Home Price Forecast 2025: A Comprehensive Analysis

Related Articles: Home Price Forecast 2025: A Comprehensive Analysis

- Color Trends For 2025: Embracing Nature, Technology, And Nostalgia

- 2025 World Ski Championships: A Glimpse Into The Future Of Alpine Skiing

- Weeks Until August 2025: A Countdown To The Future

- 2025 Volvo XC60 Plus Black Edition: A Sophisticated And Striking SUV

- Jaguar 2025: A Vision Of The Future

Introduction

With great pleasure, we will explore the intriguing topic related to Home Price Forecast 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Home Price Forecast 2025: A Comprehensive Analysis

Home Price Forecast 2025: A Comprehensive Analysis

Introduction

The real estate market is a complex and ever-changing landscape, influenced by a multitude of factors. Predicting future home prices is a challenging endeavor, but it is essential for investors, homeowners, and real estate professionals to have an informed outlook on the market’s trajectory. This article aims to provide a comprehensive analysis of home price forecasts for 2025, examining the key drivers and potential risks that may shape the market in the coming years.

Economic Factors

The overall economic climate plays a significant role in determining home prices. A strong economy with low unemployment and rising wages typically leads to increased demand for housing, which can push prices higher. Conversely, an economic downturn can result in job losses and reduced consumer spending, leading to a decrease in home sales and prices.

Interest Rates

Interest rates have a direct impact on the affordability of mortgages. When interest rates are low, it is cheaper to borrow money, which can lead to an increase in demand for housing and higher prices. On the other hand, rising interest rates make mortgages more expensive, potentially reducing demand and putting downward pressure on prices.

Demographic Trends

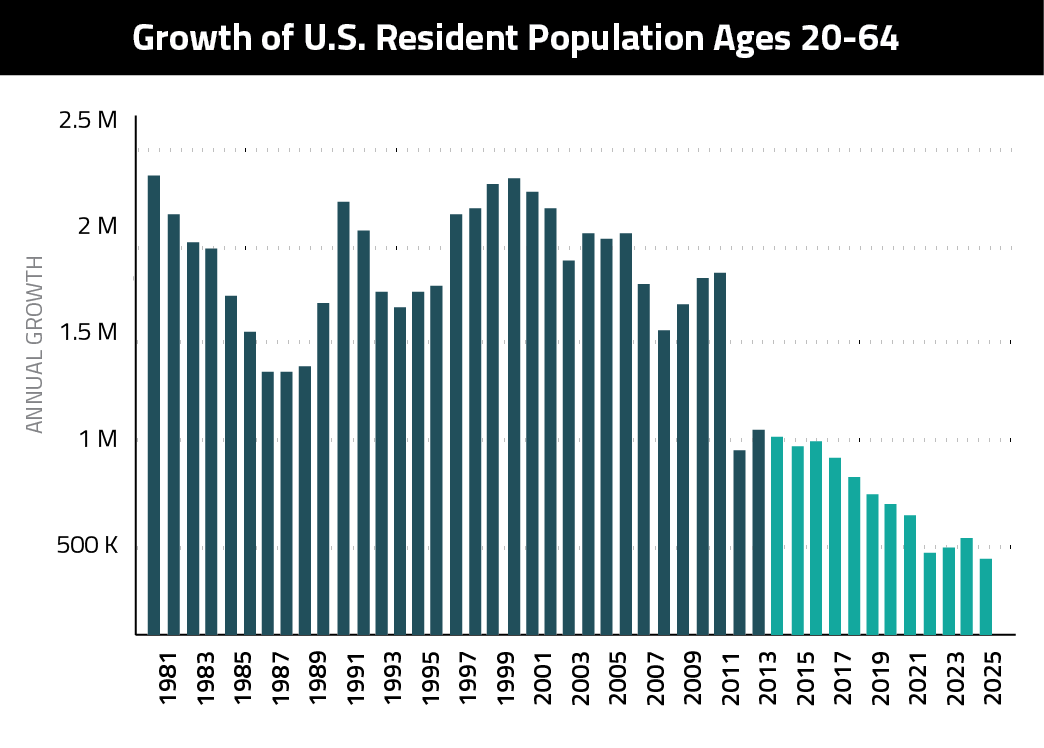

The age distribution of the population can also affect home prices. As the population ages, there is typically a decrease in the number of first-time homebuyers, which can lead to a slowdown in price growth. Conversely, a growing population of millennials and Gen Zers entering the housing market can increase demand and drive prices higher.

