Housing Interest Rates Prediction 2025: A Comprehensive Analysis

Related Articles: Housing Interest Rates Prediction 2025: A Comprehensive Analysis

- 255 Henri Bourassa Est: A Vibrant Hub In The Heart Of Montreal

- The New Dodge Ram 2025: A Beast Reborn

- Good Friday 2025: Observance, Significance, And Traditions

- This Day In 2025: A Glimpse Into The Future

- Vanguard 2025 Fund: A Comprehensive Analysis Of Its Price Performance

Introduction

With great pleasure, we will explore the intriguing topic related to Housing Interest Rates Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Housing Interest Rates Prediction 2025: A Comprehensive Analysis

Housing Interest Rates Prediction 2025: A Comprehensive Analysis

Introduction

Housing interest rates play a pivotal role in shaping the real estate market, influencing home affordability, mortgage lending, and overall economic activity. As the global economy navigates a period of uncertainty, predicting the trajectory of housing interest rates has become increasingly challenging. This article provides a comprehensive analysis of housing interest rates, examining the key factors that will shape their movement and presenting an outlook for 2025.

Factors Influencing Housing Interest Rates

- Economic Growth: A strong economy typically leads to higher interest rates as the demand for capital increases.

- Inflation: Rising inflation erodes the value of money, prompting central banks to raise interest rates to maintain price stability.

- Federal Reserve Policy: The Federal Reserve (Fed) is the primary institution responsible for setting short-term interest rates. Its decisions are heavily influenced by economic growth and inflation.

- Global Economic Conditions: Global economic conditions can impact the demand for US dollars, which in turn affects interest rates.

- Housing Market Dynamics: The supply and demand for housing, as well as the availability of mortgage financing, can influence interest rates.

Current Interest Rate Environment

As of June 2023, the average 30-year fixed-rate mortgage rate in the United States stands at 5.78%. This is a significant increase from the historic lows of 2020 and 2021, which were driven by the COVID-19 pandemic and the Fed’s quantitative easing policies.

Outlook for 2025

Predicting housing interest rates for 2025 is subject to numerous uncertainties, including the trajectory of economic growth, inflation, and Fed policy. However, based on current market conditions and expert analysis, the following outlook is presented:

- Economic Growth: The global economy is expected to continue growing in the coming years, albeit at a slower pace than in the past. This growth will support demand for housing and put upward pressure on interest rates.

- Inflation: Inflation is likely to remain elevated in the near term, but is expected to gradually decline towards the Fed’s target of 2%. This will reduce the pressure on the Fed to raise interest rates aggressively.

