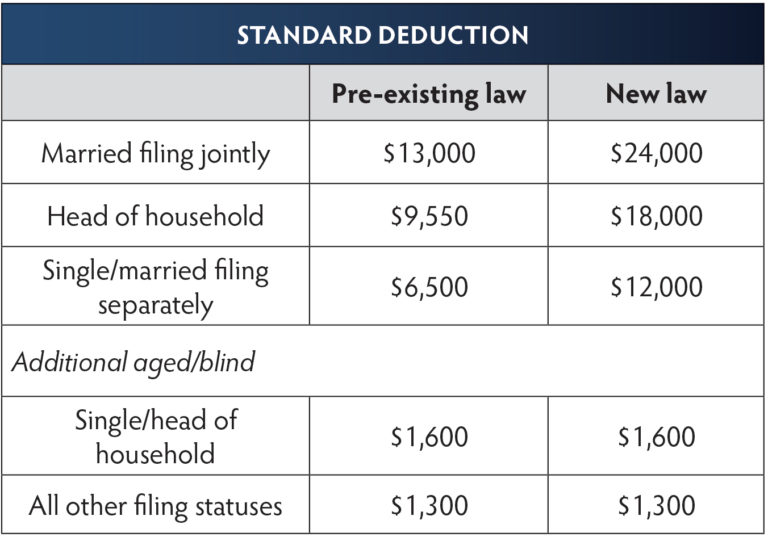

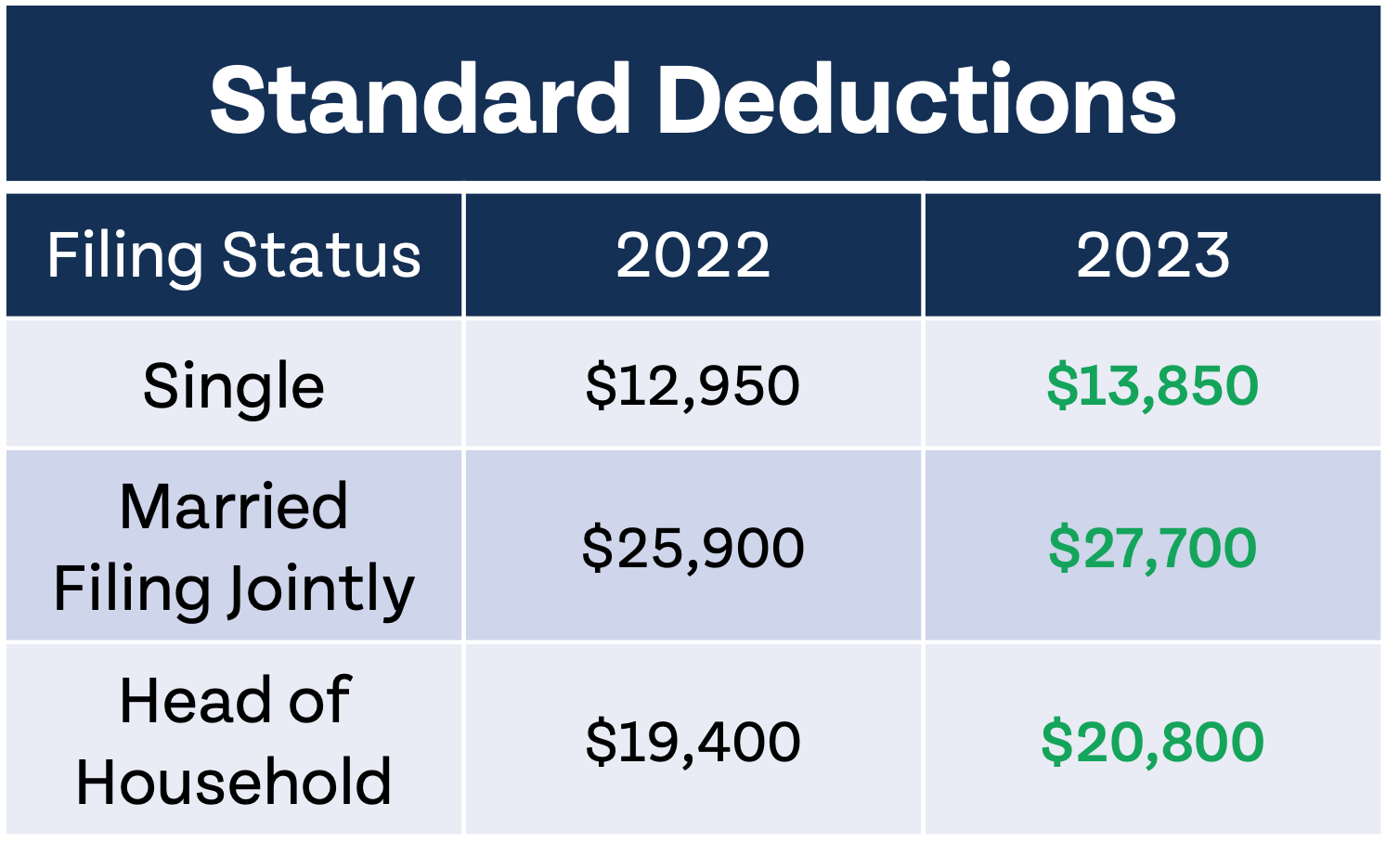

2024 Standard Deduction Amounts for Seniors Over 65

The standard deduction amounts for seniors over 65 in 2024 are as follows:

- Single: $13,850

- Married filing jointly: $27,700

- Married filing separately: $13,850

- Head of household: $20,800

How to Claim the Standard Deduction

To claim the standard deduction, you simply need to check the box on your tax return that says "Standard Deduction." You do not need to itemize your deductions unless you have deductions that are greater than the standard deduction amount.

Benefits of the Standard Deduction

The standard deduction offers a number of benefits, including:

- It is simple to claim. You do not need to keep track of your expenses or receipts.

- It is valuable. The standard deduction can save you a significant amount of money on your taxes.

- It is inflation-adjusted. The standard deduction amount is adjusted each year for inflation.

Itemizing Deductions

If you have deductions that are greater than the standard deduction amount, you may want to itemize your deductions. Itemizing your deductions means that you list each of your deductions on your tax return.

Some common itemized deductions include:

- Medical expenses

- State and local taxes

- Mortgage interest

- Charitable contributions

Choosing the Best Option

Whether you should claim the standard deduction or itemize your deductions depends on your individual circumstances. If you have a lot of deductions, it may be worth it to itemize. However, if your deductions are less than the standard deduction amount, it is simpler to just claim the standard deduction.

Conclusion

The standard deduction is a valuable tax break for seniors over 65. It can save you a significant amount of money on your taxes. If you are not sure whether you should claim the standard deduction or itemize your deductions, it is a good idea to speak with a tax professional.

Closure

Thus, we hope this article has provided valuable insights into Standard Deduction for Seniors Over 65 in 2024: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!