Federal Estate Tax Rates After 2025: A Comprehensive Guide

Related Articles: Federal Estate Tax Rates After 2025: A Comprehensive Guide

- When Is The Boston Marathon 2025?

- Thanksgiving Day 2025: A Comprehensive Overview

- Africa Cup Of Nations Qualification 2025: A Comprehensive Overview

- Mazda CX-5 GT 2025: A Refined And Versatile SUV For The Modern Driver

- 2025 Ford Explorer ST SUV: A Pinnacle Of Performance And Innovation

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Federal Estate Tax Rates After 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Federal Estate Tax Rates After 2025: A Comprehensive Guide

Federal Estate Tax Rates After 2025: A Comprehensive Guide

The federal estate tax is a tax on the transfer of property from a deceased person to their beneficiaries. The estate tax is levied on the value of the decedent’s taxable estate, which is the value of all property owned by the decedent at the time of death, minus certain deductions and exemptions.

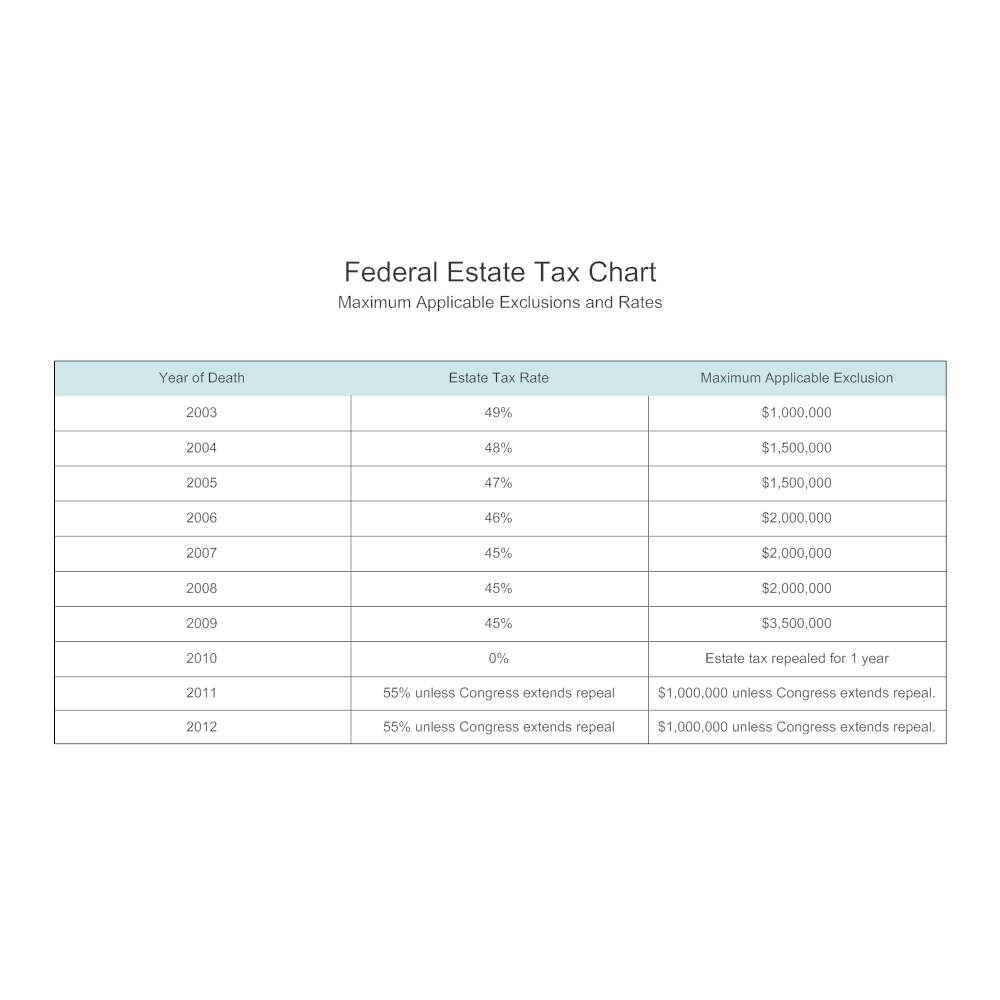

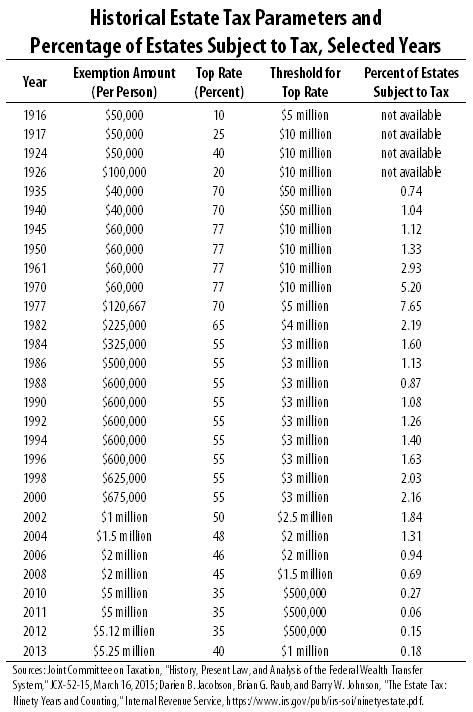

The federal estate tax rates are scheduled to change in 2026. The following table shows the current estate tax rates and the rates that will be in effect after 2025:

| Taxable Estate Value | Current Estate Tax Rate | Estate Tax Rate After 2025 |

|---|---|---|

| $0 – $12,060,000 | 0% | 0% |

| $12,060,000 – $14,000,000 | 35% | 40% |

| $14,000,000 – $20,000,000 | 39% | 45% |

| $20,000,000 – $26,000,000 | 40% | 50% |

| $26,000,000 and above | 45% | 60% |

As you can see, the estate tax rates are scheduled to increase significantly after 2025. This means that more estates will be subject to the estate tax, and the amount of tax owed will be higher.

Exemptions and Deductions

There are a number of exemptions and deductions that can reduce the value of a taxable estate. The most important exemption is the unified credit. The unified credit is a dollar-for-dollar reduction in the amount of estate tax owed. The unified credit is currently $12,060,000. This means that estates worth less than $12,060,000 are not subject to the estate tax.