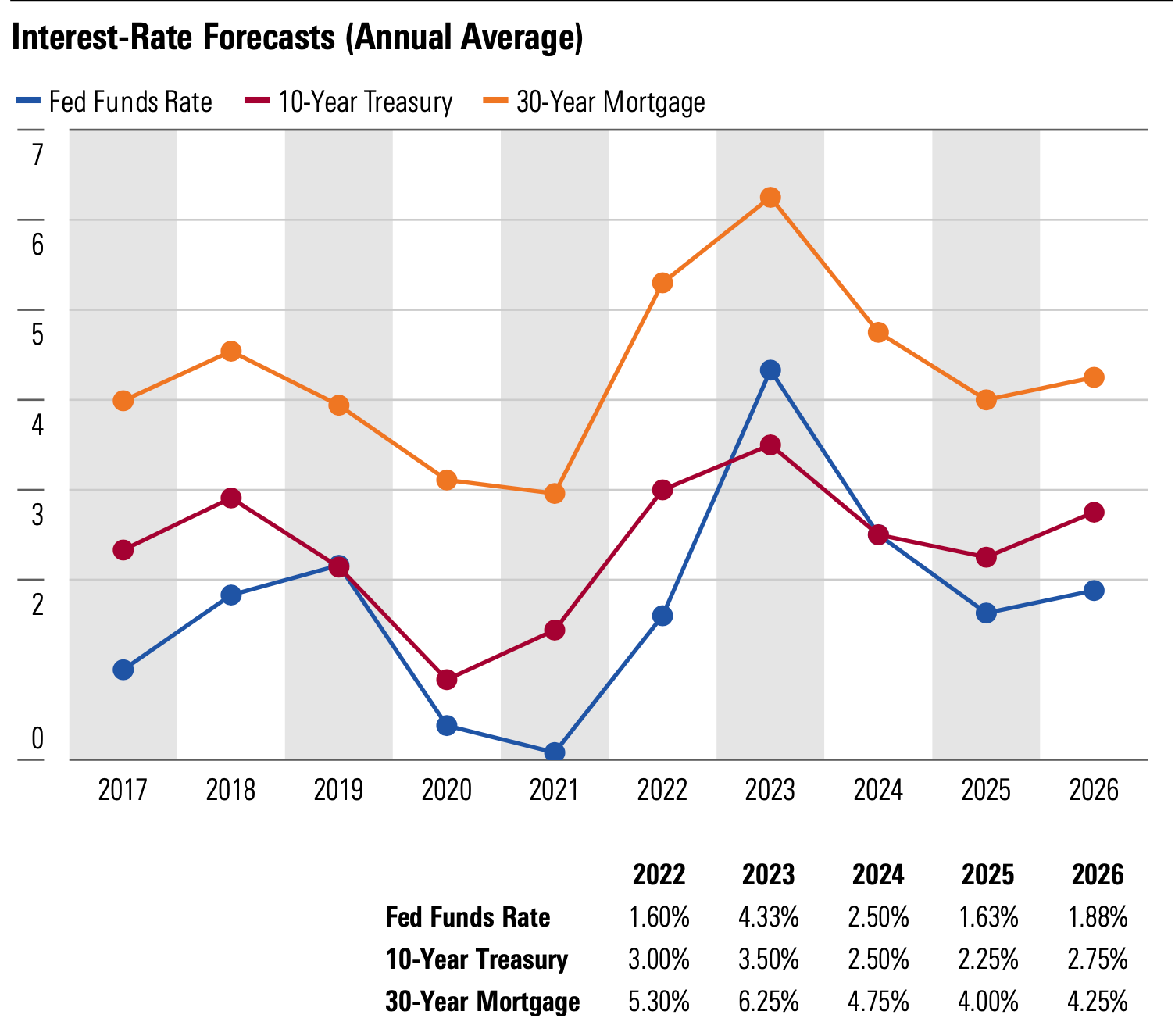

- Federal Reserve Policy: The Fed is expected to continue raising interest rates in 2023, but at a more gradual pace than in the first half of the year. The Fed has indicated that it will maintain a hawkish stance until inflation is under control.

- Global Economic Conditions: The global economy is facing headwinds from factors such as the ongoing Russia-Ukraine conflict and the slowdown in China. These factors could lead to increased demand for safe-haven assets like the US dollar, which would put upward pressure on interest rates.

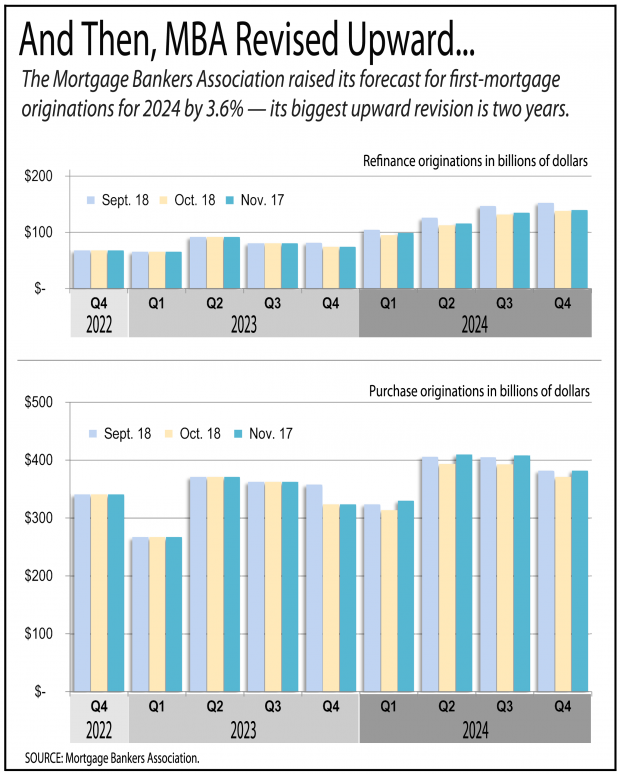

- Housing Market Dynamics: The housing market is expected to cool in 2023 and 2024 as rising mortgage rates reduce affordability. This will ease the supply-demand imbalance and put downward pressure on interest rates.

