IRMAA Tax Brackets 2025: Understanding the Medicare Surtax

Related Articles: IRMAA Tax Brackets 2025: Understanding the Medicare Surtax

- The 2025 QB Draft Class: A Comprehensive Analysis

- Hawaii DOE Calendar 2024-2025: A Comprehensive Guide

- Hatchet 5 In 2025: The Future Of Mobile Computing

- When Diwali Comes In 2025: A Comprehensive Guide To The Festival Of Lights

- MDX 2025 Release Date And Price: Unveiling The Future Of Data Visualization

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to IRMAA Tax Brackets 2025: Understanding the Medicare Surtax. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about IRMAA Tax Brackets 2025: Understanding the Medicare Surtax

IRMAA Tax Brackets 2025: Understanding the Medicare Surtax

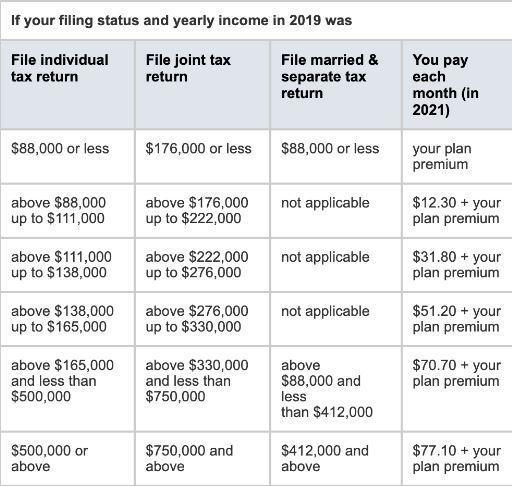

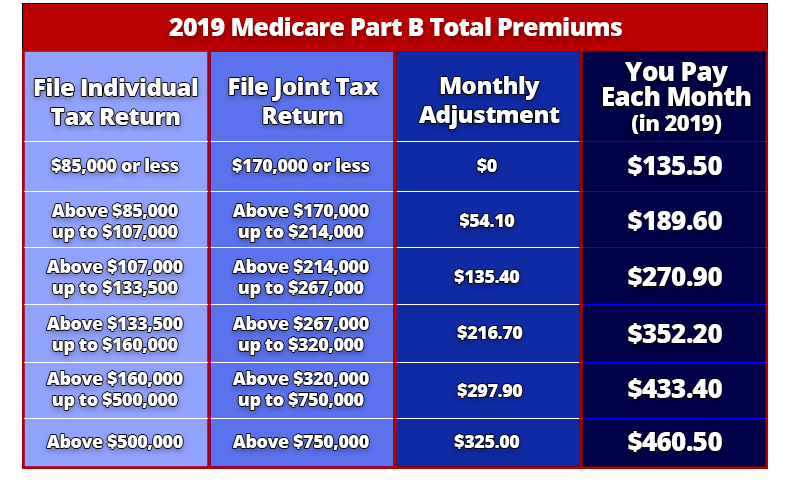

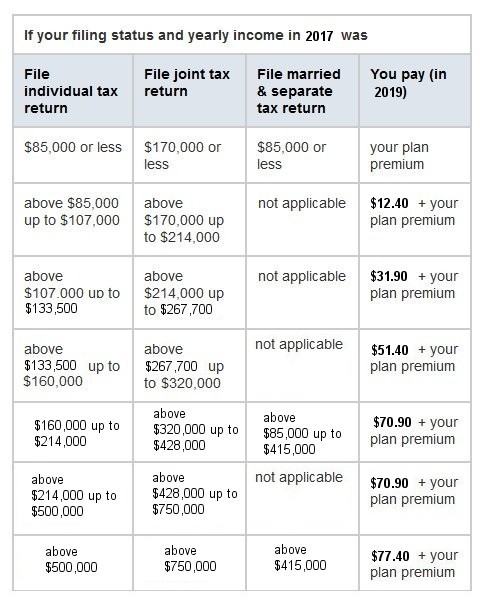

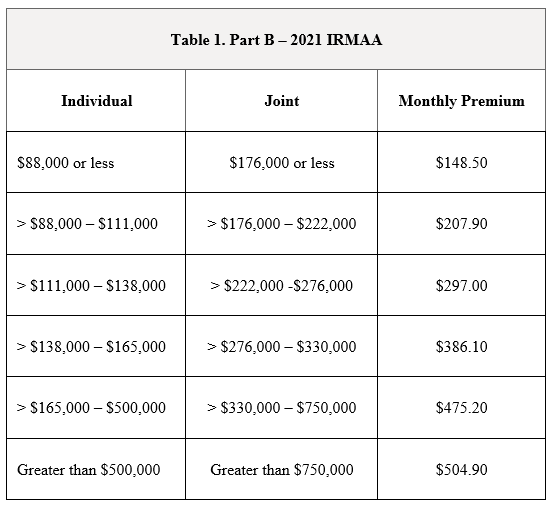

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge that is added to the Medicare Part B and Part D premiums for individuals and families with higher incomes. IRMAA was implemented to help fund the Medicare program, which provides health insurance to Americans aged 65 and older, as well as to younger individuals with certain disabilities.

The IRMAA surtax is based on the modified adjusted gross income (MAGI) of the taxpayer. MAGI is the taxpayer’s adjusted gross income (AGI) plus certain deductions and exclusions. For 2025, the IRMAA tax brackets are as follows:

| Filing Status | MAGI Threshold | Surtax Percentage |

|---|---|---|

| Single | $97,000 | 0% |

| Single | $123,000 | 50% |

| Single | $154,000 | 80% |

| Single | $282,000 | 100% |

| Married Filing Jointly | $174,000 | 0% |

| Married Filing Jointly | $220,000 | 50% |

| Married Filing Jointly | $266,000 | 80% |

| Married Filing Jointly | $528,000 | 100% |

| Head of Household | $133,000 | 0% |

| Head of Household | $166,000 | 50% |

| Head of Household | $199,000 | 80% |

| Head of Household | $404,000 | 100% |

Example:

A single taxpayer with a MAGI of $125,000 would be subject to a 50% IRMAA surtax. This means that they would pay an additional $25 per month for Medicare Part B and an additional $12.50 per month for Medicare Part D, for a total of $37.50 per month.

Exemptions:

There are certain individuals who are exempt from the IRMAA surtax, including:

- Individuals who are enrolled in Medicaid

- Individuals who have low incomes and qualify for Medicare Savings Programs

- Individuals who have end-stage renal disease (ESRD)

- Individuals who are permanently and totally disabled

Impact of IRMAA:

The IRMAA surtax can have a significant impact on the cost of Medicare coverage for individuals with higher incomes. For example, a single taxpayer with a MAGI of $282,000 would pay an additional $200 per month for Medicare Part B and an additional $100 per month for Medicare Part D, for a total of $300 per month.

Conclusion:

The IRMAA surtax is an important factor to consider when planning for Medicare costs. Individuals with higher incomes should be aware of the IRMAA brackets and the potential impact of the surtax on their monthly premiums. There are certain exemptions available for individuals with low incomes or certain medical conditions, and individuals who qualify for these exemptions should apply to avoid paying the IRMAA surtax.

Closure

Thus, we hope this article has provided valuable insights into IRMAA Tax Brackets 2025: Understanding the Medicare Surtax. We hope you find this article informative and beneficial. See you in our next article!