Should I Buy a House Now or Wait?

Related Articles: Should I Buy a House Now or Wait?

- 2025 Year Of The Horse Calendar: A Comprehensive Overview

- SKT Icon: The Undisputed World 2025 Champion

- Housing Interest Rates Prediction 2025: A Comprehensive Analysis

- 2025 Toyota Camry Hybrid: A Technological Tour De Force

- Kaufman Chiropractic: Advancing Chiropractic Care In Kaufman, TX

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Should I Buy a House Now or Wait?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Should I Buy a House Now or Wait?

Should I Buy a House Now or Wait?

![Should I Buy a Home Now? Or Wait Until Next Year? [INFOGRAPHIC] - LHB Financial](https://d3sj2vq3d2xms.cloudfront.net/wp-content/uploads/2017/09/28124459/Cost-of-Waiting-KCM.jpg)

Purchasing a home is a significant financial decision that requires careful consideration. With rising interest rates and fluctuating market conditions, many potential homebuyers are faced with the dilemma of whether to buy now or wait. This article aims to provide an in-depth analysis of the factors to consider when making this important choice.

Factors to Consider:

1. Interest Rates:

Interest rates have a direct impact on the cost of a mortgage. When interest rates are low, monthly payments are lower, making it more affordable to buy a home. However, interest rates have been rising steadily in recent months, which has increased mortgage costs. It is crucial to factor in the potential impact of rising interest rates on your budget before making a decision.

2. Market Conditions:

The real estate market is constantly fluctuating. In a seller’s market, there is a shortage of homes for sale, which drives up prices and makes it more difficult for buyers to find affordable options. Conversely, in a buyer’s market, there is an abundance of homes for sale, which gives buyers more negotiating power and allows them to secure better deals. Understanding the current market conditions is essential for making an informed decision.

3. Personal Finances:

Your financial situation plays a crucial role in determining whether you are ready to buy a home. You should have a stable income, a good credit score, and sufficient savings for a down payment and closing costs. It is also important to consider your long-term financial goals and whether purchasing a home aligns with them.

4. Lifestyle and Future Plans:

Your lifestyle and future plans can influence your decision. If you anticipate a major life change, such as getting married, having children, or changing jobs, it may be wise to postpone buying a home until your situation is more settled. Conversely, if you are in a stable and predictable phase of life, purchasing a home can provide stability and potential financial benefits.

5. Investment Potential:

Real estate can be a valuable investment over the long term. However, the housing market can experience fluctuations, and there is no guarantee of a profit. If you are primarily interested in purchasing a home as an investment, it is crucial to conduct thorough research and consider the potential risks involved.

Pros of Buying Now:

- Locking in a Lower Interest Rate: If interest rates are expected to continue rising, buying now can help you lock in a lower mortgage rate, saving you money in the long run.

- Appreciation Potential: Historically, real estate has appreciated in value over time. While there are no guarantees, buying a home now could provide you with potential financial gain in the future.

- Tax Benefits: Homeowners can deduct mortgage interest and property taxes from their federal income taxes, which can save you money.

Cons of Buying Now:

- Higher Interest Rates: If interest rates continue to rise, your monthly mortgage payments could become more expensive.

- Limited Inventory: In a seller’s market, finding an affordable home can be challenging. You may have to compromise on your desired location or amenities.

- Unexpected Costs: Homeownership comes with unexpected costs, such as repairs, maintenance, and property taxes. It is important to factor these costs into your budget.

Pros of Waiting:

- Lower Interest Rates: If interest rates are expected to fall, waiting could save you money on your mortgage payments.

- More Inventory: As the market cools, more homes may become available for sale, giving you a wider selection to choose from.

- Improved Financial Situation: Waiting can give you more time to improve your credit score, save for a larger down payment, or increase your income.

Cons of Waiting:

- Rising Prices: If the housing market continues to appreciate, waiting could mean paying more for a home in the future.

