How Much FSA Rollover: Understanding the FSA Rollover Limit and Carryover Rules

Related Articles: How Much FSA Rollover: Understanding the FSA Rollover Limit and Carryover Rules

- Project 2025: Empowering A Sustainable And Equitable Future

- 2025 Dodge Ramcharger: A Resurgence Of Off-Road Dominance

- Africa Cup Of Nations Qualification 2025: A Comprehensive Overview

- Ukrainian Temporary Protection: A Comprehensive Guide (March 4, 2025)

- If I Was Born In 2007, How Old Am I In 2025?

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to How Much FSA Rollover: Understanding the FSA Rollover Limit and Carryover Rules. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: How Much FSA Rollover: Understanding the FSA Rollover Limit and Carryover Rules

- 2 Introduction

- 3 Video about How Much FSA Rollover: Understanding the FSA Rollover Limit and Carryover Rules

- 4 How Much FSA Rollover: Understanding the FSA Rollover Limit and Carryover Rules

- 4.1 Understanding the FSA Rollover Limit

- 4.2 Carryover Rules for Unused FSA Funds

- 4.3 Factors to Consider When Rolling Over FSA Funds

- 4.4 Maximizing Your FSA Rollover

- 4.5 Conclusion

- 5 Closure

Video about How Much FSA Rollover: Understanding the FSA Rollover Limit and Carryover Rules

How Much FSA Rollover: Understanding the FSA Rollover Limit and Carryover Rules

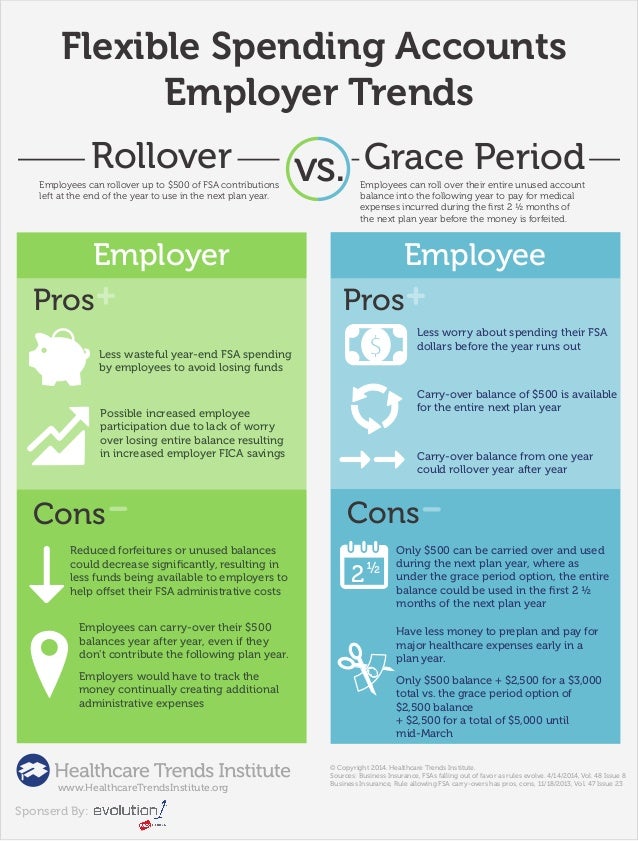

Flexible Spending Accounts (FSAs) are employer-sponsored plans that allow employees to set aside pre-tax dollars to cover qualified medical expenses. These accounts offer several tax advantages, including reducing taxable income and saving on out-of-pocket healthcare costs. One of the key features of FSAs is the ability to roll over unused funds from one year to the next, subject to certain limits and rules.

Understanding the FSA Rollover Limit

The FSA rollover limit is the maximum amount of unused funds that can be carried over from one plan year to the next. This limit varies depending on the type of FSA:

- Health FSA (HRA): The rollover limit for health FSAs is $570 for 2023, up from $550 in 2022.

- Dependent Care FSA (DCFSA): The rollover limit for dependent care FSAs is $2,750 for 2023, up from $2,500 in 2022.

Carryover Rules for Unused FSA Funds

In addition to the rollover limit, there are also carryover rules that govern how unused FSA funds can be handled:

- Grace Period: Employers may offer a grace period of up to 2.5 months after the end of the plan year for employees to use any remaining funds. During this grace period, unused funds are still available for reimbursement of eligible expenses.

- Limited Carryover: For health FSAs, employers may allow employees to carry over up to $570 of unused funds from the previous year. This carryover amount is subject to the annual rollover limit.

- Full Carryover: For dependent care FSAs, employers may allow employees to carry over all unused funds from the previous year, up to the annual rollover limit of $2,750.

Factors to Consider When Rolling Over FSA Funds

Before rolling over unused FSA funds, it’s important to consider the following factors:

- Need for Funds: Determine if you anticipate having significant medical or dependent care expenses in the upcoming year. If so, rolling over unused funds can be beneficial.

- Tax Implications: Rolling over FSA funds means deferring taxes on those funds until they are used for eligible expenses. However, if you do not use the funds, you will ultimately forfeit them and pay taxes on them.

- Plan Rules: Review your FSA plan document carefully to understand the specific rules and limits regarding rollovers and carryovers.

Maximizing Your FSA Rollover

To maximize the benefits of FSA rollovers, consider the following tips:

- Estimate Your Expenses: Accurately estimate your eligible medical or dependent care expenses for the upcoming year to determine how much you need to contribute to your FSA.

- Use Funds Wisely: Use your FSA funds throughout the plan year to cover eligible expenses and minimize the amount of unused funds that need to be rolled over.

- Consider a Grace Period: If your employer offers a grace period, take advantage of it to use any remaining funds before they expire.

- Roll Over Strategically: Roll over only the amount of funds that you are likely to use in the upcoming year. Avoid rolling over more than the annual limit, as any excess funds will be forfeited.

Conclusion

Understanding the FSA rollover limit and carryover rules is essential for maximizing the benefits of your Flexible Spending Account. By carefully considering your needs, following plan rules, and implementing these strategies, you can effectively manage your FSA funds and save on healthcare expenses. Remember to consult with your employer or a qualified financial advisor for personalized guidance on FSA rollovers.

Closure

Thus, we hope this article has provided valuable insights into How Much FSA Rollover: Understanding the FSA Rollover Limit and Carryover Rules. We hope you find this article informative and beneficial. See you in our next article!