IR 2024 Receita Federal: A Comprehensive Guide

Related Articles: IR 2024 Receita Federal: A Comprehensive Guide

- 2025 Lakewood Ranch Boulevard: A Premier Destination For Business And Lifestyle

- Kaufman Chiropractic: Advancing Chiropractic Care In Kaufman, TX

- 2025 Jeep Grand Cherokee SRT: A Beast Unleashed

- LEAP 2025 Practice Test Answer Key: A Comprehensive Guide

- Jaguar Cars 2025 Models: A Glimpse Into The Future Of British Luxury

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to IR 2024 Receita Federal: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about IR 2024 Receita Federal: A Comprehensive Guide

IR 2024 Receita Federal: A Comprehensive Guide

Introduction

The Imposto de Renda (IR) is a federal income tax levied on individuals and legal entities in Brazil. It is one of the main sources of revenue for the Brazilian government and plays a crucial role in funding public services and infrastructure. The Receita Federal do Brasil (RFB) is the federal agency responsible for administering and collecting the IR.

In 2024, the IR regulations will undergo significant changes. These changes aim to simplify the tax system, reduce tax evasion, and promote economic growth. This article provides a comprehensive guide to the IR 2024 Receita Federal, outlining the key changes and their implications for taxpayers.

Key Changes to IR 2024

The following are the most important changes introduced by IR 2024:

