Qualcomm Stock Price Prediction 2025: A Comprehensive Analysis

Related Articles: Qualcomm Stock Price Prediction 2025: A Comprehensive Analysis

- Zante Holidays 2025: Discover The Enchanting Island Of Zakynthos

- Eligible Countries For DV Lottery 2025: A Comprehensive Guide

- Edexcel Maths GCSE 2025: A Comprehensive Guide

- 2025 Toyota Camry Hybrid: A Technological Tour De Force

- 2025 Batteries: The Next Generation Of Energy Storage

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Qualcomm Stock Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Qualcomm Stock Price Prediction 2025: A Comprehensive Analysis

Qualcomm Stock Price Prediction 2025: A Comprehensive Analysis

Introduction

Qualcomm Incorporated (NASDAQ: QCOM) is a global leader in the semiconductor industry, known for its cutting-edge mobile chipsets, wireless communication technologies, and automotive solutions. The company’s stock has been a consistent performer over the years, driven by strong fundamentals and a growing addressable market. In this article, we will delve into the factors that are likely to shape Qualcomm’s stock price in the coming years and provide a comprehensive analysis of its potential trajectory by 2025.

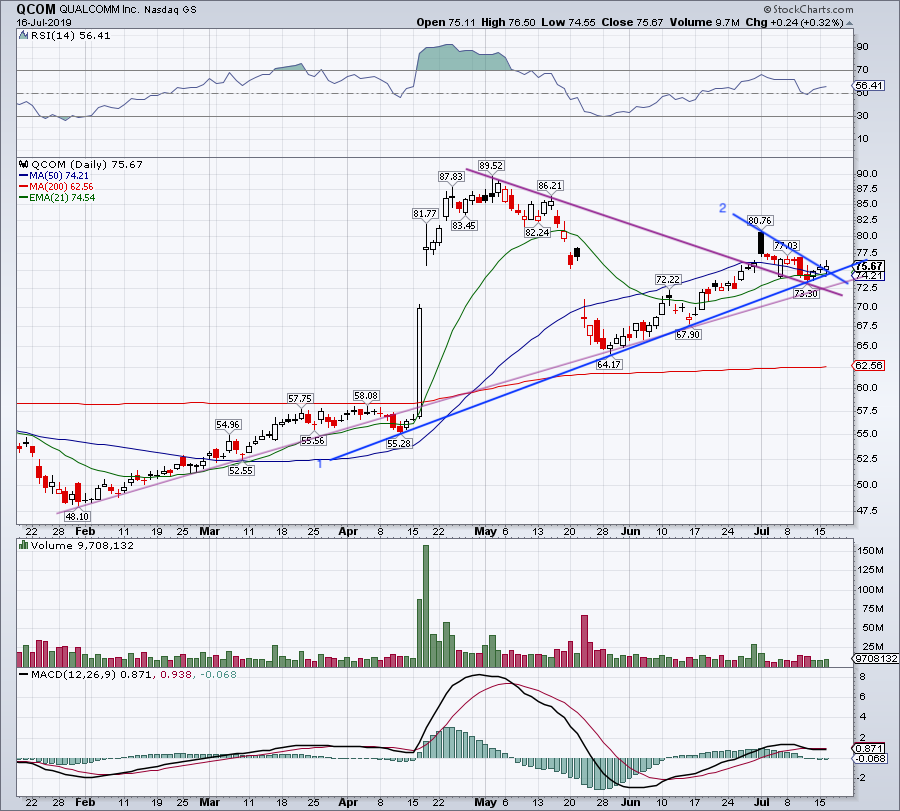

Historical Performance

Qualcomm’s stock has historically exhibited a steady upward trend, with occasional corrections along the way. Over the past five years, the stock has grown by over 120%, outperforming the broader market. This impressive performance can be attributed to the company’s continued innovation, strong financial results, and growing demand for its products.

Fundamental Drivers

Several fundamental factors are expected to continue driving Qualcomm’s growth in the years to come.

- 5G Adoption: Qualcomm is a major player in the 5G market, providing chipsets and modems for smartphones, infrastructure, and other devices. The global rollout of 5G networks is expected to create significant demand for Qualcomm’s products.

- Automotive Technology: The automotive industry is undergoing a rapid transformation towards connected and autonomous vehicles. Qualcomm’s automotive solutions, such as its Snapdragon Ride platform, are well-positioned to capture this growing market.

- Internet of Things (IoT): The IoT market is expanding rapidly, with billions of devices connecting to the internet. Qualcomm’s wireless connectivity technologies and IoT solutions are expected to benefit from this trend.

- Cloud Computing: Qualcomm is expanding its presence in the cloud computing market with its Snapdragon 8cx Gen 3 platform. This platform is designed for laptops and other devices that require high-performance computing capabilities.

Financial Performance

Qualcomm has consistently reported strong financial results, with steady growth in revenue and earnings. The company’s gross profit margin has remained stable around 60%, indicating its strong pricing power. Qualcomm also generates significant cash flow, which it uses to fund research and development, acquisitions, and share buybacks.

Market Analysis

The semiconductor industry is highly competitive, with several major players vying for market share. However, Qualcomm has established a strong position in the mobile chipsets market and is well-positioned to capitalize on the growing demand for 5G, automotive, and IoT technologies.

Analysts have a generally positive outlook on Qualcomm’s stock. According to a recent consensus estimate, the average target price for Qualcomm is $160, representing a potential upside of over 20% from its current price.

Stock Price Prediction 2025

Based on the fundamental drivers, financial performance, and market analysis, we believe that Qualcomm’s stock price has the potential to reach $200 by 2025. This represents a compound annual growth rate (CAGR) of approximately 10% over the next five years.

Several factors support this bullish outlook:

- The global rollout of 5G networks is expected to accelerate, creating significant demand for Qualcomm’s products.

- The automotive industry is undergoing a major transformation towards connected and autonomous vehicles, which will benefit Qualcomm’s automotive solutions.

- The IoT market is expanding rapidly, providing growth opportunities for Qualcomm’s wireless connectivity technologies.

- Qualcomm has a strong financial position and is well-positioned to invest in research and development, acquisitions, and share buybacks.

Risks and Challenges

While Qualcomm’s outlook is generally positive, there are certain risks and challenges that could impact its stock price:

- Competition from other semiconductor companies, such as Intel and Samsung.

- Economic downturns or recessions could reduce demand for Qualcomm’s products.

- Technological disruptions or changes in industry trends could affect Qualcomm’s business.

Conclusion

Qualcomm Incorporated is a global leader in the semiconductor industry with a strong track record of innovation and financial performance. The company is well-positioned to benefit from the growing demand for 5G, automotive, and IoT technologies. Based on our analysis, we believe that Qualcomm’s stock price has the potential to reach $200 by 2025, representing a CAGR of approximately 10% over the next five years. However, investors should be aware of the risks and challenges that could impact the company’s performance.

Closure

Thus, we hope this article has provided valuable insights into Qualcomm Stock Price Prediction 2025: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!