IRMAA 2025 Brackets and Premiums Chart

Related Articles: IRMAA 2025 Brackets and Premiums Chart

- 2025 S 8th Ave, Maywood, IL 60153: A Luxurious Oasis In The Heart Of Maywood

- Genesis GV80 Coupe 2025: A Glimpse Into The Future Of Luxury SUVs

- IRFC Share Price Target 20: A Comprehensive Analysis

- 2025 World Masters Games: A Sporting Extravaganza For Athletes Of All Ages

- 2025 Ford Expedition: A Build Fit For The Future

Introduction

With great pleasure, we will explore the intriguing topic related to IRMAA 2025 Brackets and Premiums Chart. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about IRMAA 2025 Brackets and Premiums Chart

IRMAA 2025 Brackets and Premiums Chart

The Affordable Care Act (ACA) created the Income-Related Monthly Adjustment Amount (IRMAA) to help offset the cost of health insurance for higher-income individuals and families. IRMAA is an additional premium that is added to the monthly premiums of individuals and families who have incomes above certain thresholds. The IRMAA thresholds are adjusted annually based on the cost of health insurance.

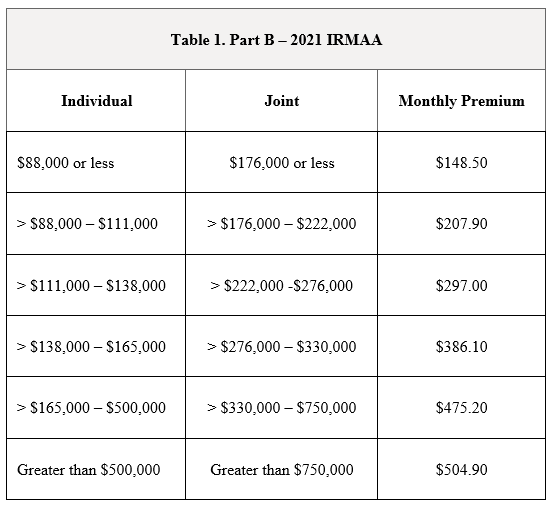

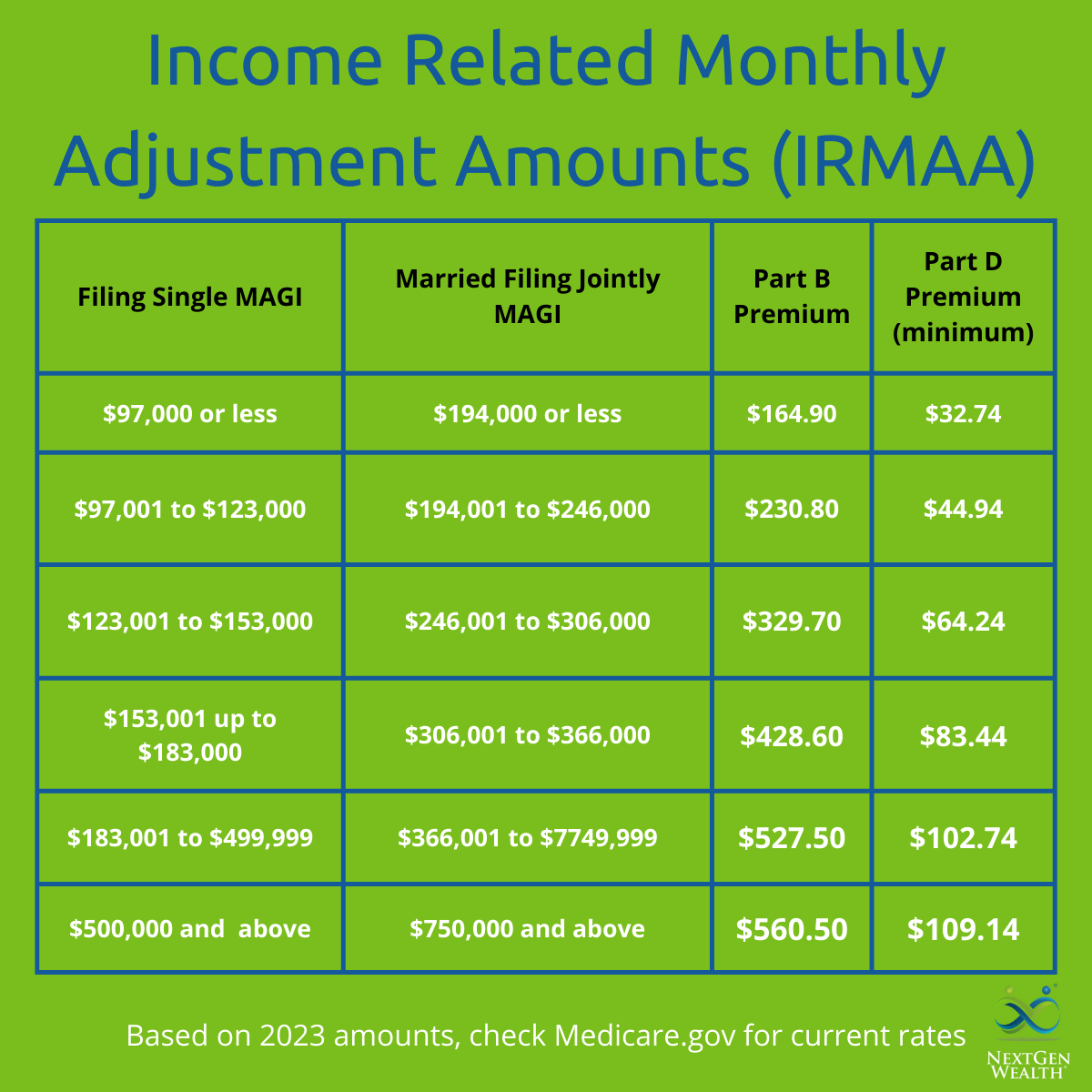

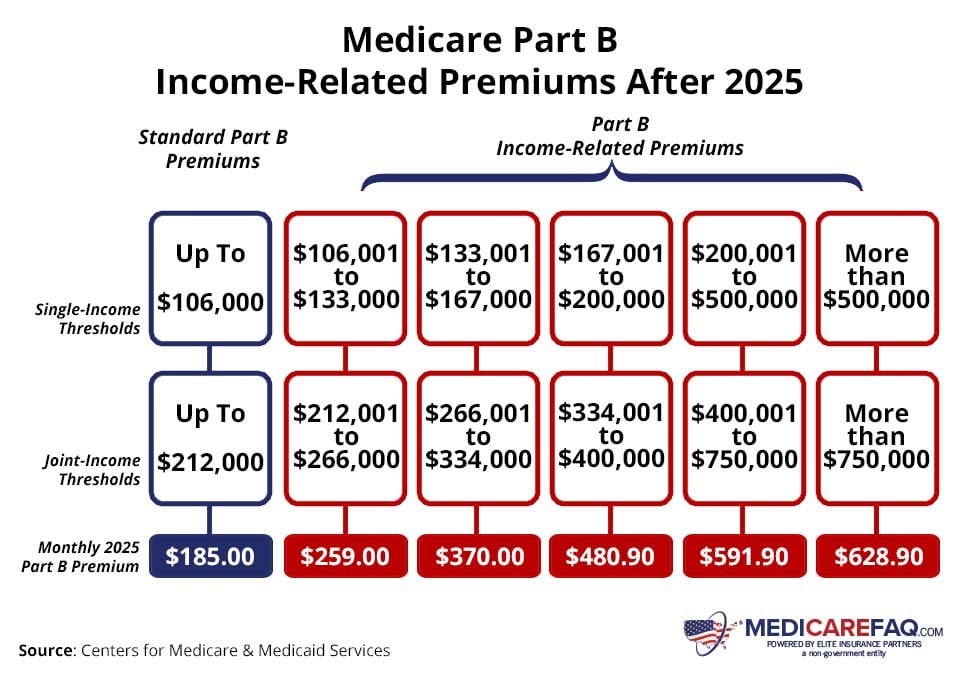

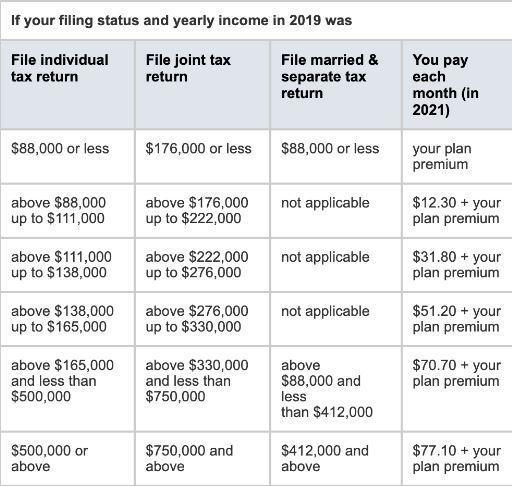

For 2025, the IRMAA thresholds have been increased. This means that more individuals and families will be subject to IRMAA in 2025. The following chart shows the IRMAA thresholds and premiums for 2025:

| Filing Status | Income Threshold | IRMAA Premium |

|---|---|---|

| Single | $97,000 | $240 |

| Head of Household | $138,000 | $560 |

| Married Filing Jointly | $194,000 | $1,280 |

| Married Filing Separately | $97,000 | $640 |

How to Avoid IRMAA

There are a few ways to avoid IRMAA. One way is to reduce your income. This can be done by contributing more to a retirement account, such as a 401(k) or IRA. Another way to avoid IRMAA is to increase your family size. This can be done by having children or adopting children.

