Should I Buy a Home in 2024? A Comprehensive Guide

Related Articles: Should I Buy a Home in 2024? A Comprehensive Guide

- New Kicks 2025: The Next Generation Of Footwear Innovation

- Color Of The Year 2025: Unveiling The Hues That Will Define The Future

- Canada Summer Games 2025: A Comprehensive Schedule

- 2025 Jeep Gladiator: The Ultimate Off-Road Pickup For The Canadian Wilderness

- Should I Sell My House In 2025? A Comprehensive Guide To Market Conditions And Considerations

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Should I Buy a Home in 2024? A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Should I Buy a Home in 2024? A Comprehensive Guide

Should I Buy a Home in 2024? A Comprehensive Guide

Introduction

The decision of whether or not to buy a home is a significant one, involving both financial and lifestyle considerations. The real estate market is constantly evolving, and it’s essential to stay informed about the latest trends and forecasts before making a decision. This article will delve into the factors to consider when contemplating a home purchase in 2024, providing insights to help you make an informed choice.

Current Market Conditions

The real estate market in 2023 has been characterized by high home prices, rising interest rates, and a limited supply of homes for sale. These factors have made it challenging for many potential homebuyers to enter the market. However, there are signs that the market is starting to shift.

Projected Market Trends in 2024

Experts predict that the real estate market in 2024 will continue to be competitive, but some key changes are expected:

- Home prices: Home prices are expected to continue rising, but at a slower pace than in recent years.

- Interest rates: Interest rates are expected to remain elevated but may stabilize or even decline slightly.

- Inventory: The supply of homes for sale is expected to gradually increase, providing more options for buyers.

Financial Considerations

Buying a home is a major financial commitment. Here are some factors to consider:

- Down payment: A down payment of at least 20% is typically required to secure a mortgage with favorable interest rates.

- Mortgage rates: Interest rates affect the monthly mortgage payment. Higher interest rates mean higher payments.

- Closing costs: Closing costs include fees associated with the purchase of a home, such as appraisal fees, title insurance, and lender fees.

- Property taxes: Property taxes vary by location and are typically paid annually.

- Homeowners insurance: Homeowners insurance protects your home from damage and liability.

Lifestyle Considerations

In addition to financial considerations, lifestyle factors also play a role in the decision of whether or not to buy a home:

- Stability: Homeownership provides stability and a sense of belonging.

- Space: A home offers more space than an apartment or rental, which can be ideal for families or those who need extra room.

- Customization: As a homeowner, you have the freedom to customize your home to suit your needs and preferences.

- Maintenance: Homeownership involves ongoing maintenance and repair costs, which can be a financial burden.

- Location: The location of your home can impact your quality of life and commute time.

Pros and Cons of Buying a Home

Pros:

- Potential for appreciation: Homes can appreciate in value over time, building equity for the homeowner.

- Tax benefits: Mortgage interest and property taxes are often tax-deductible.

- Customization: Homeowners have the freedom to personalize their homes to their liking.

- Stability: Homeownership provides a sense of stability and belonging.

Cons:

- Financial burden: Homeownership involves significant financial obligations, including mortgage payments, property taxes, and maintenance costs.

- Lack of flexibility: Homeowners are less flexible than renters, as selling a home can be a lengthy and costly process.

- Maintenance: Homeowners are responsible for maintaining and repairing their homes, which can be time-consuming and expensive.

- Limited space: Some homes may not offer sufficient space for growing families or those with specific needs.

Alternatives to Homeownership

If you’re not sure whether homeownership is right for you, there are several alternatives to consider:

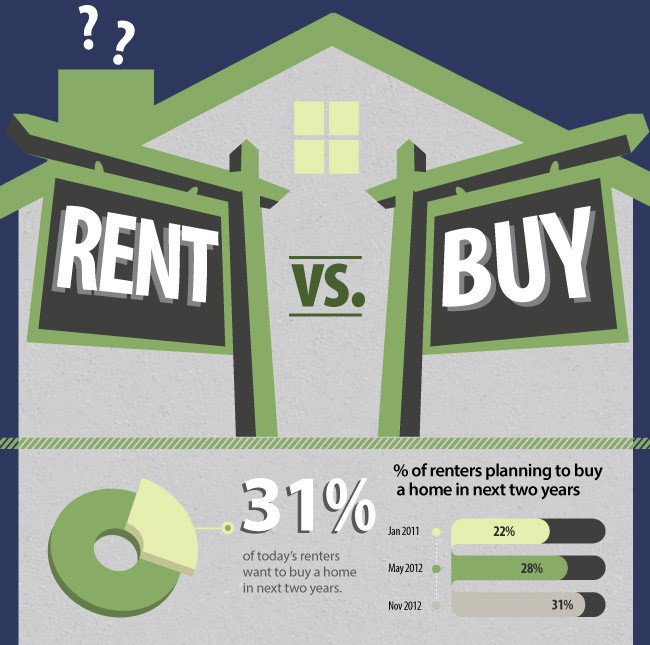

- Renting: Renting offers flexibility and affordability, but it does not provide the same benefits as homeownership, such as potential appreciation and tax benefits.

- Condominiums: Condominiums are a type of homeownership that offers less maintenance and more amenities than a single-family home.

- Townhouses: Townhouses are similar to condominiums but typically offer more space and privacy.

- Co-ops: Co-ops are a type of homeownership where you own shares in a cooperative corporation that owns the building.

Conclusion

Deciding whether or not to buy a home in 2024 is a complex decision that involves both financial and lifestyle considerations. The real estate market is expected to remain competitive, but with rising home prices and interest rates, it’s important to carefully weigh the pros and cons before making a commitment. By considering your financial situation, lifestyle needs, and the projected market trends, you can make an informed decision that’s right for you.

Closure

Thus, we hope this article has provided valuable insights into Should I Buy a Home in 2024? A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!