FSA Rollover Amount 2025: Understanding the Changes

Related Articles: FSA Rollover Amount 2025: Understanding the Changes

- Travel Marketing Trends: Shaping The Future Of Travel In 2025

- Walgreens Near The Battery: A Convenient Destination For Healthcare And Daily Essentials

- Soul Train Cruise 2025 Lineup Unveiled: A Star-Studded Voyage Of Soulful Sounds

- How Many Years Until December 2025?

- Super Bowl 2024: How To Watch The Big Game For Free

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to FSA Rollover Amount 2025: Understanding the Changes. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about FSA Rollover Amount 2025: Understanding the Changes

FSA Rollover Amount 2025: Understanding the Changes

Introduction

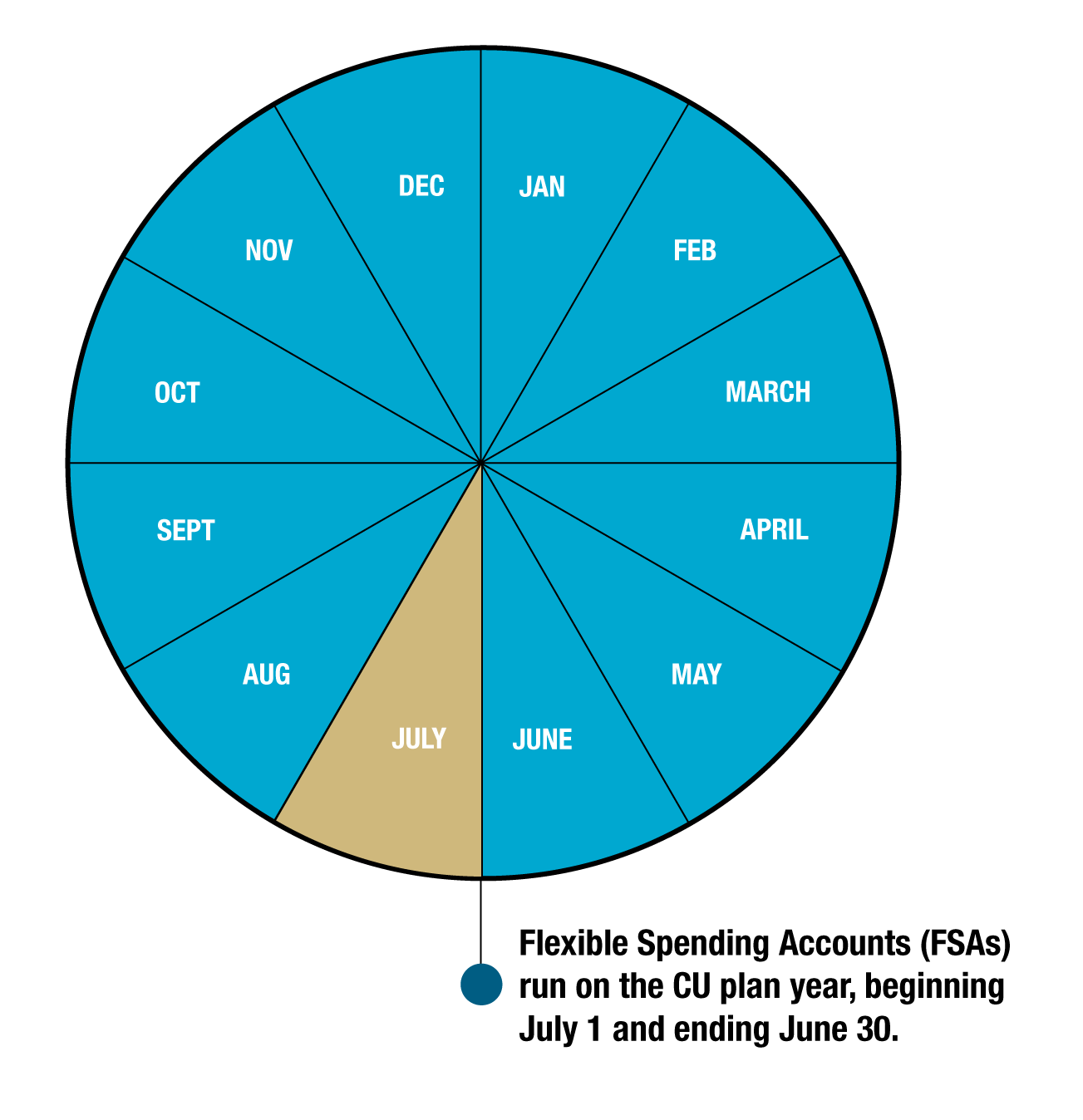

Flexible Spending Accounts (FSAs) are a popular employee benefit that allows individuals to set aside pre-tax dollars to cover qualified medical, dental, and vision expenses. In recent years, the IRS has made significant changes to FSA regulations, including the upcoming increase in the FSA rollover amount in 2025. This article will provide a comprehensive overview of the FSA rollover amount 2025, explaining the changes, eligibility requirements, and implications for employees and employers.

FSA Rollover Amount 2025

The FSA rollover amount for 2025 will increase to $600, up from the current limit of $550. This means that employees who do not use the full amount of their FSA contributions in a given plan year can roll over up to $600 to the next year. The rollover amount is only available for health FSAs, not dependent care FSAs.

Eligibility Requirements

To be eligible for the FSA rollover amount, employees must meet the following criteria:

- Have an active health FSA with a calendar year plan year

- Have unused FSA funds at the end of the plan year

- Not have claimed reimbursement for expenses incurred in the previous two and a half months

Implications for Employees

The increased FSA rollover amount provides employees with greater flexibility and control over their healthcare expenses. Key implications include:

- Increased Savings: Employees can now save more money in their FSAs on a pre-tax basis, reducing their overall healthcare costs.

- More Time to Use Funds: The extended rollover period allows employees to accumulate unused funds over multiple years, providing them with more time to use them for qualified expenses.

- Reduced Risk of Forfeiture: Employees are less likely to lose unused FSA funds due to the increased rollover amount, minimizing potential financial losses.

Implications for Employers

The FSA rollover amount 2025 also has implications for employers. Key considerations include:

- Increased Employee Benefits: Employers can offer a more attractive employee benefit package by providing a higher FSA rollover amount, demonstrating their commitment to employee well-being.

- Reduced Administrative Costs: Employers may experience reduced administrative costs associated with processing FSA claims, as employees have more time to use their funds.

- Tax Savings: Employers may realize tax savings on their portion of FSA contributions if employees utilize the increased rollover amount effectively.

Implementation Considerations

Employers should take the following steps to implement the FSA rollover amount 2025:

- Update FSA Plan Documents: Amend existing FSA plan documents to reflect the increased rollover amount.

- Communicate Changes to Employees: Inform employees about the changes to the FSA rollover amount and provide guidance on how to maximize their savings.

- Review FSA Administration Processes: Ensure that FSA administration processes are updated to accommodate the increased rollover amount.

Conclusion

The FSA rollover amount 2025 is a significant change that provides employees with increased flexibility and savings on their healthcare expenses. Employers should embrace this change by updating their FSA plans and communicating the benefits to their employees. By understanding the eligibility requirements and implications of the increased rollover amount, both employees and employers can optimize their FSA utilization and maximize their financial benefits.

Closure

Thus, we hope this article has provided valuable insights into FSA Rollover Amount 2025: Understanding the Changes. We hope you find this article informative and beneficial. See you in our next article!