Supply and Demand

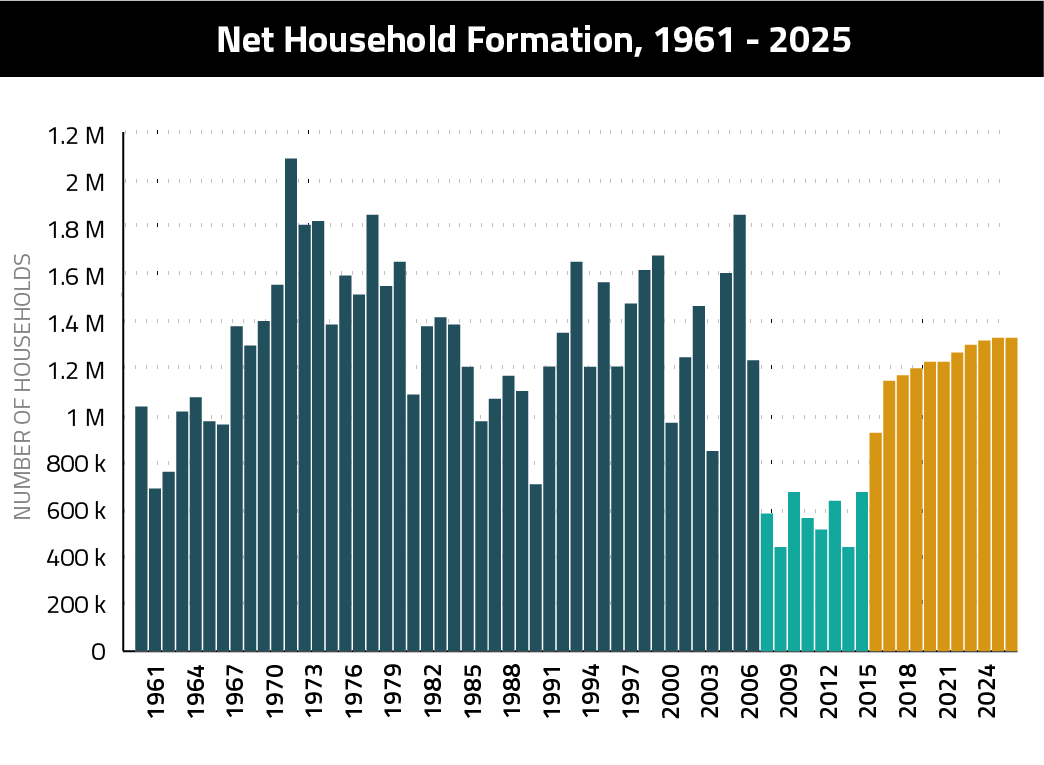

The balance between supply and demand is a fundamental factor in determining home prices. When there is a shortage of housing relative to demand, prices tend to rise. Conversely, when there is an oversupply of homes, prices may fall. The construction of new homes and the availability of existing inventory will significantly impact the supply side of the market.

Regional Variations

Home price forecasts can vary significantly across different regions. Factors such as local economic conditions, job growth, and migration patterns can influence the demand for housing and affect prices. Some regions may experience strong price appreciation, while others may see more modest growth or even declines.

