Lithium Price Prediction 2025: A Comprehensive Analysis

Related Articles: Lithium Price Prediction 2025: A Comprehensive Analysis

- The 2025 Diversity Immigrant Visa Program: A Gateway To American Dreams

- F Stock Prediction 2025: A Comprehensive Analysis

- Into The Spider-Verse: Spider-Man 2025 Explores The Dystopian Future Of The Spider-Verse

- Eligible Countries For DV Lottery 2025: A Comprehensive Guide

- Holi 2025: A Vibrant Celebration Of Colors And Unity

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Lithium Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Lithium Price Prediction 2025: A Comprehensive Analysis

Lithium Price Prediction 2025: A Comprehensive Analysis

Introduction

Lithium, a critical component in the production of electric vehicle (EV) batteries, has witnessed a surge in demand in recent years. As the world transitions towards a greener future, the demand for lithium is expected to soar even further. This has led to a surge in lithium prices, prompting investors and industry experts to speculate about the future trajectory of the market. This article aims to provide a comprehensive analysis of lithium price predictions for 2025, considering various factors influencing the market dynamics.

Factors Influencing Lithium Prices

Several factors play a pivotal role in determining lithium prices. These include:

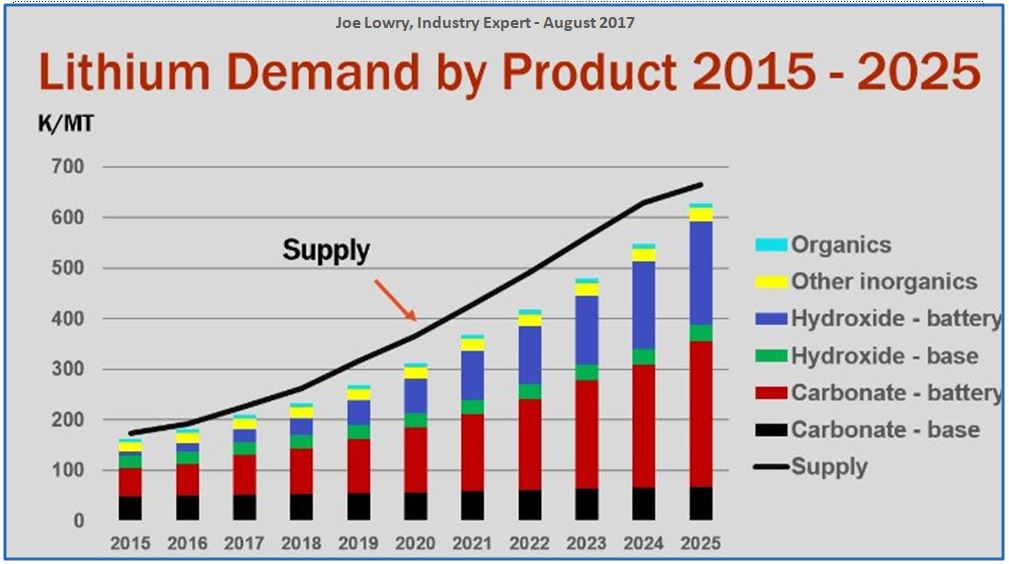

- Supply and demand: The balance between lithium supply and demand is a primary driver of prices. Growing EV adoption and the expansion of battery storage systems have significantly increased lithium demand. On the supply side, production capacity constraints and geopolitical factors can impact supply levels.

- Battery technology advancements: Innovations in battery technology, such as the development of solid-state batteries, could reduce the amount of lithium required per battery, potentially impacting demand.

- Government policies: Government regulations and incentives aimed at promoting EV adoption and renewable energy can stimulate lithium demand.

- Economic conditions: Global economic conditions, including inflation, interest rates, and currency fluctuations, can influence lithium prices.