Projection for 2025

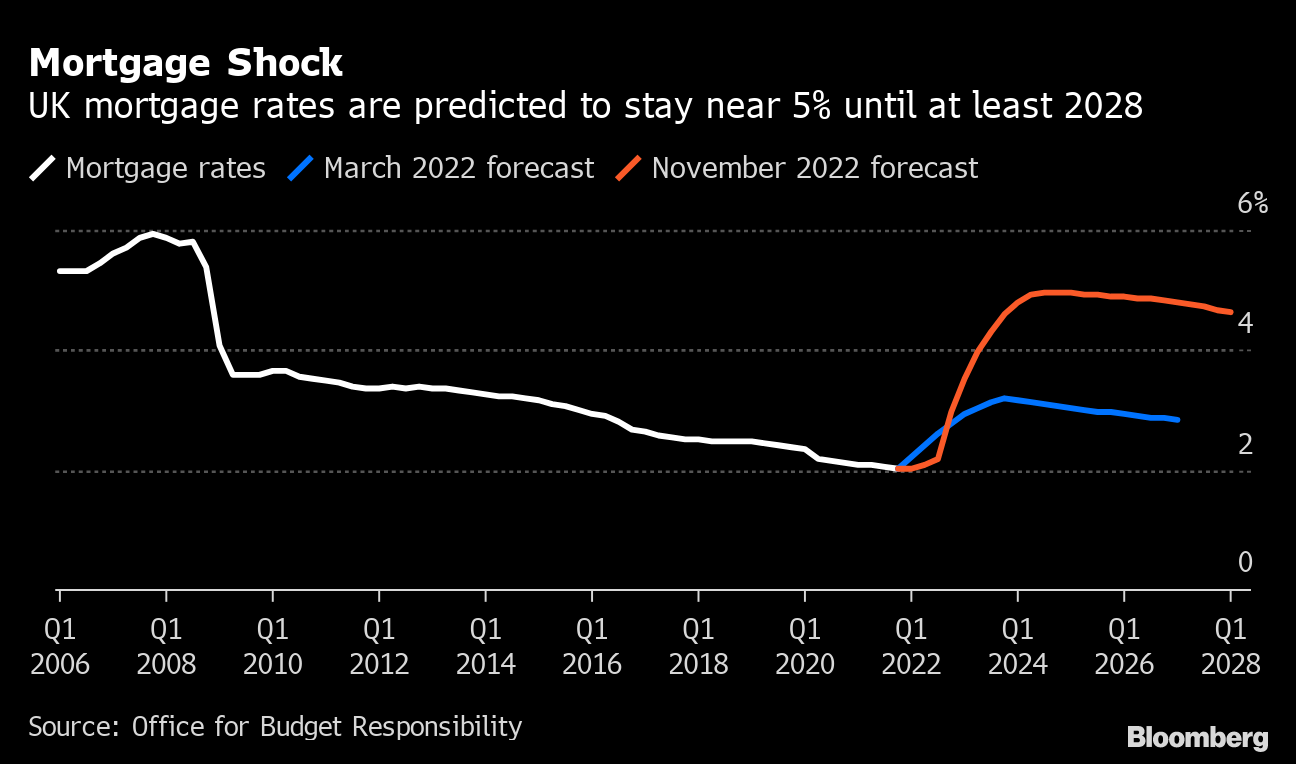

Based on these factors, it is projected that housing interest rates will continue to rise in 2023, with the average 30-year fixed-rate mortgage rate reaching approximately 6.5% by the end of the year. In 2024, interest rates are expected to stabilize and gradually decline as inflation moderates and the Fed pauses its rate hikes. By 2025, the average 30-year fixed-rate mortgage rate is projected to be in the range of 5.5% to 6%.

