Lifetime Gift and Estate Tax Exemption: 2025 Changes and Implications

Related Articles: Lifetime Gift and Estate Tax Exemption: 2025 Changes and Implications

- 2025-2026 Pocket Calendar: Your Essential Planning Companion

- Overview Of The G20 2025: Shaping The Future Of Global Cooperation

- Tickets For World Juniors 2025: Everything You Need To Know

- Color Of The Year 2025: Unveiling The Hues That Will Define The Future

- Africa Cup Of Nations Qualification 2025: A Comprehensive Overview

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Lifetime Gift and Estate Tax Exemption: 2025 Changes and Implications. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Lifetime Gift and Estate Tax Exemption: 2025 Changes and Implications

Lifetime Gift and Estate Tax Exemption: 2025 Changes and Implications

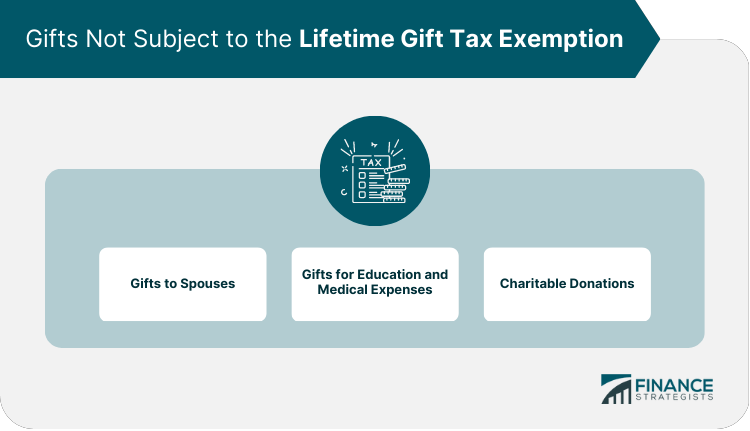

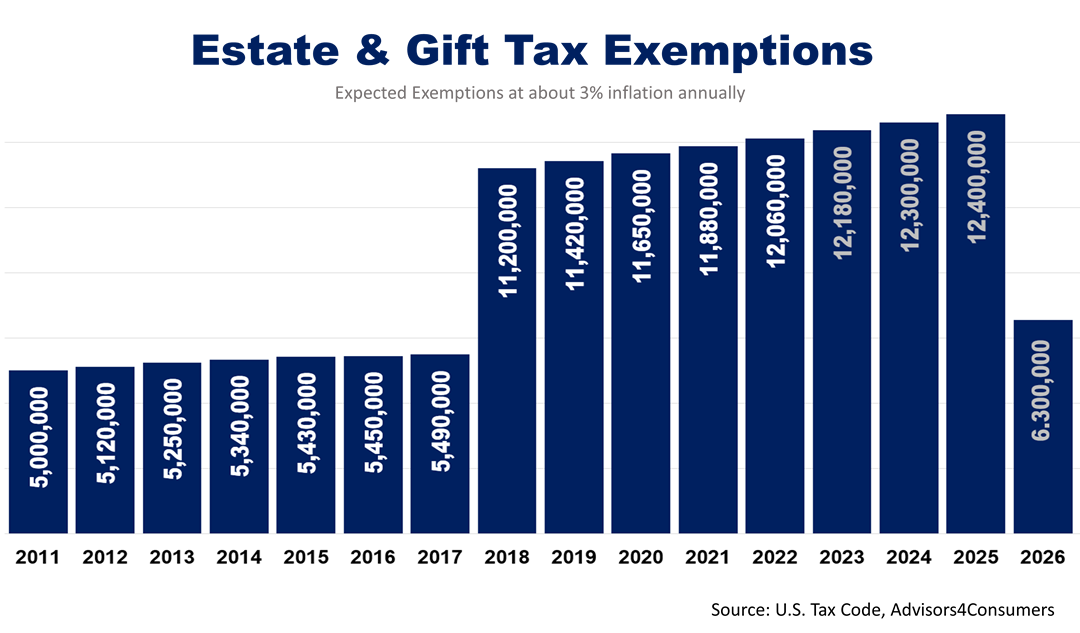

The lifetime gift and estate tax exemption, also known as the "unified credit," is a crucial factor in estate planning. It allows individuals to transfer a certain amount of wealth during their lifetime or upon their death without incurring federal gift or estate taxes. The exemption amount has undergone significant changes over the years, and further adjustments are expected in 2025. This article provides an overview of the lifetime gift and estate tax exemption, its historical evolution, the upcoming changes in 2025, and their potential implications.

