Projected Interest Rates 2025: A Comprehensive Analysis

Related Articles: Projected Interest Rates 2025: A Comprehensive Analysis

- Marvel Vs Capcom 4 2025

- Project 2025: A Vision For The Future Of Religion

- 2024 Genesis Gv80 Vs 2025 Genesis Gv80

- 2025 Mercedes-Benz GLE 450: A Symphony Of Luxury, Performance, And Technology

- Thailand: A Journey To Paradise In 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Projected Interest Rates 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Projected Interest Rates 2025: A Comprehensive Analysis

Projected Interest Rates 2025: A Comprehensive Analysis

Introduction

Interest rates play a crucial role in shaping the economic landscape, influencing everything from consumer spending to business investment. As we approach 2025, understanding the projected trajectory of interest rates becomes imperative for individuals, businesses, and policymakers alike. This comprehensive analysis delves into the factors driving interest rate projections, examines the latest forecasts, and explores the potential implications for various stakeholders.

Factors Driving Interest Rate Projections

Several factors influence the Federal Reserve’s (Fed) decisions regarding interest rates, including:

- Economic Growth: A strong economy typically leads to higher interest rates as the central bank seeks to prevent inflation from overheating.

- Inflation: The Fed’s primary mandate is to maintain price stability. Rising inflation prompts the central bank to raise interest rates to curb demand and tame price increases.

- Unemployment: Low unemployment rates can indicate a tight labor market, potentially leading to wage inflation. The Fed may respond by raising interest rates to cool the economy.

- Financial Stability: Excessive risk-taking and asset bubbles can threaten financial stability. The Fed may raise interest rates to mitigate these risks.

- Global Economic Conditions: The Fed considers global economic conditions when setting interest rates, as they can impact inflation and growth in the United States.