In addition to the unified credit, there are a number of other deductions that can reduce the value of a taxable estate. These deductions include:

- The marital deduction: This deduction allows a decedent to transfer an unlimited amount of property to their spouse tax-free.

- The charitable deduction: This deduction allows a decedent to transfer an unlimited amount of property to qualified charities tax-free.

- The medical deduction: This deduction allows a decedent to deduct medical expenses that were incurred within one year of death.

- The funeral deduction: This deduction allows a decedent to deduct funeral expenses.

Planning for the Estate Tax

If you are concerned about the estate tax, there are a number of steps you can take to reduce your estate tax liability. These steps include:

- Making gifts during your lifetime: Gifts made during your lifetime are not subject to the estate tax. You can make gifts of up to $15,000 per year to any individual without having to file a gift tax return.

- Establishing a trust: Trusts can be used to reduce your estate tax liability by transferring assets out of your estate. There are a variety of different types of trusts that can be used for estate planning purposes.

- Purchasing life insurance: Life insurance proceeds are not subject to the estate tax. You can purchase a life insurance policy to provide your beneficiaries with funds to pay the estate tax.

Conclusion

The federal estate tax is a complex and ever-changing area of law. If you are concerned about the estate tax, it is important to speak with an experienced estate planning attorney. An attorney can help you develop a plan to reduce your estate tax liability and ensure that your wishes are carried out after your death.

Closure

Thus, we hope this article has provided valuable insights into Federal Estate Tax Rates After 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!