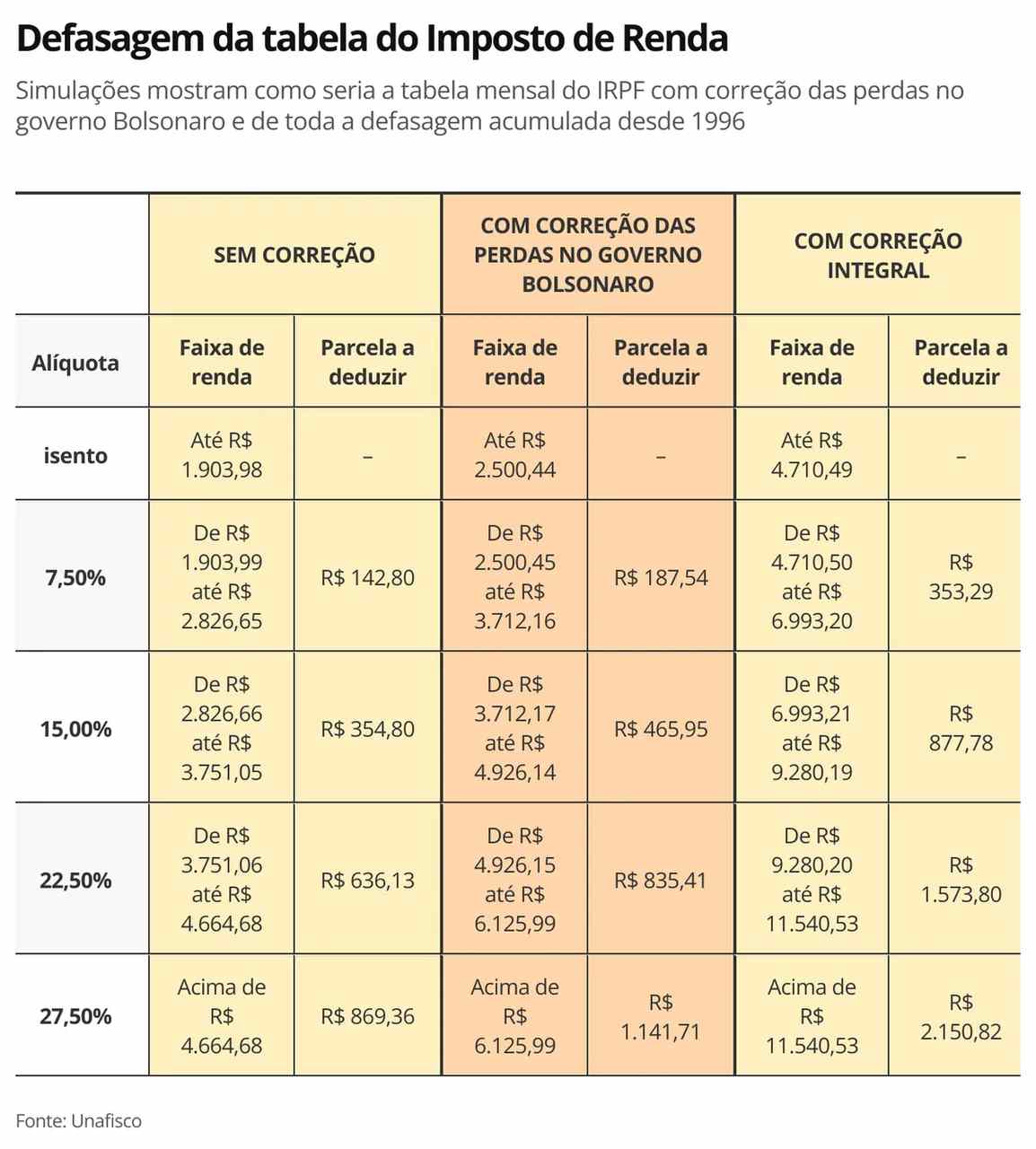

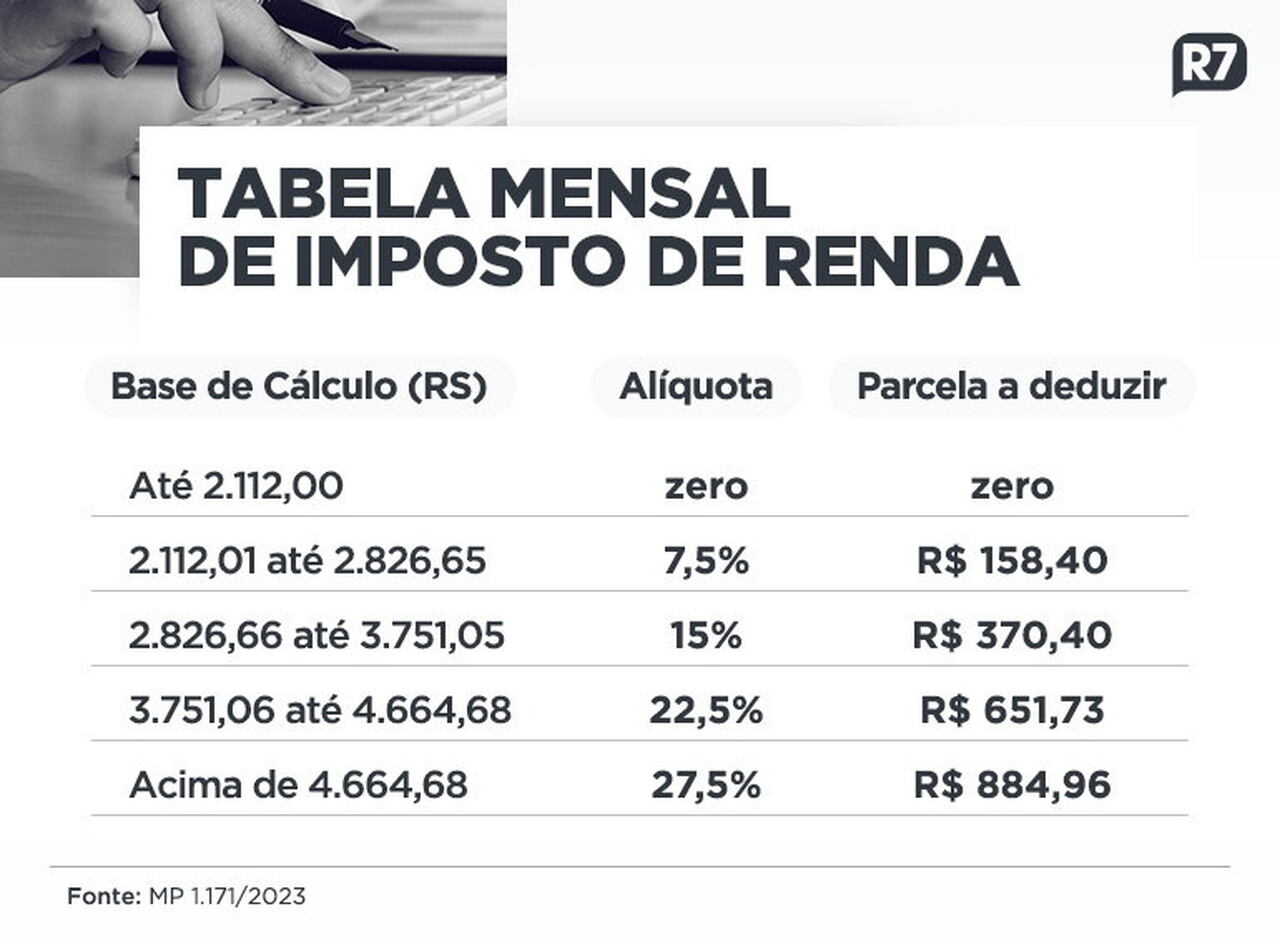

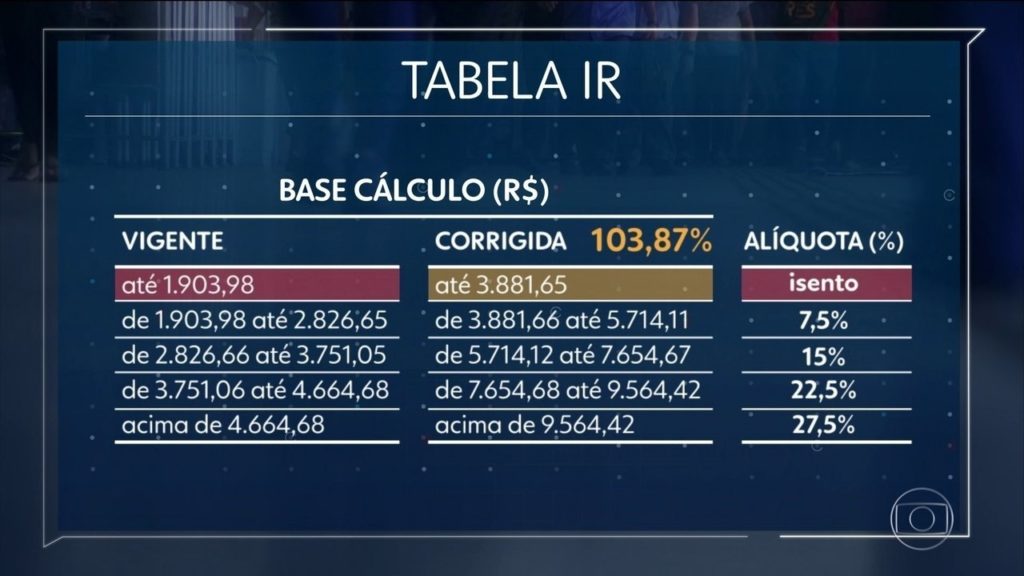

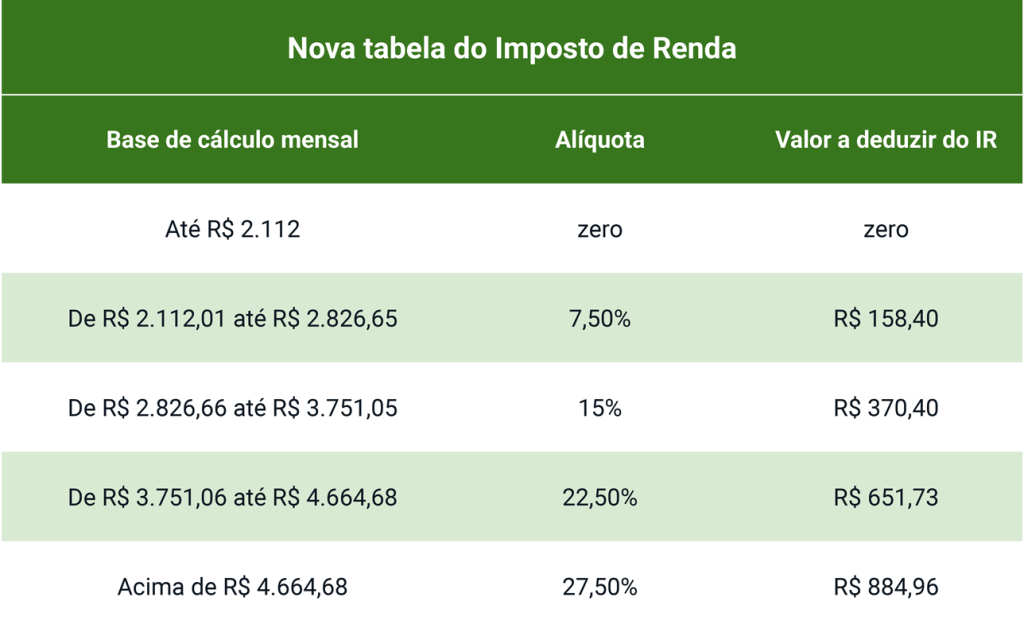

1. Progressive Tax Rates

The current flat tax rate of 27.5% for individuals will be replaced with a progressive tax rate structure. Under the new system, individuals will be taxed at different rates based on their income level. The progressive tax rates will range from 7.5% to 27.5%.

2. Standard Deduction

A standard deduction will be introduced for individuals, reducing the amount of taxable income. The standard deduction will be a fixed amount that is subtracted from the taxpayer’s gross income before calculating the tax liability.

3. Personal Exemptions

Personal exemptions for dependents will be eliminated. This means that taxpayers will no longer be able to claim deductions for their spouses or children.

4. Capital Gains

The capital gains tax rate will be reduced from 20% to 15%. This change is intended to encourage investment and economic growth.

5. Digital Transactions

The RFB will implement new measures to monitor and tax digital transactions. This includes transactions made through e-commerce platforms, digital wallets, and cryptocurrency exchanges.

Implications for Taxpayers

