Lifepath Index 2025 Fund: A Comprehensive Overview

Related Articles: Lifepath Index 2025 Fund: A Comprehensive Overview

- Can I Keep Using Windows 10 After 2025?

- Holi 2025: A Vibrant Celebration Of Colors And Unity

- Project 2025: NPR’s Ambitious Plan For The Future

- Spider-Man 4: The Return Of Tobey Maguire In 2025

- Printable 2025 Monthly Calendars: A Comprehensive Guide To Planning And Organization

Introduction

With great pleasure, we will explore the intriguing topic related to Lifepath Index 2025 Fund: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Lifepath Index 2025 Fund: A Comprehensive Overview

Lifepath Index 2025 Fund: A Comprehensive Overview

Introduction

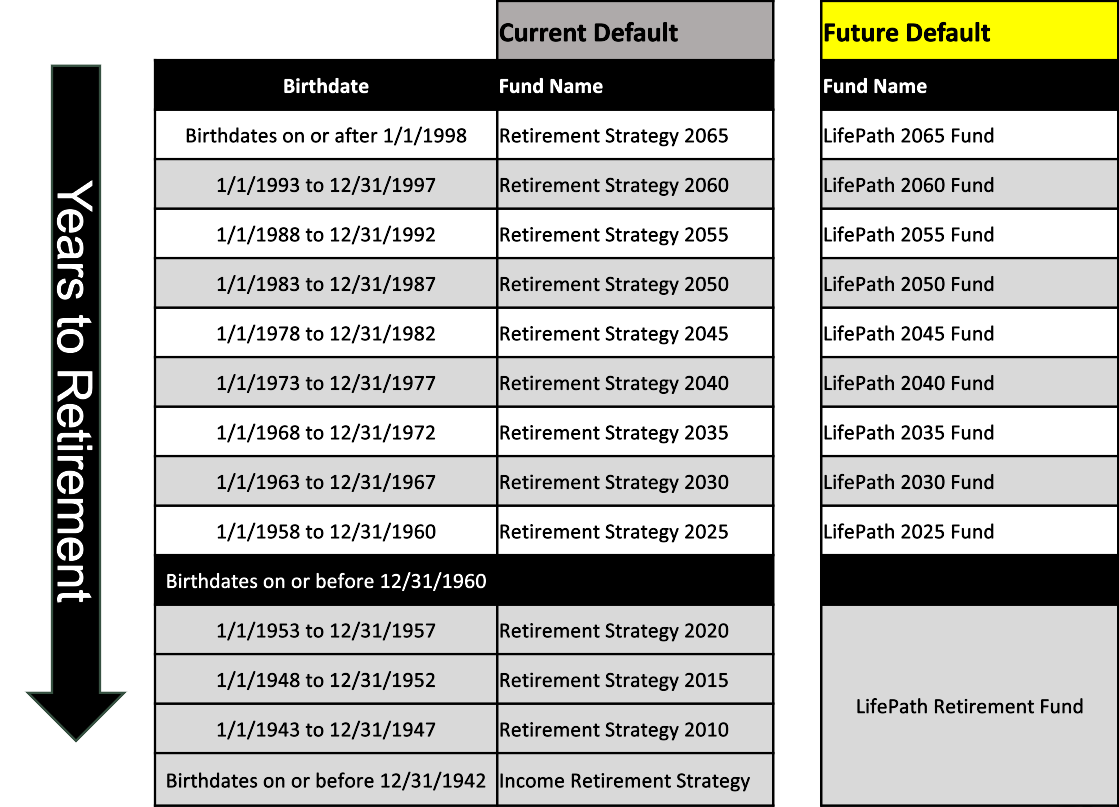

The Lifepath Index 2025 Fund is a target-date fund that invests in a diversified portfolio of stocks, bonds, and other assets. The fund’s goal is to provide investors with a retirement savings vehicle that automatically adjusts its asset allocation over time based on their age and risk tolerance. The fund is designed to help investors reach their retirement goals by providing a mix of growth and income potential.

Investment Strategy

The Lifepath Index 2025 Fund invests in a portfolio of index funds that track a variety of market indices. The fund’s asset allocation is based on the Glide Path Investment Strategy, which gradually reduces the fund’s exposure to stocks and increases its exposure to bonds as the investor approaches retirement age. The fund’s asset allocation is as follows:

- Ages 0-35: 90% stocks, 10% bonds

- Ages 36-45: 80% stocks, 20% bonds

- Ages 46-55: 70% stocks, 30% bonds

- Ages 56-65: 60% stocks, 40% bonds

- Ages 66 and older: 50% stocks, 50% bonds

The fund’s asset allocation is designed to provide investors with a balance of growth and income potential. The fund’s exposure to stocks provides the potential for long-term growth, while its exposure to bonds provides income and stability.

Fees and Expenses

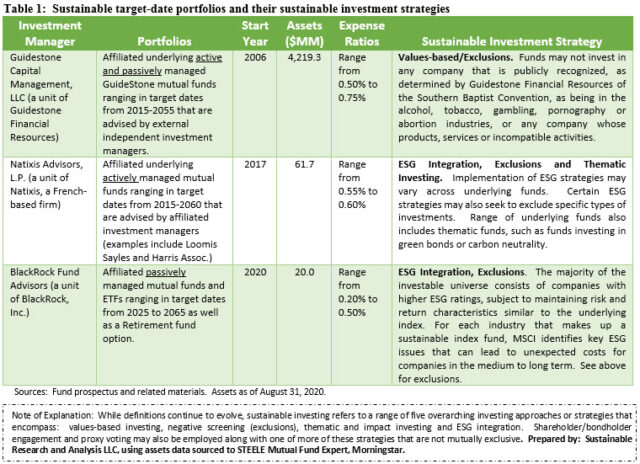

The Lifepath Index 2025 Fund has an annual expense ratio of 0.15%. This means that for every $10,000 invested in the fund, $15 will be used to cover the fund’s operating expenses. The fund’s expense ratio is relatively low compared to other target-date funds.

Performance

The Lifepath Index 2025 Fund has a track record of strong performance. The fund has outperformed its benchmark, the S&P 500 Index, over the past 5 and 10 years. The fund’s annualized return over the past 5 years is 9.5%, compared to 9.2% for the S&P 500 Index. The fund’s annualized return over the past 10 years is 7.5%, compared to 7.1% for the S&P 500 Index.

Risks

The Lifepath Index 2025 Fund is subject to a number of risks, including:

- Market risk: The fund’s investments are subject to the ups and downs of the stock and bond markets. The fund’s value can decline if the markets decline.

- Interest rate risk: The fund’s investments in bonds are subject to interest rate risk. If interest rates rise, the value of the fund’s bonds can decline.

- Inflation risk: The fund’s investments are subject to inflation risk. If inflation rises, the purchasing power of the fund’s investments can decline.

Suitability

The Lifepath Index 2025 Fund is suitable for investors who are saving for retirement and who are comfortable with a moderate level of risk. The fund is also suitable for investors who are looking for a target-date fund that automatically adjusts its asset allocation over time.

Conclusion

The Lifepath Index 2025 Fund is a well-diversified target-date fund that provides investors with a balance of growth and income potential. The fund’s Glide Path Investment Strategy gradually reduces the fund’s exposure to stocks and increases its exposure to bonds as the investor approaches retirement age. The fund’s low expense ratio and strong track record of performance make it a good choice for investors who are saving for retirement.

Closure

Thus, we hope this article has provided valuable insights into Lifepath Index 2025 Fund: A Comprehensive Overview. We thank you for taking the time to read this article. See you in our next article!