IR 2025 Como Declarar: A Comprehensive Guide for Brazilian Individuals

Related Articles: IR 2025 Como Declarar: A Comprehensive Guide for Brazilian Individuals

- The 2025 QB Draft Class: A Comprehensive Analysis

- 20253 Northcove Square: A Luxurious Waterfront Haven In The Heart Of Miami

- 2025 Infiniti Q60: A Vision Of Power And Elegance

- 2025 Jeep Renegade Truck: A Rugged Beast For Adventure Seekers

- How Many Hours Until 2025: A Countdown To The Future

Introduction

With great pleasure, we will explore the intriguing topic related to IR 2025 Como Declarar: A Comprehensive Guide for Brazilian Individuals. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about IR 2025 Como Declarar: A Comprehensive Guide for Brazilian Individuals

IR 2025 Como Declarar: A Comprehensive Guide for Brazilian Individuals

Introduction

The Imposto de Renda Pessoa Física (IRPF), or Individual Income Tax, is a tax levied on the income of individuals residing in Brazil. The Brazilian tax authority, the Receita Federal do Brasil (RFB), requires individuals to file an annual IRPF return, known as the Declaração do Imposto de Renda Pessoa Física (DIRPF). This article provides a comprehensive guide to assist Brazilian individuals in filing their IRPF return for the 2025 tax year.

Who is Required to File an IRPF Return?

Individuals who meet any of the following criteria are required to file an IRPF return:

- Earned income exceeding R$28,559.70 in the tax year

- Received income from non-taxable sources exceeding R$40,000.00

- Had capital gains from the sale of assets

- Had rental income

- Had income from abroad

- Were a beneficiary of a trust or estate

Filing Deadlines

The deadline for filing an IRPF return varies depending on the individual’s filing method:

- Online Filing: March 15th to April 30th

- Software Filing: March 15th to May 15th

- Paper Filing: March 15th to April 30th

Filing Methods

Individuals can file their IRPF return using the following methods:

- Online Filing: Through the RFB’s e-CAC portal (https://cav.receita.fazenda.gov.br/autenticacao/login)

- Software Filing: Using software provided by the RFB or third-party vendors

- Paper Filing: At a local RFB office

Required Documents

To file an IRPF return, individuals will need the following documents:

- CPF (Cadastro de Pessoas Físicas) number

- Proof of income (e.g., pay stubs, invoices)

- Proof of deductions and credits (e.g., receipts, bank statements)

- Information on assets and liabilities

Steps to File an IRPF Return

1. Gather Required Documents

Collect all necessary documents as listed above.

2. Choose a Filing Method

Select one of the three filing methods mentioned earlier.

3. Prepare Your Return

Fill out the DIRPF form with the required information. The form can be accessed through the RFB’s website or through software.

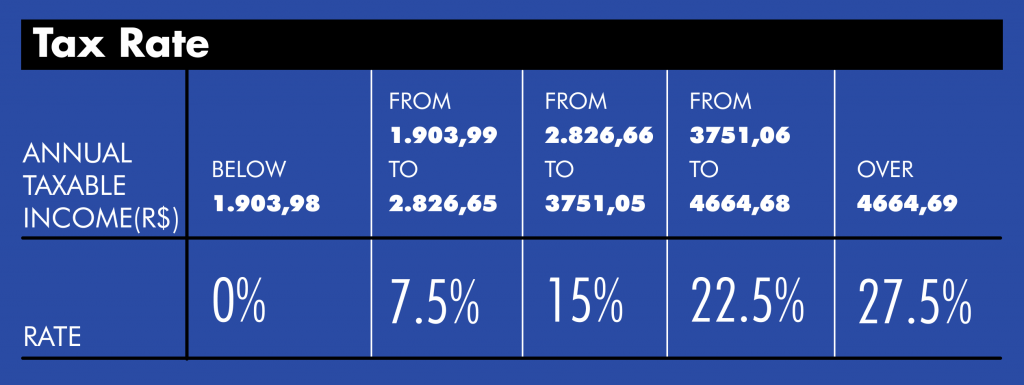

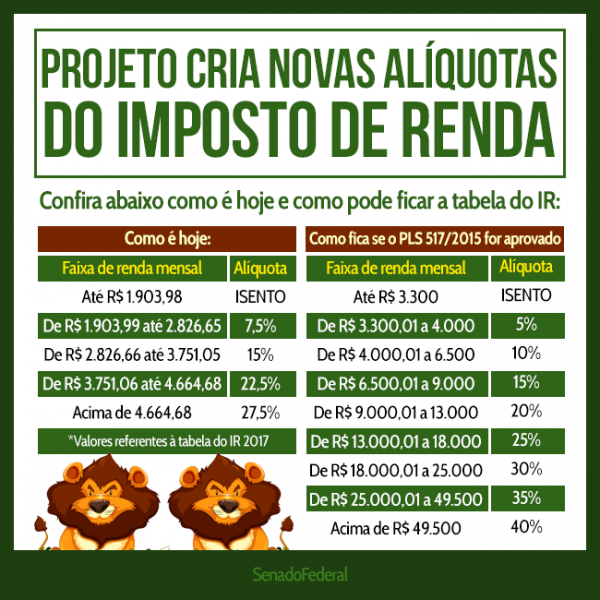

4. Calculate Your Tax

Determine the amount of tax owed based on your income and deductions. The RFB provides online tools to assist with tax calculations.

5. Pay Your Tax

If you owe taxes, make the payment through the options provided by the RFB (e.g., online banking, credit card).

6. Submit Your Return

Submit your completed return using the chosen filing method before the applicable deadline.

Deductions and Credits

Individuals can reduce their taxable income by claiming certain deductions and credits. Common deductions include:

- Medical expenses

- Education expenses

- Social security contributions

- Dependent expenses

Common credits include:

- Dependent tax credit

- Education tax credit

Penalties for Late Filing

Filing an IRPF return late can result in penalties and interest charges. The penalty for late filing is 1% of the tax due, with a minimum fine of R$165.74.

Additional Information

- Individuals can amend their IRPF return within five years of the original filing date.

- The RFB provides online assistance and support for taxpayers.

- Taxpayers can also seek professional assistance from accountants or tax attorneys.

Conclusion

Filing an IRPF return can be a complex process, but by following the steps outlined in this guide, Brazilian individuals can ensure that they meet their tax obligations accurately and on time. It is important to gather the necessary documents, choose a filing method, prepare the return carefully, calculate the tax due, pay the tax, and submit the return by the deadline to avoid penalties.

Closure

Thus, we hope this article has provided valuable insights into IR 2025 Como Declarar: A Comprehensive Guide for Brazilian Individuals. We thank you for taking the time to read this article. See you in our next article!