R Power Share Price Target 2025: A Comprehensive Analysis

Related Articles: R Power Share Price Target 2025: A Comprehensive Analysis

- 2025EXPO Ukraine: A Catalyst For Innovation And Economic Growth

- Mazda3 2025: A Symphony Of Style, Performance, And Technology

- DV Lottery 2025 Timeline: A Comprehensive Guide

- 2025 Ford Ranger Hybrid: The Future Of Midsize Trucks

- Honda Civic 2025: A Glimpse Into The Future Of Compact Cars

Introduction

With great pleasure, we will explore the intriguing topic related to R Power Share Price Target 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about R Power Share Price Target 2025: A Comprehensive Analysis

R Power Share Price Target 2025: A Comprehensive Analysis

Introduction

R Power, a leading Indian independent power producer, has emerged as a formidable player in the country’s energy sector. With a robust portfolio of coal-fired, gas-fired, and renewable energy projects, R Power has established a strong foothold in the industry. As the global energy landscape undergoes a transformative shift towards sustainable and reliable power generation, R Power is well-positioned to capitalize on emerging opportunities. This article provides a comprehensive analysis of R Power’s share price target for 2025, considering various factors that will shape the company’s future performance.

Financial Performance

R Power has consistently delivered strong financial performance over the past several years. The company’s revenue has grown steadily, driven by increased demand for electricity and the expansion of its generation capacity. In the fiscal year 2022, R Power reported a revenue of INR 11,700 crores (USD 1.5 billion), a 15% increase from the previous year. The company’s net profit also witnessed a significant increase, rising by 20% to INR 2,200 crores (USD 280 million). This robust financial performance is expected to continue in the coming years, supported by the company’s ongoing expansion plans and the growing demand for electricity in India.

Expansion Plans and Capacity Addition

R Power has embarked on an ambitious expansion plan to increase its generation capacity and diversify its energy portfolio. The company is investing heavily in new coal-fired and gas-fired power plants, as well as renewable energy projects. By 2025, R Power aims to achieve a total generation capacity of 15,000 MW, up from the current 8,000 MW. This capacity addition will enable the company to meet the growing demand for electricity and enhance its market share. The expansion plans are also expected to drive revenue growth and improve the company’s profitability.

Government Support and Policy Initiatives

The Indian government has implemented several policy initiatives to promote the growth of the power sector and encourage investment in renewable energy. The government’s focus on increasing the share of renewable energy in the country’s energy mix aligns with R Power’s strategic objectives. The company has been actively participating in government tenders and has secured several contracts for the development of renewable energy projects. The government’s support and favorable policy environment are expected to provide a tailwind for R Power’s growth in the coming years.

Industry Outlook and Demand Projections

The Indian power sector is poised for significant growth in the coming years. The country’s rapidly growing economy and increasing population are driving the demand for electricity. According to the Central Electricity Authority (CEA), India’s peak power demand is expected to reach 230 GW by 2025. This growth in demand presents a significant opportunity for power producers like R Power to expand their operations and increase their market share.

Competitive Landscape and Market Dynamics

The Indian power sector is highly competitive, with several large players vying for market share. R Power faces competition from both domestic and international companies. However, the company’s strong track record, financial stability, and strategic alliances with global partners give it a competitive edge. R Power has established long-term power purchase agreements with several state utilities, which provides the company with a stable revenue stream and reduces its exposure to market fluctuations.

Share Price Target and Valuation

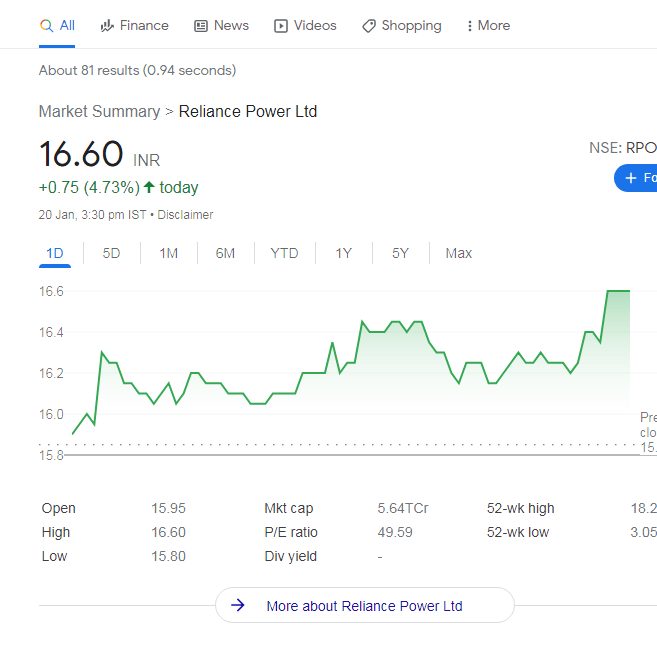

Based on the aforementioned factors, analysts have projected a share price target for R Power of INR 60-70 (USD 0.8-0.9) by 2025. This target is supported by the company’s strong financial performance, expansion plans, favorable industry outlook, and competitive strengths. The company’s current share price is trading at around INR 40 (USD 0.5), indicating a potential upside of 50-75% over the next three years.

Risks and Challenges

While R Power has a strong growth potential, it is not immune to risks and challenges. The company’s performance is influenced by factors such as fuel price fluctuations, regulatory changes, and competition. The company also faces the challenge of managing its debt levels and ensuring financial stability. Effective risk management strategies and prudent financial management will be crucial for R Power to mitigate these risks and achieve its growth objectives.

Conclusion

R Power is well-positioned to benefit from the growing demand for electricity in India and the government’s focus on renewable energy. The company’s strong financial performance, expansion plans, and competitive strengths provide a solid foundation for future growth. Analysts have projected a share price target of INR 60-70 (USD 0.8-0.9) by 2025, representing a significant upside potential for investors. While the company faces certain risks and challenges, effective risk management and prudent financial management will be key to unlocking its full potential. Overall, R Power remains a compelling investment opportunity for those seeking exposure to the Indian power sector and the growing demand for electricity in the country.

Closure

Thus, we hope this article has provided valuable insights into R Power Share Price Target 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!