Implications for Homebuyers and Investors

The rising interest rate environment has significant implications for homebuyers and investors:

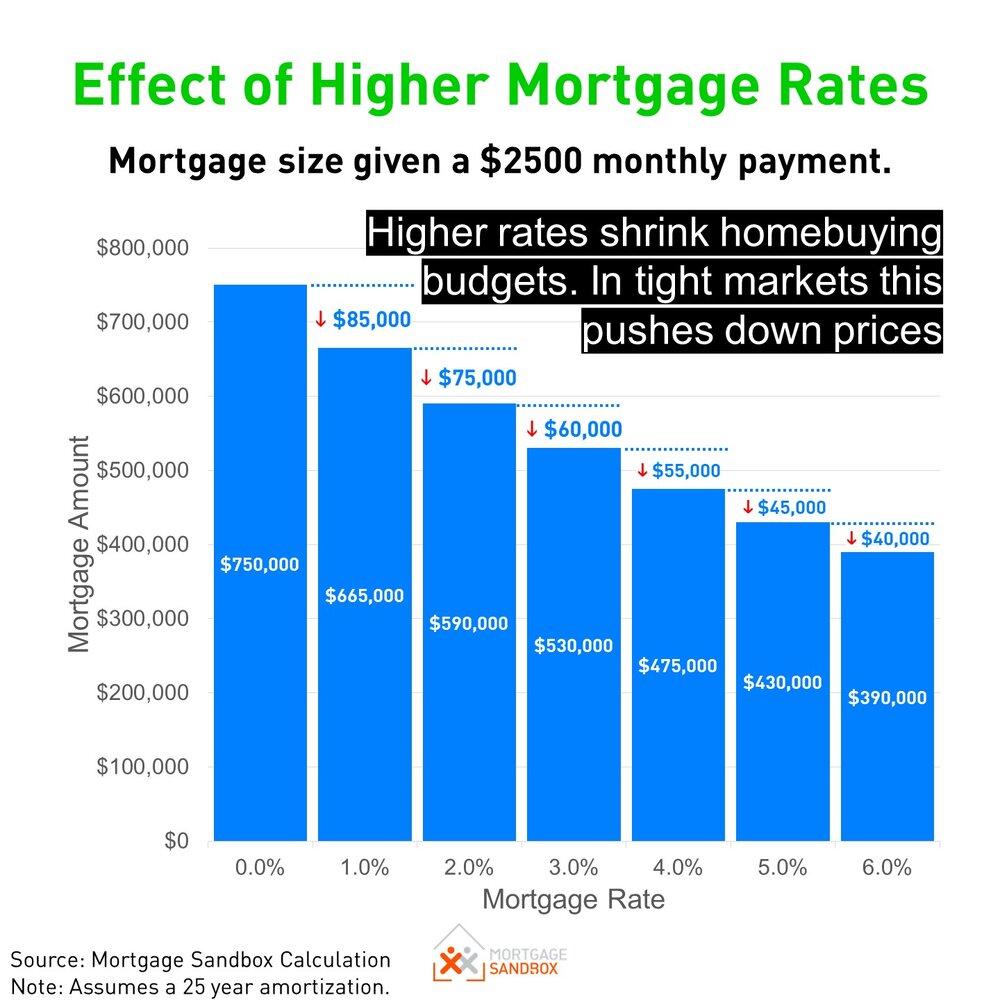

- Homebuyers: Higher interest rates make mortgages more expensive, reducing affordability and potentially delaying home purchases. Buyers may need to adjust their budgets and consider downsizing or purchasing in less expensive areas.

- Investors: Rising interest rates can increase the cost of financing rental properties, reducing profitability. Investors may need to reassess their investment strategies and consider alternative assets.

Conclusion

Housing interest rates are a critical factor in the real estate market, and their trajectory is influenced by a complex interplay of economic, financial, and housing market dynamics. While predicting interest rates for 2025 is challenging, the analysis presented in this article provides a comprehensive outlook based on current market conditions and expert projections. Homebuyers and investors should carefully consider the potential impact of rising interest rates on their financial plans and make informed decisions to navigate the evolving market.

Closure

Thus, we hope this article has provided valuable insights into Housing Interest Rates Prediction 2025: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!