Historical Evolution of the Exemption

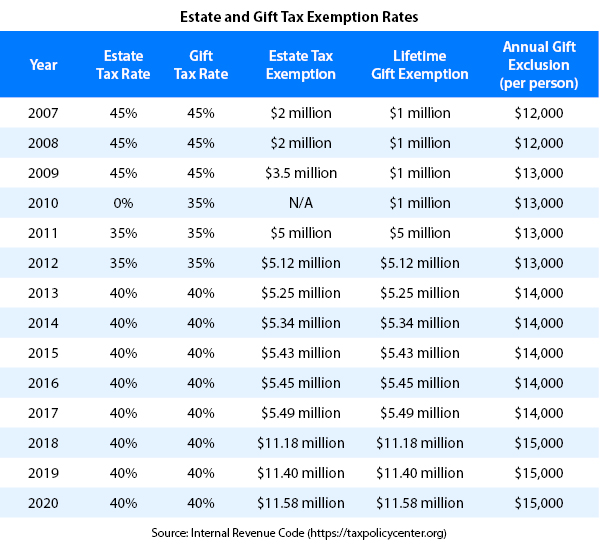

The lifetime gift and estate tax exemption was first introduced in 1916 as a way to reduce the tax burden on large estates. Since then, the exemption amount has been revised several times through various tax laws. The most recent change was made by the Tax Cuts and Jobs Act (TCJA) of 2017, which doubled the exemption amount to $11.58 million per individual ($23.16 million for married couples). This increased exemption was set to expire in 2026, but the American Rescue Plan Act of 2021 extended it through 2025.

2025 Changes

In 2025, the lifetime gift and estate tax exemption is scheduled to revert to its pre-TCJA level of $5 million per individual ($10 million for married couples). This significant reduction could have substantial implications for individuals with high-value estates.

Implications of the 2025 Changes

The decrease in the exemption amount in 2025 could result in more individuals being subject to federal gift or estate taxes. This could lead to increased tax liability and reduced flexibility in estate planning. Here are some potential implications:

- Increased Tax Liability: With a lower exemption amount, more individuals will have to pay gift or estate taxes on the transfer of assets. This could result in higher tax bills for heirs and beneficiaries.

- Reduced Flexibility: The lower exemption amount will limit the ability of individuals to make large gifts during their lifetime or transfer assets upon their death without incurring taxes. This could affect estate planning strategies and limit the ability to pass on wealth to future generations.

- Increased Complexity: The reduction in the exemption amount will increase the complexity of estate planning. Individuals will need to carefully consider their options and potentially restructure their estate plans to minimize tax liability.

- Potential for Retroactive Taxation: The change in the exemption amount in 2025 could potentially lead to retroactive taxation for individuals who made large gifts under the higher exemption limits between 2018 and 2025.

Planning Considerations

In light of the upcoming changes in 2025, individuals with high-value estates should consider reviewing their estate plans and exploring strategies to minimize the potential tax impact. Here are some planning considerations:

- Make Gifts Before 2025: Individuals who wish to take advantage of the higher exemption amount may consider making gifts before 2025 to reduce the value of their taxable estate.

- Establish Trusts: Irrevocable trusts can be used to transfer assets outside of an individual’s taxable estate, potentially reducing future tax liability.

- Consider Life Insurance: Life insurance policies can provide a tax-free source of funds to cover estate taxes.

- Seek Professional Advice: Consulting with an experienced estate planning attorney is essential to develop a comprehensive plan that addresses the specific needs and goals of the individual.

Conclusion

The lifetime gift and estate tax exemption is a critical element of estate planning. The upcoming changes in 2025 will significantly reduce the exemption amount, potentially affecting individuals with high-value estates. By understanding the implications of these changes and considering appropriate planning strategies, individuals can mitigate the potential tax impact and ensure the smooth transfer of their wealth to future generations. It is important to seek professional advice to navigate the complexities of estate planning and make informed decisions that align with individual circumstances and objectives.

Closure

Thus, we hope this article has provided valuable insights into Lifetime Gift and Estate Tax Exemption: 2025 Changes and Implications. We hope you find this article informative and beneficial. See you in our next article!