The changes to IR 2024 will have significant implications for taxpayers. Here are some key points to consider:

1. Lower Tax Burden for Low-Income Earners

The progressive tax rates will reduce the tax burden for low-income earners. Individuals with incomes below a certain threshold will be exempt from paying IR altogether.

2. Increased Tax Burden for High-Income Earners

High-income earners will face a higher tax burden under the new progressive tax rate structure. This is because the tax rate will increase as their income increases.

3. Reduced Standard Deduction

The standard deduction will reduce the amount of taxable income, but it may not fully compensate for the elimination of personal exemptions. This could result in a higher tax liability for some taxpayers.

4. Lower Capital Gains Tax

The reduced capital gains tax rate is a positive development for investors. It is expected to encourage investment and stimulate economic growth.

5. Increased Scrutiny of Digital Transactions

The RFB’s increased focus on monitoring and taxing digital transactions may lead to increased tax audits and penalties for non-compliance. Taxpayers are advised to keep accurate records of their digital transactions.

Compliance and Enforcement

The RFB is committed to enforcing the new IR 2024 regulations. Taxpayers are expected to comply with the new rules and file their tax returns accurately and on time. The RFB has implemented various measures to improve compliance, including:

1. Enhanced Data Analytics

The RFB is using advanced data analytics to detect tax evasion and identify non-compliant taxpayers.

2. Increased Audits

The RFB has increased the number of audits conducted to ensure compliance with tax laws.

3. Stricter Penalties

The RFB has implemented stricter penalties for tax evasion and non-compliance. These penalties can include fines, imprisonment, and seizure of assets.

Conclusion

The IR 2024 Receita Federal represents a significant change to the Brazilian tax system. The new regulations aim to simplify the tax system, reduce tax evasion, and promote economic growth. Taxpayers are advised to familiarize themselves with the new rules and seek professional advice if necessary to ensure compliance. The RFB is committed to enforcing the new regulations and ensuring that all taxpayers contribute their fair share to the public treasury.

Closure

Thus, we hope this article has provided valuable insights into IR 2024 Receita Federal: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!