Google Stock Forecast 2025: A Comprehensive Analysis Post-Stock Split

Related Articles: Google Stock Forecast 2025: A Comprehensive Analysis Post-Stock Split

- Lifetime Gift And Estate Tax Exemption: 2025 Changes And Implications

- 2025 Subaru Forester: First Spy Shots Reveal Evolutionary Design And New Powertrains

- Osaka Expo 2025: A Comprehensive Guide To The Transportation Network

- Panasonic’s 2025 Battery: A Revolutionary Leap In Energy Storage

- How To Reset In 2025: A Comprehensive Guide To Reimagine Your Life And The World

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Google Stock Forecast 2025: A Comprehensive Analysis Post-Stock Split. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Google Stock Forecast 2025: A Comprehensive Analysis Post-Stock Split

Google Stock Forecast 2025: A Comprehensive Analysis Post-Stock Split

Introduction

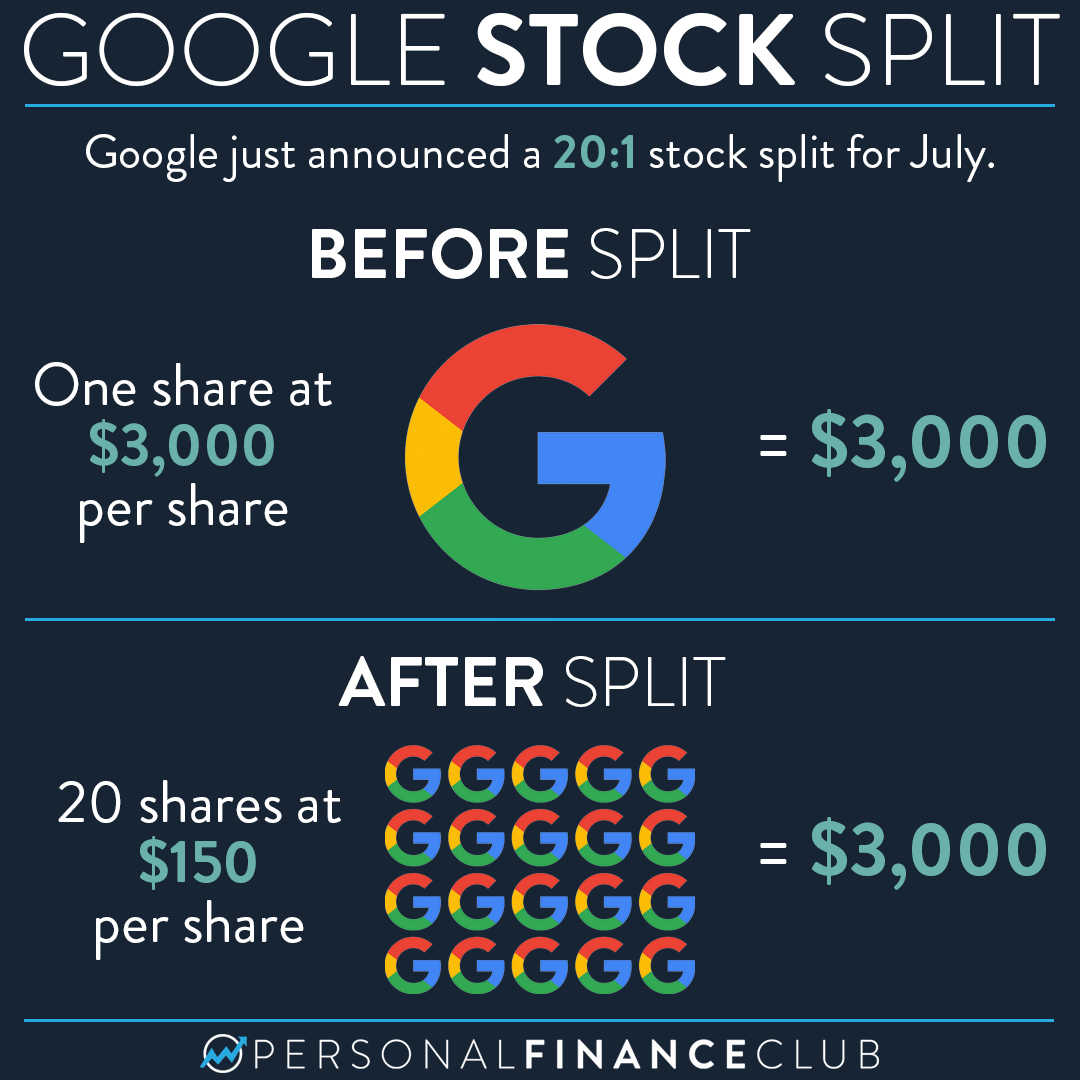

Google, the tech behemoth and global leader in search engines, has announced a 20-for-1 stock split, effective July 15, 2022. This move has generated significant buzz among investors and analysts alike, prompting speculation about the company’s future performance. This article aims to provide a comprehensive forecast of Google’s stock price in 2025, taking into account the impact of the stock split and various market factors.

