Federal Income Tax Rates 2025: A Comprehensive Guide

Related Articles: Federal Income Tax Rates 2025: A Comprehensive Guide

- 2025 E Newport Ave Milwaukee, WI: A Historical Landmark With A Modern Twist

- Volkswagen Bus 2025: A Vision Of The Future

- 2025 World Cup Tickets: A Comprehensive Guide

- The New Dodge Ram 2025: A Beast Reborn

- Canada Games 2025: A Catalyst For Unity And Sporting Excellence

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Federal Income Tax Rates 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Federal Income Tax Rates 2025: A Comprehensive Guide

Federal Income Tax Rates 2025: A Comprehensive Guide

The federal income tax system in the United States is a complex and ever-changing landscape. The tax rates, brackets, and deductions are adjusted annually to reflect changes in the economy and government policies. For individuals and businesses planning for the future, it is essential to stay abreast of these changes to ensure accurate tax calculations and financial planning.

This article provides a comprehensive overview of the federal income tax rates for 2025, including the latest updates and insights. It covers the tax brackets, standard deductions, and other key provisions that will impact taxpayers in the coming year.

Tax Brackets for 2025

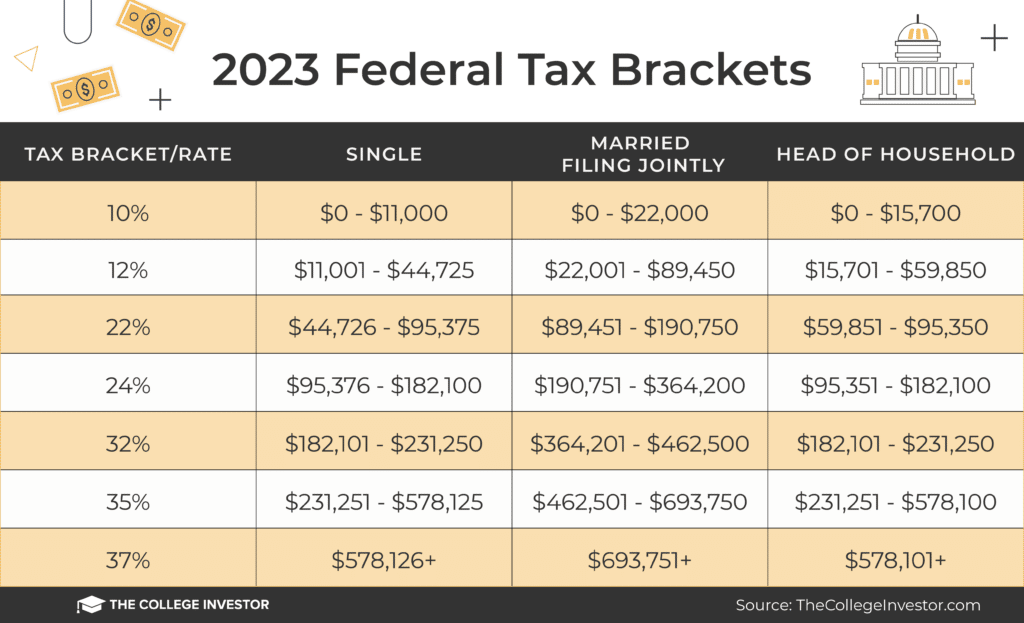

The federal income tax system is a progressive system, meaning that the tax rates increase as taxable income increases. For 2025, the tax brackets for individuals are as follows:

| Tax Bracket | Taxable Income | Marginal Tax Rate |

|---|---|---|

| 10% | $0 – $10,275 | 10% |

| 12% | $10,276 – $41,775 | 12% |

| 22% | $41,776 – $89,075 | 22% |

| 24% | $89,076 – $170,050 | 24% |

| 32% | $170,051 – $215,950 | 32% |

| 35% | $215,951 – $539,900 | 35% |

| 37% | $539,901 – $1,077,350 | 37% |

| 39.6% | $1,077,351 or more | 39.6% |

Standard Deductions for 2025

The standard deduction is a specific amount that taxpayers can deduct from their taxable income before calculating their tax liability. The standard deduction varies depending on the taxpayer’s filing status. For 2025, the standard deductions are as follows:

| Filing Status | Standard Deduction |

|---|---|

| Single | $13,850 |

| Married filing jointly | $27,700 |

| Married filing separately | $13,850 |

| Head of household | $20,800 |

Other Key Provisions for 2025

In addition to the tax brackets and standard deductions, there are several other key provisions that will impact taxpayers in 2025. These include:

- Personal exemption: The personal exemption has been eliminated as of 2018.

- Dependent exemption: The dependent exemption has also been eliminated as of 2018.

- Child tax credit: The child tax credit is a refundable tax credit for qualifying children. For 2025, the maximum credit is $2,000 per child under the age of 17.

- Earned income tax credit: The earned income tax credit is a refundable tax credit for low- and moderate-income working individuals and families. For 2025, the maximum credit ranges from $6,935 to $7,430, depending on the taxpayer’s filing status and number of qualifying children.

- Alternative minimum tax: The alternative minimum tax (AMT) is a parallel tax system that ensures that high-income taxpayers pay a minimum amount of tax. For 2025, the AMT exemption amounts are $89,500 for single filers and $114,600 for married couples filing jointly.

Planning for 2025

Understanding the federal income tax rates and provisions for 2025 is crucial for accurate tax planning. Taxpayers should consider the following strategies to minimize their tax liability and maximize their financial well-being:

- Maximize deductions: Utilize eligible deductions to reduce taxable income, such as mortgage interest, charitable contributions, and retirement savings contributions.

- Claim credits: Take advantage of tax credits, such as the child tax credit and earned income tax credit, to directly reduce tax liability.

- Consider tax-advantaged investments: Invest in tax-advantaged accounts, such as 401(k) plans and IRAs, to defer or reduce taxes on investment earnings.

- Plan for potential AMT liability: High-income taxpayers should assess their potential AMT liability and consider strategies to mitigate it.

- Seek professional advice: If necessary, consult with a tax professional to ensure compliance with tax laws and optimize tax planning.

Conclusion

The federal income tax rates and provisions for 2025 provide a framework for calculating tax liability and planning for the future. By understanding the latest tax laws and incorporating appropriate strategies, taxpayers can navigate the tax system effectively, reduce their tax burden, and achieve their financial goals. It is recommended to stay informed about any potential changes to tax laws and consult with a tax professional for personalized guidance.

Closure

Thus, we hope this article has provided valuable insights into Federal Income Tax Rates 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!