Form 202 Instructions: A Comprehensive Guide

Related Articles: Form 202 Instructions: A Comprehensive Guide

- 2025 Oregon Ducks Football Recruiting: A Comprehensive Analysis

- Project 2025: A Bold Vision For A Sustainable Future

- 2025 Subaru Forester: A Comprehensive Review

- Introducing The American Girl Doll Girl Of The Year 2025: A Beacon Of Hope And Inspiration

- Calendrier Scolaire 2024-2025 En Belgique

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Form 202 Instructions: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Form 202 Instructions: A Comprehensive Guide

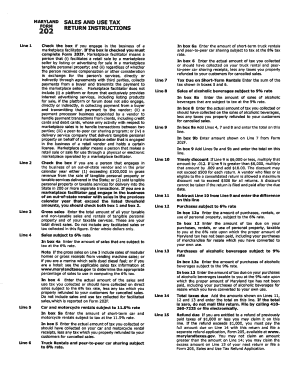

Form 202 Instructions: A Comprehensive Guide

Introduction

Form 202 is an essential tax form used by non-resident aliens to report their U.S. income and pay any applicable taxes. Understanding the instructions for this form is crucial to ensure accurate and timely tax filing. This comprehensive guide will provide a detailed explanation of the Form 202 instructions, covering all sections and relevant requirements.

Section 1: Personal Information

- Name and Address: Provide your full name and permanent address outside the United States.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): If you have an SSN or ITIN, enter it in the designated field. If you do not have either, leave this section blank.

- Marital Status: Indicate your marital status as of the last day of the tax year.

- Number of Dependents: Enter the number of dependents you claimed on your tax return.

Section 2: Income

- Gross Income: Report your total gross income from all U.S. sources, including wages, salaries, dividends, interest, and any other taxable income.

- Adjusted Gross Income (AGI): Calculate your AGI by subtracting allowable deductions from your gross income.

- Taxable Income: Determine your taxable income by subtracting personal exemptions and itemized deductions or the standard deduction from your AGI.

Section 3: Deductions and Credits

- Deductions: Itemize your allowable deductions, such as mortgage interest, charitable contributions, and state and local taxes.

- Credits: List any applicable tax credits, such as the foreign tax credit or the child tax credit.

Section 4: Tax Calculation

- Tax: Calculate your U.S. income tax liability based on the tax rates applicable to your taxable income.

- Foreign Tax Credit: If you paid taxes in a foreign country on income earned in the United States, you may be eligible to claim a foreign tax credit.

- Other Credits: Apply any other available tax credits to reduce your tax liability.

Section 5: Payments and Refunds

- Estimated Tax Payments: Enter the amount of estimated tax payments you made during the year.

- Tax Withheld: Indicate the amount of tax withheld from your U.S. income.

- Refund or Amount Due: Calculate the difference between your tax liability and your total payments. If the result is a positive number, you are entitled to a refund. If the result is a negative number, you owe additional taxes.

Section 6: Signature and Date

- Signature: Sign and date the form.

- Preparer’s Information: If a tax preparer assisted you, provide their name, address, and signature.

Additional Instructions

- Attach Supporting Documents: Include copies of any relevant supporting documents, such as W-2 forms, 1099s, and receipts for deductions.

- File by April 15th: The deadline for filing Form 202 is April 15th of the year following the tax year. However, if you are unable to file by this date, you can request an extension using Form 4868.

- File Electronically: You can file Form 202 electronically using tax software or through the IRS website.

- Seek Professional Advice: If you have complex tax matters, consider consulting with a tax professional for guidance.

Conclusion

Understanding the Form 202 instructions is essential for accurate and timely tax filing. By carefully following these instructions, non-resident aliens can ensure that they meet their tax obligations and avoid potential penalties. It is important to note that tax laws and regulations are subject to change, so it is recommended to consult the latest IRS guidelines before filing your return.

Closure

Thus, we hope this article has provided valuable insights into Form 202 Instructions: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!