Latest Interest Rate Forecasts

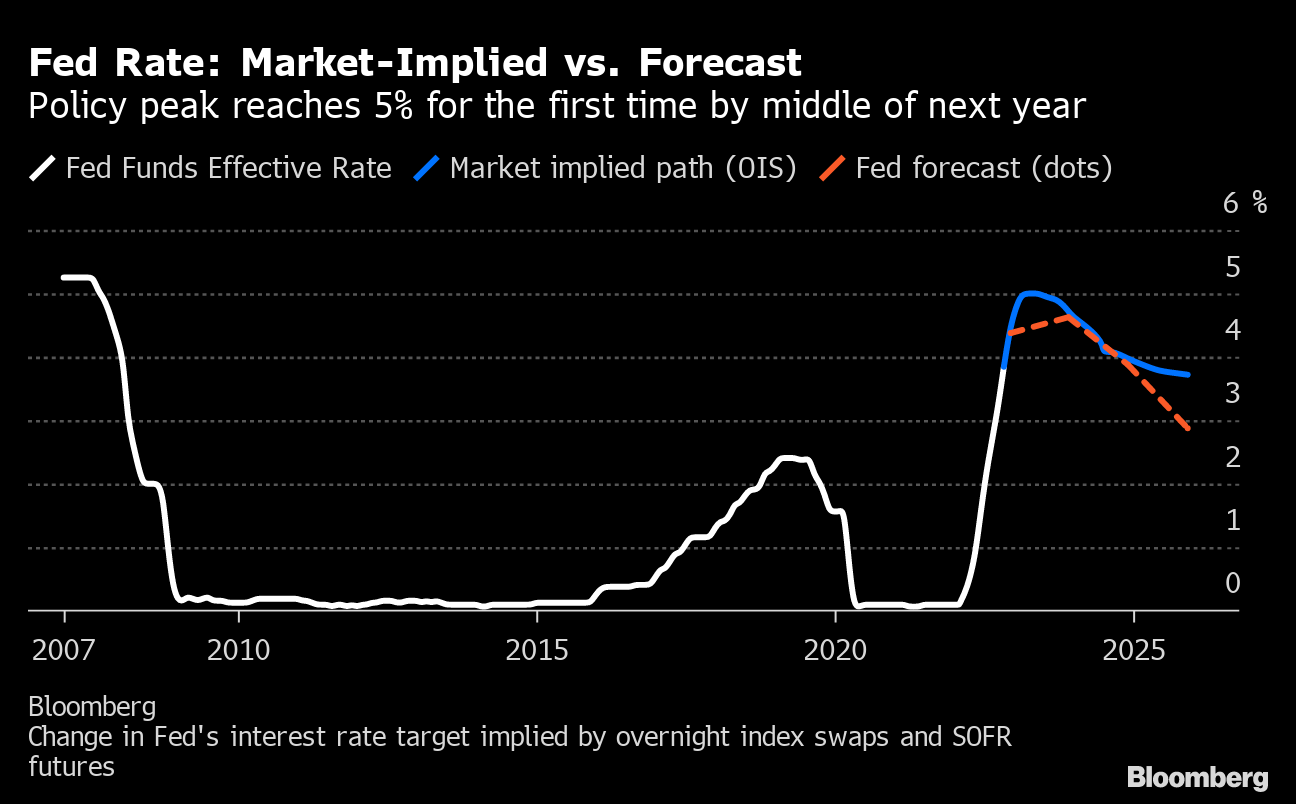

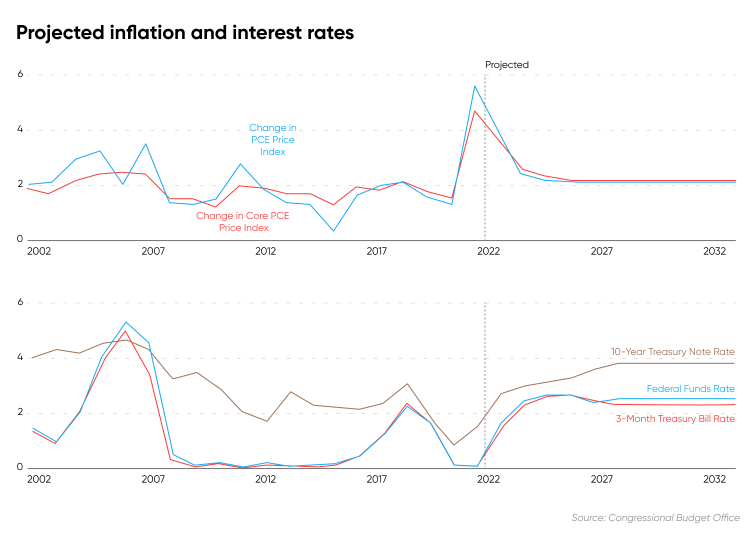

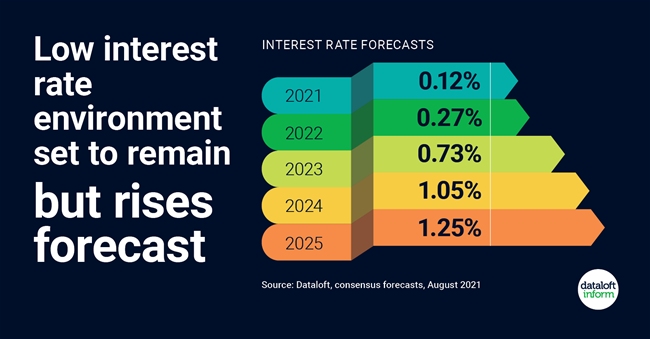

The Fed’s latest projections indicate that interest rates will remain elevated in 2025. The median estimate among Fed officials is for the federal funds rate to be in the range of 4.6% to 5.0% by the end of 2025. This is significantly higher than the current rate of 3.75% to 4.00%.

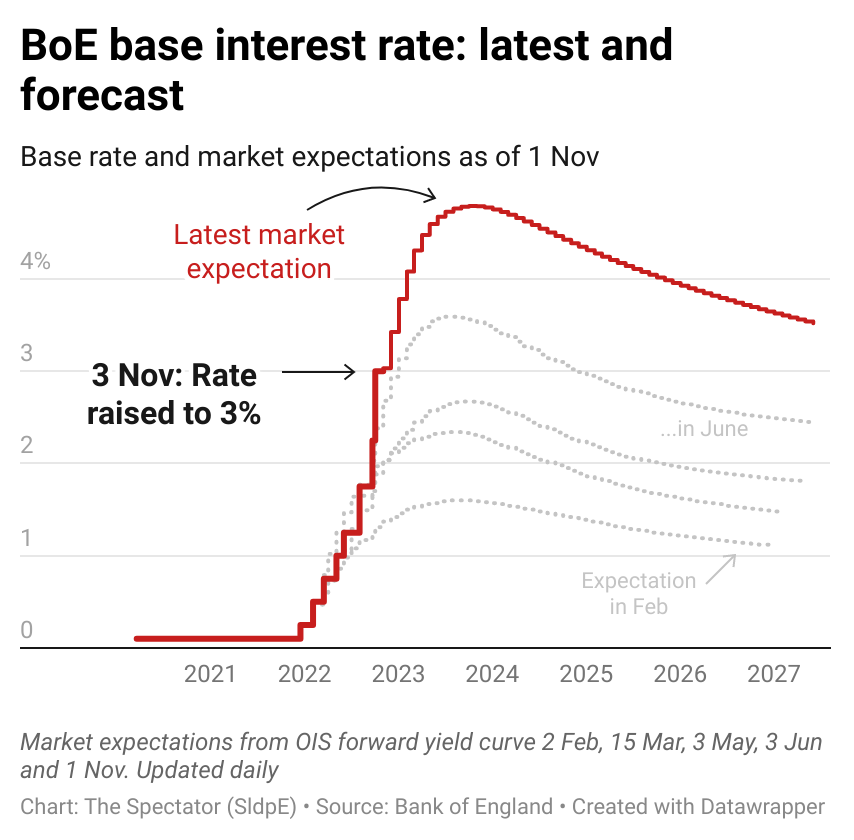

Other major central banks, such as the European Central Bank (ECB) and the Bank of England (BoE), have also signaled their intention to continue raising interest rates in the coming years. The ECB projects its deposit rate to reach 3.25% by the end of 2025, while the BoE forecasts its policy rate to be at 4.00%.