Lithium Price Predictions 2025

Forecasting lithium prices is challenging due to the dynamic nature of the market. However, industry analysts have made predictions based on current trends and projections. Here are some notable predictions for 2025:

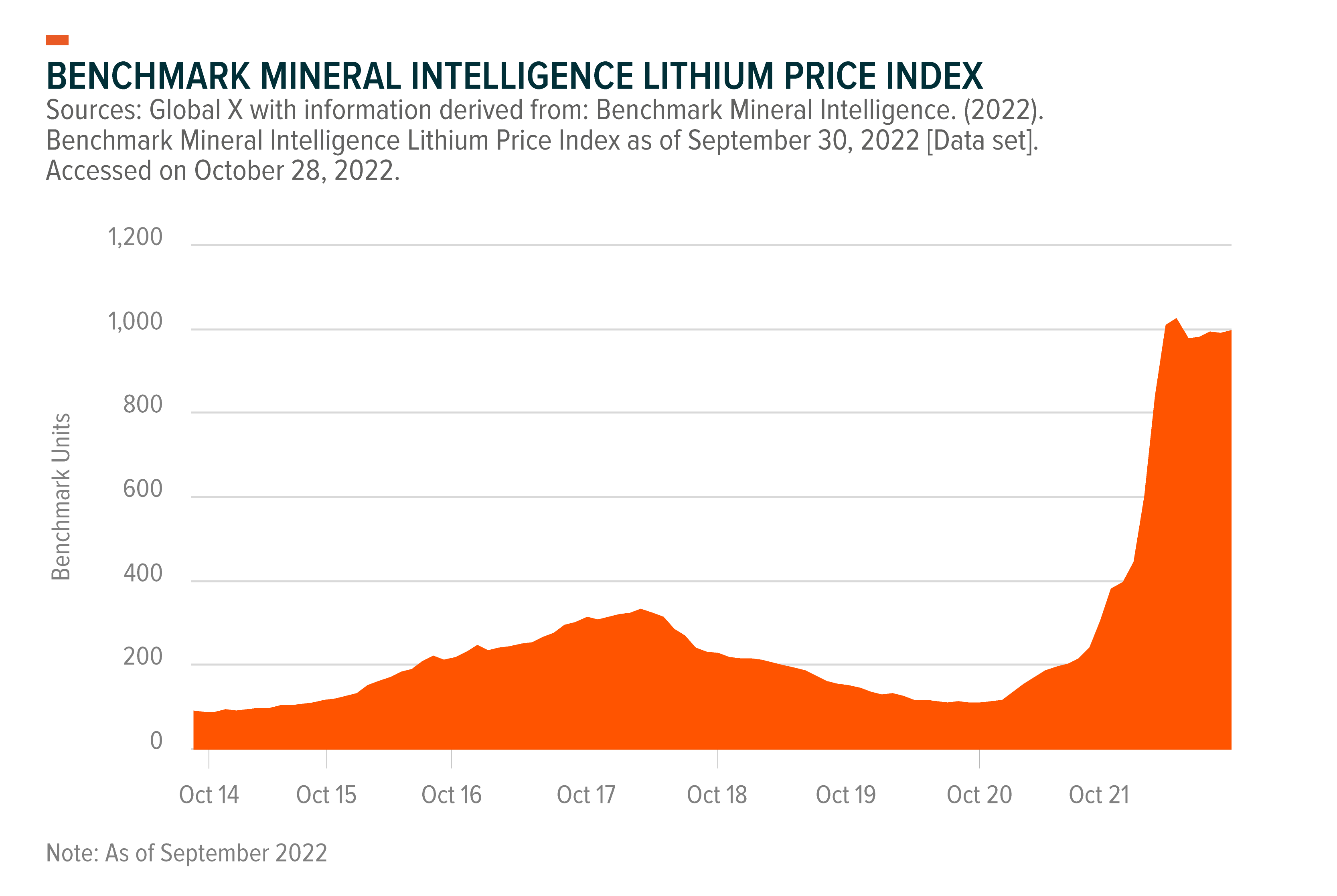

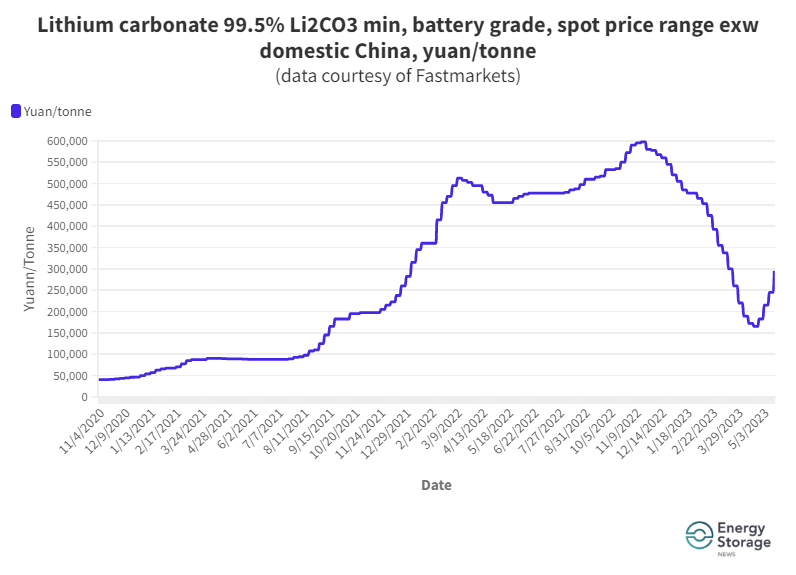

- Benchmark Mineral Intelligence (BMI): BMI predicts that lithium prices will remain elevated in 2025, with a price range of $15,000 to $25,000 per tonne for battery-grade lithium carbonate (LCE).

- Roskill: Roskill forecasts that lithium prices will continue to rise in the short term, reaching $22,000 per tonne for LCE by 2025. However, they expect prices to stabilize in the long term as new supply comes online.

- S&P Global Platts: Platts predicts that lithium prices will moderate in 2025, with LCE prices averaging around $18,000 per tonne. They attribute this moderation to increased supply and technological advancements.

Factors Supporting High Prices

Several factors support the bullish outlook for lithium prices in 2025:

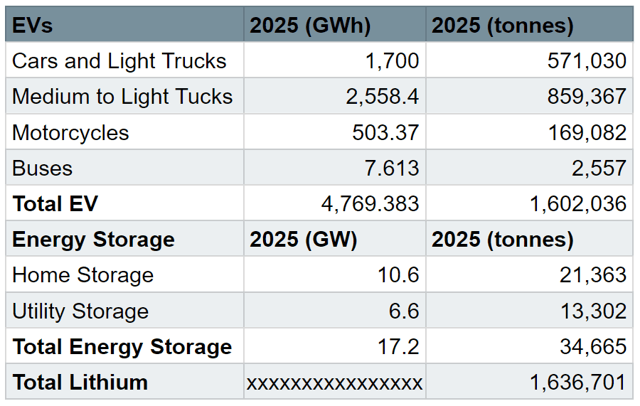

- Growing EV demand: The rapid adoption of EVs worldwide is driving up lithium demand. By 2025, it is estimated that EV sales will account for over a third of global car sales.

- Battery storage expansion: The deployment of large-scale battery storage systems for renewable energy integration is also increasing lithium demand.

- Supply constraints: Lithium production capacity is currently unable to keep up with the surge in demand, leading to supply shortages.

- Geopolitical risks: Political instability in major lithium-producing countries, such as Chile and Australia, can disrupt supply chains and drive up prices.

Factors Moderating Prices

Despite the bullish outlook, some factors could moderate lithium prices in the long term:

- Increased supply: New lithium mines and projects are expected to come online in the coming years, increasing supply and potentially easing price pressures.

- Battery technology improvements: The development of new battery chemistries and designs could reduce lithium consumption per battery.

- Recycling and reuse: Increased recycling and reuse of lithium-ion batteries can reduce demand for new lithium.

Conclusion

The lithium price outlook for 2025 is complex and influenced by various factors. While supply constraints and growing demand are expected to keep prices elevated in the short term, increased supply and technological advancements could moderate prices in the long run. Industry analysts predict a price range of $15,000 to $25,000 per tonne for LCE by 2025, with potential for further moderation in subsequent years. It is important to note that these predictions are subject to change based on unforeseen events and market dynamics.

Closure

Thus, we hope this article has provided valuable insights into Lithium Price Prediction 2025: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!