Conclusion

IRMAA is an additional premium that is added to the monthly premiums of individuals and families who have incomes above certain thresholds. The IRMAA thresholds are adjusted annually based on the cost of health insurance. For 2025, the IRMAA thresholds have been increased. This means that more individuals and families will be subject to IRMAA in 2025. There are a few ways to avoid IRMAA. One way is to reduce your income. Another way to avoid IRMAA is to increase your family size.

Additional Information

- IRMAA is only applied to health insurance plans that are purchased through the Health Insurance Marketplace.

- IRMAA is not applied to employer-sponsored health insurance plans.

- IRMAA is not applied to Medicare Part A or Part B premiums.

- IRMAA is not applied to Medicaid premiums.

FAQs

- What is IRMAA?

IRMAA is the Income-Related Monthly Adjustment Amount. It is an additional premium that is added to the monthly premiums of individuals and families who have incomes above certain thresholds.

- How much is IRMAA?

The amount of IRMAA depends on your filing status and income. The IRMAA thresholds and premiums for 2025 are shown in the chart above.

- How can I avoid IRMAA?

There are a few ways to avoid IRMAA. One way is to reduce your income. Another way to avoid IRMAA is to increase your family size.

- Does IRMAA apply to employer-sponsored health insurance plans?

No, IRMAA does not apply to employer-sponsored health insurance plans.

- Does IRMAA apply to Medicare Part A or Part B premiums?

No, IRMAA does not apply to Medicare Part A or Part B premiums.

- Does IRMAA apply to Medicaid premiums?

No, IRMAA does not apply to Medicaid premiums.

Closure

Thus, we hope this article has provided valuable insights into IRMAA 2025 Brackets and Premiums Chart. We thank you for taking the time to read this article. See you in our next article!