Potential Implications

The projected interest rate trajectory for 2025 has several implications for various stakeholders:

Individuals:

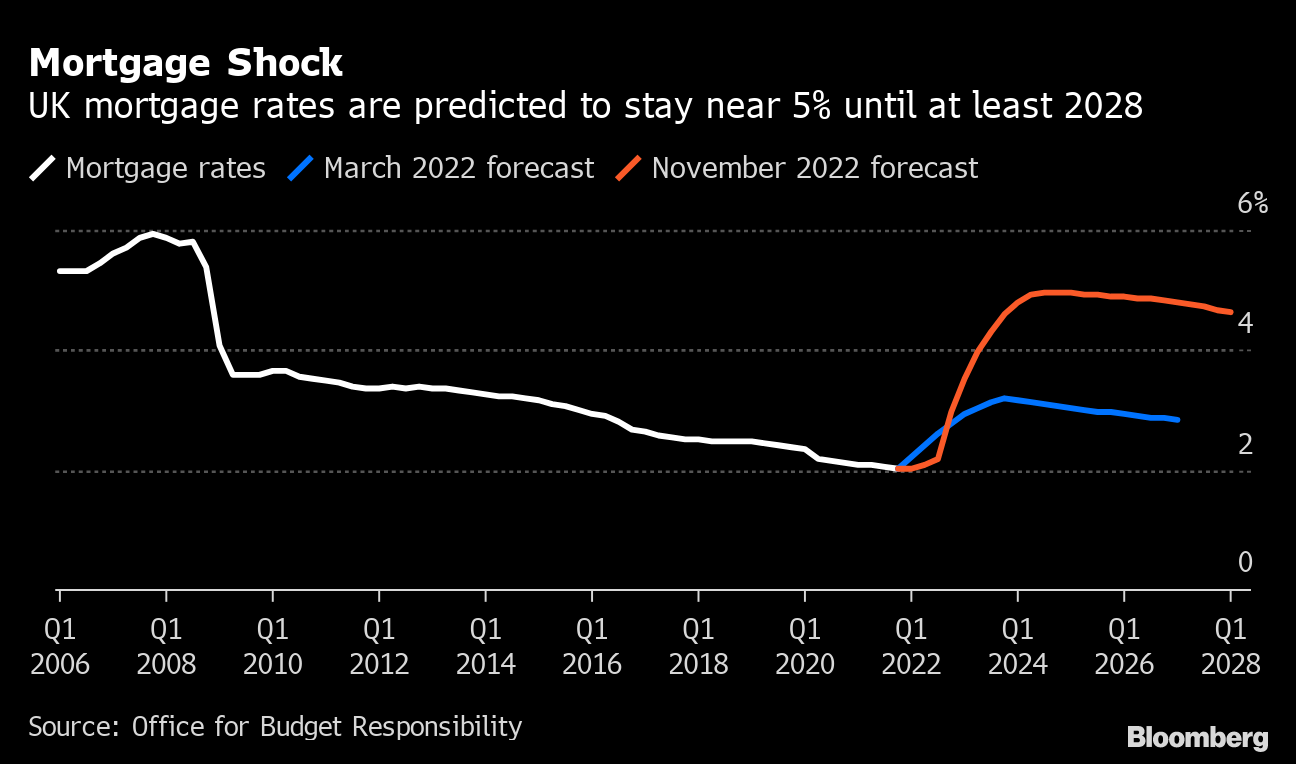

- Mortgage Rates: Higher interest rates make mortgages more expensive, which can impact affordability and homeownership aspirations.

- Savings Accounts: Interest rates on savings accounts are expected to rise, providing higher returns for depositors.

- Consumer Spending: Elevated interest rates may dampen consumer spending, as households face higher borrowing costs and reduced purchasing power.

Businesses:

- Investment: Higher interest rates make it more expensive for businesses to borrow, potentially slowing down investment and growth.

- Profitability: Reduced consumer spending can impact business profitability, especially in interest-sensitive industries.

- Capital Structure: Companies may consider adjusting their capital structure, reducing debt and increasing equity to mitigate interest rate risk.

