Housing Price Prediction 2025: Navigating the Evolving Market

Related Articles: Housing Price Prediction 2025: Navigating the Evolving Market

- 2025 Mediterranean Cruises: Embark On An Unforgettable Odyssey Through History And Beauty

- Nintendo: A Vision For The Future In 2025 And Beyond

- Mazda3 2025 Hatchback: A Symphony Of Style, Performance, And Technology

- 2025 Canadian Calendar: A Comprehensive Overview

- Ohio State Football Recruiting 2025: A Comprehensive Analysis

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Housing Price Prediction 2025: Navigating the Evolving Market. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Housing Price Prediction 2025: Navigating the Evolving Market

Housing Price Prediction 2025: Navigating the Evolving Market

The housing market is a complex and ever-evolving landscape, influenced by a multitude of factors. Predicting future housing prices is a challenging task, but it is essential for investors, homeowners, and policymakers alike. This article explores the key factors that will shape the housing market in the coming years and provides an in-depth analysis of housing price predictions for 2025.

Economic Indicators

The overall economic outlook plays a significant role in determining housing prices. A strong economy with low unemployment rates and rising wages tends to boost housing demand and push prices upward. Conversely, an economic downturn can lead to decreased demand and lower prices.

Interest Rates

Interest rates have a direct impact on mortgage affordability. When interest rates are low, it is easier for buyers to qualify for loans and purchase homes. This can lead to increased demand and higher prices. Conversely, rising interest rates can make it more expensive to buy a home, which can slow down demand and put downward pressure on prices.