- Missed Opportunity: If interest rates remain low or rise only slightly, waiting could result in missing out on a good opportunity to buy a home.

- Rent Increases: Rent prices have been rising in many areas. Waiting to buy a home could mean paying higher rent for an extended period.

Conclusion:

The decision of whether to buy a house now or wait is a complex one that requires careful consideration of your individual circumstances and the current market conditions. There is no one-size-fits-all answer. By thoroughly assessing the factors discussed in this article, you can make an informed decision that aligns with your financial goals and lifestyle.

If you are financially prepared, have a stable income, and are comfortable with the potential risks involved, buying a home now could be a sound investment. However, if interest rates are expected to rise significantly or the market is experiencing a seller’s frenzy, it may be wise to wait until conditions become more favorable.

Ultimately, the best decision for you will depend on your unique circumstances and financial situation. It is advisable to consult with a financial advisor, real estate agent, and mortgage lender to gather professional advice before making a final decision.

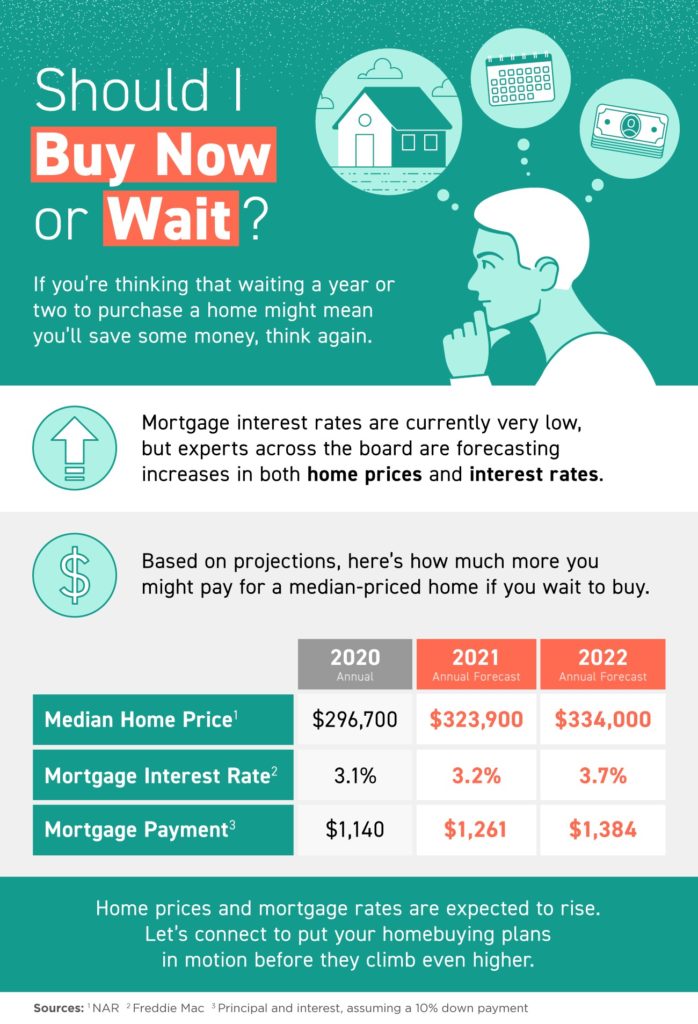

![Should I Buy Now or Wait? [INFOGRAPHIC] - Centre Realty Group](https://www.centrerealtygroup.com/wp-content/uploads/2021/04/Should-I-Buy-Now-or-Wait-INFOGRAPHIC-Copy.png)

![Should I Buy A Home Now? Or Wait Until Next Year? [INFOGRAPHIC]t Infographic, Home buying](https://i.pinimg.com/originals/44/64/de/4464deec10adeb2fd5e5587ee662e566.jpg)

Closure

Thus, we hope this article has provided valuable insights into Should I Buy a House Now or Wait?. We hope you find this article informative and beneficial. See you in our next article!