Policymakers:

- Economic Growth: The Fed’s goal is to achieve sustainable economic growth without triggering excessive inflation. Balancing these objectives will be challenging in an environment of elevated interest rates.

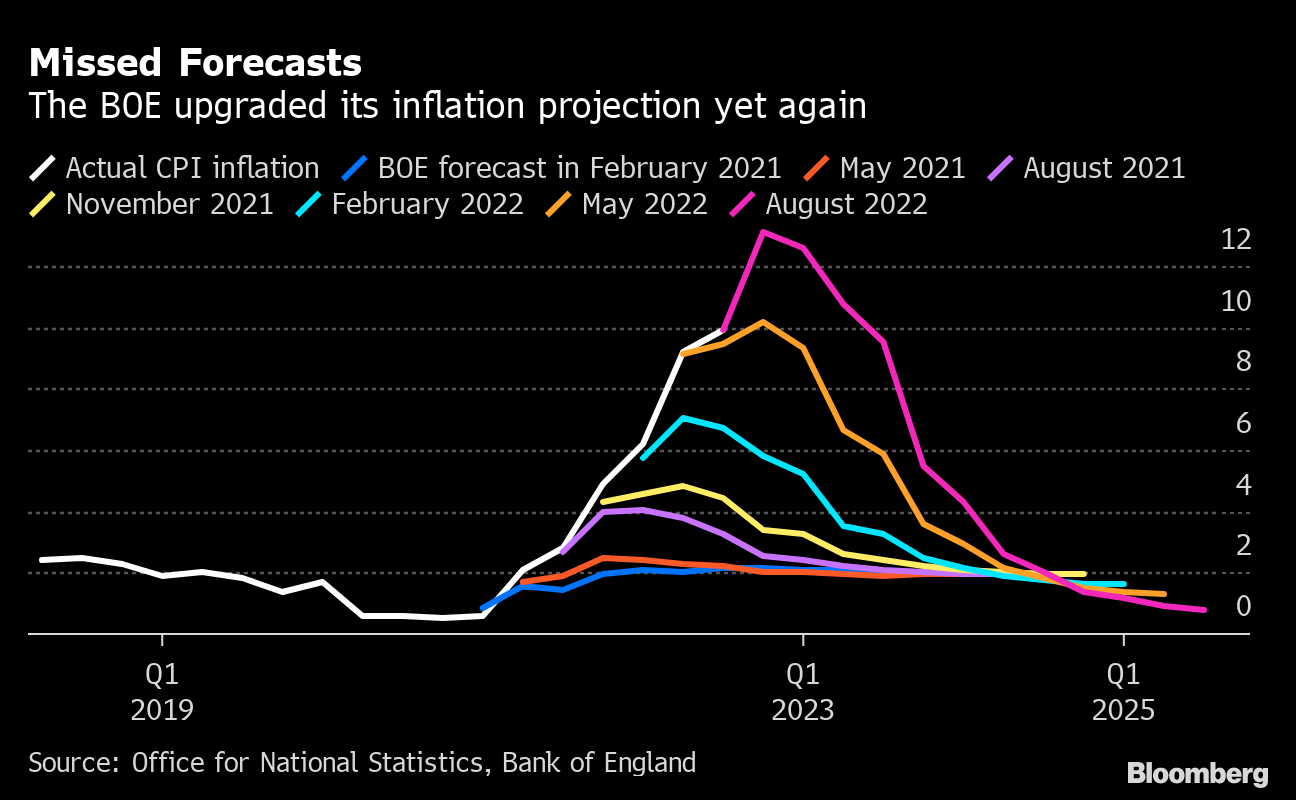

- Inflation Control: The Fed will need to monitor inflation closely and adjust interest rates accordingly to prevent it from becoming entrenched.

- Financial Stability: The central bank will need to ensure that interest rate increases do not destabilize the financial system.

Uncertainties and Risks

While the projected interest rate trajectory for 2025 provides valuable insights, it is important to note that uncertainties and risks remain.

- Economic Outlook: The global economic outlook is subject to change, which could impact the Fed’s interest rate decisions.

- Inflation Persistence: If inflation remains persistently high, the Fed may need to raise interest rates more aggressively than anticipated.

- Geopolitical Events: Unforeseen geopolitical events can disrupt the economy and influence interest rate policy.

Conclusion

The projected interest rate trajectory for 2025 indicates that rates will remain elevated, with implications for individuals, businesses, and policymakers. Understanding the factors driving these projections and the potential consequences is crucial for informed decision-making and risk management. While uncertainties and risks remain, the Fed’s commitment to maintaining economic stability and controlling inflation will continue to guide its interest rate policy in the years to come.

Closure

Thus, we hope this article has provided valuable insights into Projected Interest Rates 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!