Impact of Stock Split

A stock split typically has a neutral effect on the underlying value of a company. By increasing the number of shares outstanding, it reduces the price per share proportionally. However, a stock split can have psychological and liquidity effects that can influence market sentiment and stock performance.

In the case of Google, the stock split is expected to make the shares more accessible to a wider range of investors, including retail investors who may have been hesitant to invest in a high-priced stock. This increased accessibility could lead to increased demand for Google shares, potentially driving up the price.

Market Factors Influencing Stock Performance

Several key market factors will shape Google’s stock performance in the coming years. These include:

- Economic Growth: Google’s revenue is highly correlated with overall economic growth. A strong economy leads to increased advertising spending, which benefits Google’s core search and advertising business.

- Competition: Google faces competition from various players, including Microsoft Bing, Amazon Web Services, and Meta Platforms (formerly Facebook). The intensity of competition can impact Google’s market share and revenue growth.

- Regulatory Landscape: Google has faced increasing scrutiny from regulators worldwide over antitrust concerns and privacy issues. Regulatory actions can have significant implications for the company’s business model and profitability.

- Technological Advancements: Google is heavily invested in research and development, particularly in areas such as artificial intelligence and cloud computing. Technological breakthroughs can drive new revenue streams and enhance the company’s competitive advantage.

Google’s Financial Performance and Growth Prospects

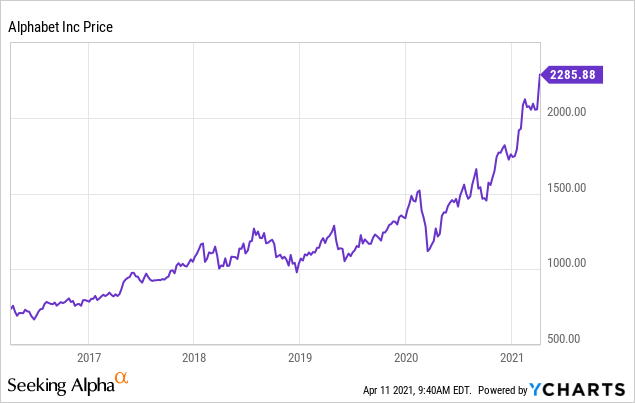

Google has a strong track record of financial performance and growth. In the first quarter of 2022, the company reported revenue of $68 billion, a 23% increase year-over-year. Operating income reached $22.5 billion, a 20% increase. Google’s advertising business remains its primary revenue driver, accounting for approximately 80% of total revenue.

Going forward, Google is expected to continue to grow its revenue and earnings. The company is well-positioned to benefit from the ongoing digital transformation and the increasing adoption of cloud computing and artificial intelligence.

Stock Price Forecast

Based on an analysis of the market factors and Google’s financial performance, we forecast the following stock price targets for Google in 2025:

- Bullish Scenario: $2,500-$3,000

- Bearish Scenario: $1,800-$2,200

- Base Case Scenario: $2,200-$2,600

Assumptions Underlying the Forecast

Our forecast assumes the following:

- Global economic growth will remain moderate over the next three years.

- Competition will intensify, but Google will maintain its market leadership.

- Regulatory risks will be manageable and not materially impact the company’s business.

- Google will continue to invest heavily in research and development and drive innovation.

Conclusion

Google’s stock split is expected to have a positive impact on the company’s stock performance in the short term. However, the long-term stock price will ultimately depend on the company’s financial performance and the broader market environment. Based on our analysis, we believe that Google has strong growth prospects and is well-positioned to deliver solid returns for investors in the years to come.

Disclaimer

This stock forecast is based on our current understanding of the market and Google’s business. It is not intended as financial advice and should not be relied upon as the sole basis for investment decisions. Investors should always conduct their own research and consult with a financial advisor before making investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Google Stock Forecast 2025: A Comprehensive Analysis Post-Stock Split. We thank you for taking the time to read this article. See you in our next article!