2025 Home Price Forecast

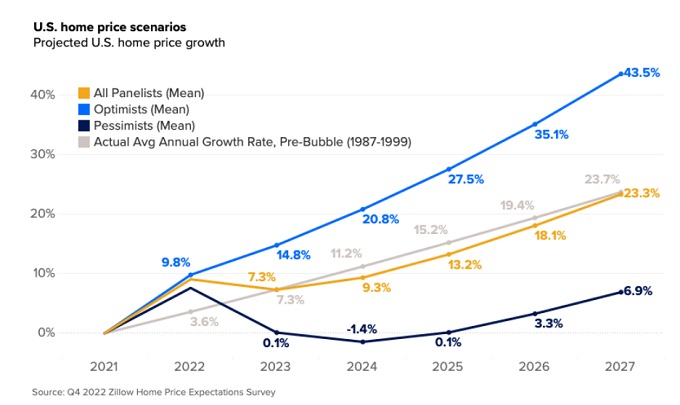

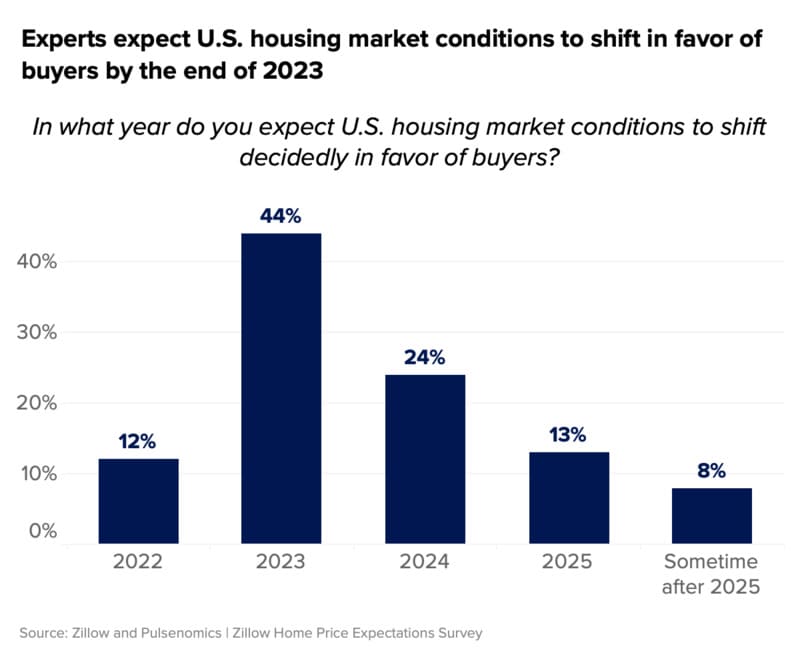

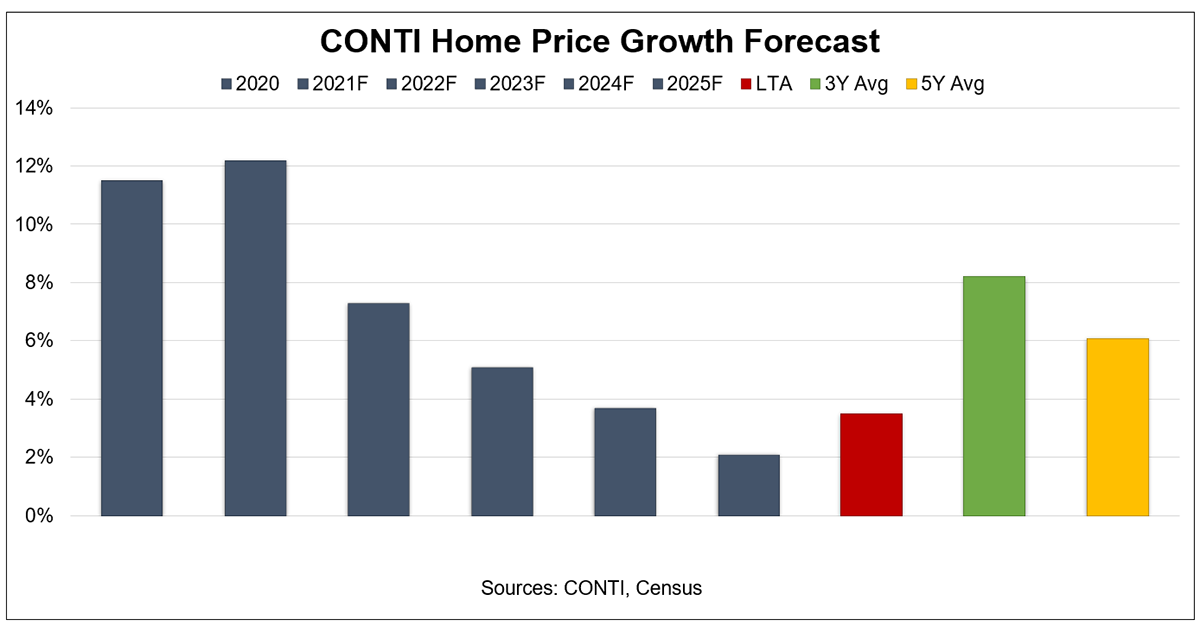

Based on an analysis of these key drivers, experts predict that home prices will continue to rise in the coming years, albeit at a slower pace than in recent years. The National Association of Realtors (NAR) projects that the median home price in the United States will reach $429,000 by 2025, representing an increase of approximately 3.5% per year.

Potential Risks

While the overall outlook for home prices is positive, there are potential risks that could impact the market in the coming years. These include:

- Economic downturn: A recession or other economic downturn could lead to job losses and reduced consumer spending, resulting in a decrease in demand for housing and lower prices.

- Rising interest rates: If interest rates rise too quickly, it could make mortgages more expensive and reduce affordability, potentially slowing down price growth or even leading to a decline in prices.

- Overbuilding: An oversupply of new homes could lead to a decrease in prices as developers compete for buyers.

- Demographic shifts: A decline in the number of first-time homebuyers or a change in migration patterns could reduce demand for housing and put downward pressure on prices.

Conclusion

Home price forecasts for 2025 indicate that the market is expected to continue to appreciate, albeit at a slower pace than in recent years. However, it is important to note that the real estate market is dynamic and subject to a variety of factors that could impact prices. Economic conditions, interest rates, demographic trends, and supply and demand will all play a role in shaping the market in the coming years. Potential risks, such as an economic downturn or rising interest rates, should also be considered when making investment decisions. By understanding the key drivers and potential risks, investors, homeowners, and real estate professionals can make informed decisions and prepare for the future of the housing market.

Closure

Thus, we hope this article has provided valuable insights into Home Price Forecast 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!