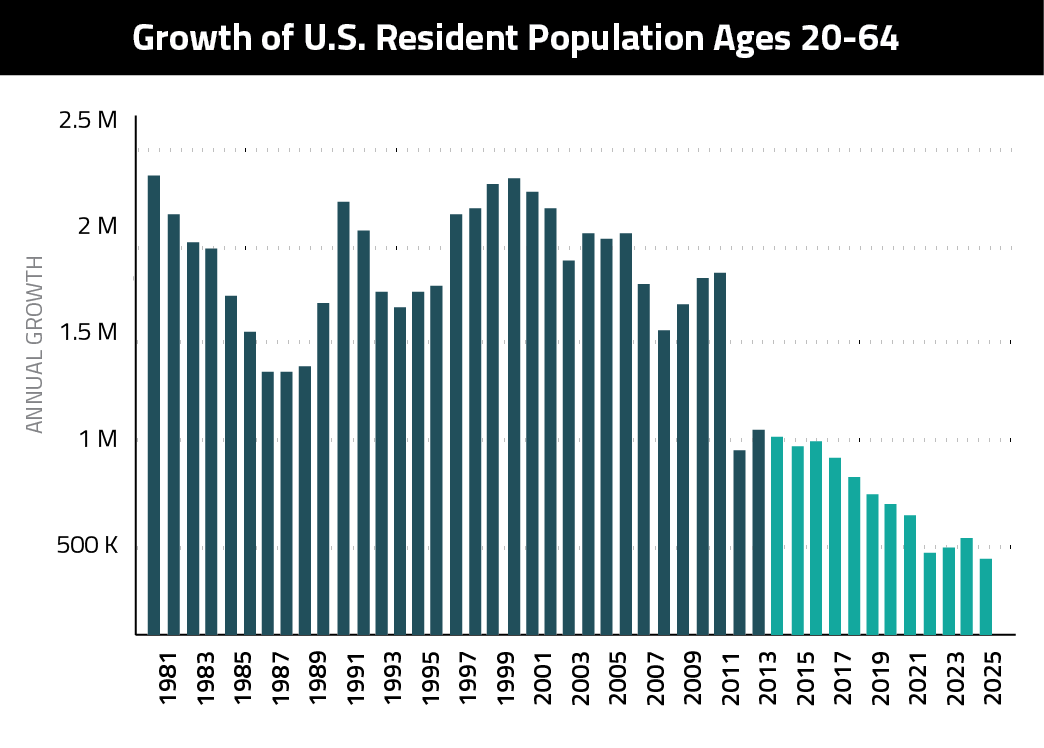

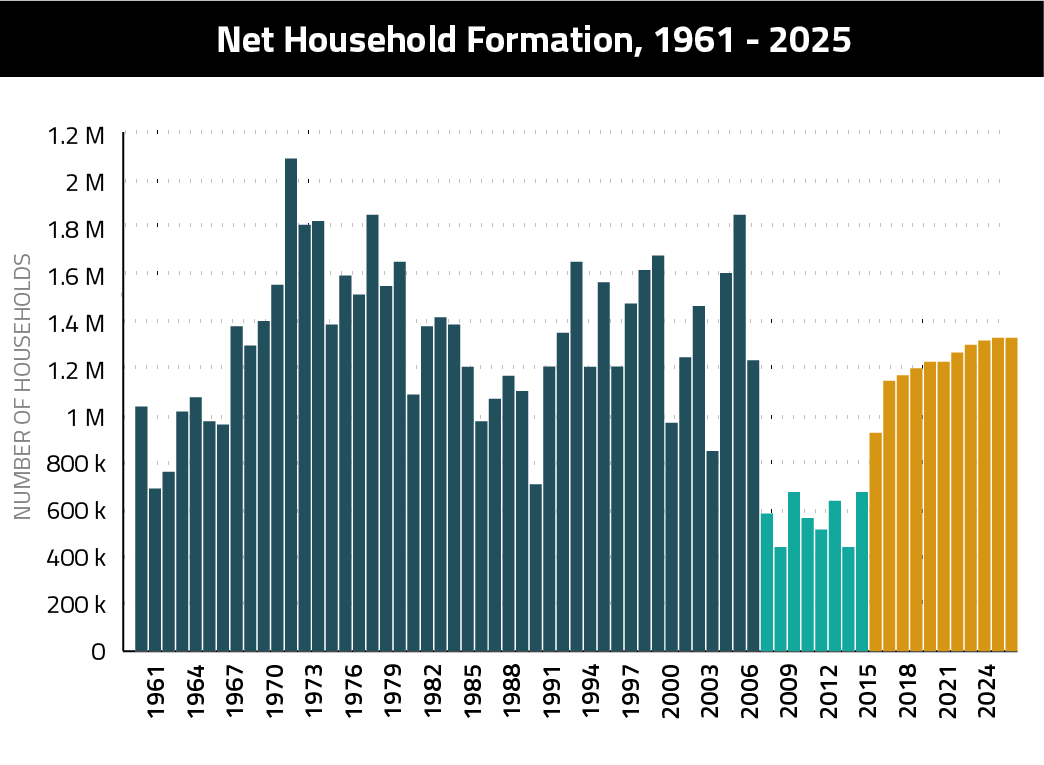

Population Growth

Population growth is another important factor that affects housing prices. Areas with high population growth typically experience increased demand for housing, leading to higher prices. Conversely, areas with declining population may see a decrease in demand and lower prices.

Supply and Demand

The balance between supply and demand is a key determinant of housing prices. When the supply of homes is limited relative to demand, prices tend to rise. Conversely, when there is a surplus of homes on the market, prices may decline.

Government Policies

Government policies can also influence housing prices. For example, tax incentives for homeownership can stimulate demand and push prices upward. Conversely, regulations that increase the cost of building or owning a home can have the opposite effect.

Technological Advancements

Technological advancements have the potential to disrupt the housing market. For example, the rise of virtual reality and augmented reality could make it easier for buyers to view homes remotely, potentially increasing demand. Additionally, the development of new construction methods could reduce the cost of building homes, making them more affordable.

Housing Price Predictions for 2025

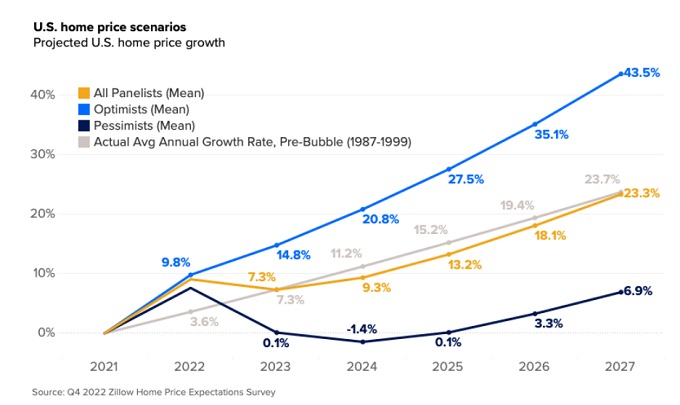

Based on an analysis of the aforementioned factors, several industry experts have provided housing price predictions for 2025. These predictions vary depending on the specific market, but the overall consensus is that prices will continue to rise, albeit at a slower pace than in recent years.

According to a report by Zillow, the median home price in the United States is expected to increase by approximately 4.2% per year from 2023 to 2025. This would bring the median home price to $420,000 by 2025.

CoreLogic, another leading real estate data provider, predicts that the median home price in the United States will increase by approximately 3.4% per year from 2023 to 2025. This would bring the median home price to $408,000 by 2025.

Regional Variations

It is important to note that housing price predictions can vary significantly from one region to another. For example, markets with strong economic growth and high population growth are likely to experience higher price increases than markets with weaker economic conditions.

Factors to Consider

When evaluating housing price predictions, it is important to consider the following factors:

- The accuracy of past predictions

- The methodology used to make the predictions

- The underlying assumptions about economic conditions, interest rates, and other factors

- The specific market being analyzed

Conclusion

Predicting housing prices is a complex task, but it is essential for investors, homeowners, and policymakers alike. By understanding the key factors that influence housing prices and analyzing expert predictions, individuals can make informed decisions about their real estate investments. While the overall consensus is that housing prices will continue to rise in the coming years, it is important to consider regional variations and other factors that may affect the market.

![28+ Housing Market Predictions 2021-2025 [Crash Coming?]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/11-More-Housing-Market-Predictions-For-2022-2023-2024-2025-Infographic-768x338.png)

Closure

Thus, we hope this article has provided valuable insights into Housing Price Prediction 2025: Navigating the Evolving Market. We appreciate your attention to our article. See you in our next article!