F Stock Prediction 2025: A Comprehensive Analysis

Related Articles: F Stock Prediction 2025: A Comprehensive Analysis

- The 2024 Winter Olympics: A Comprehensive Overview

- 2025 Batteries: The Next Generation Of Energy Storage

- 2025 Lakewood Ranch Boulevard: A Premier Destination For Business And Lifestyle

- Diwali 2025: A Resplendent Celebration Of Lights And Festivities

- Target-Date Funds: A Comprehensive Guide To The 2025 Target

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to F Stock Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about F Stock Prediction 2025: A Comprehensive Analysis

F Stock Prediction 2025: A Comprehensive Analysis

Introduction

Ford Motor Company, commonly known as Ford, is an American multinational automaker headquartered in Dearborn, Michigan. The company was founded by Henry Ford in 1903 and is one of the world’s largest automakers. Ford’s stock, traded on the New York Stock Exchange under the ticker symbol "F," has been a popular investment for decades. Investors are now eagerly anticipating the company’s future performance, particularly in light of the rapidly evolving automotive industry. This article presents a comprehensive analysis of Ford stock predictions for 2025, examining various factors that may influence its value.

Current Financial Performance

Ford’s recent financial performance has been mixed. In 2022, the company reported a net income of $17.9 billion, a significant increase from the previous year. However, the company also faced challenges, including supply chain disruptions and rising raw material costs. Ford’s stock price has fluctuated in recent years, reflecting these financial uncertainties.

Industry Trends

The automotive industry is undergoing a major transformation, driven by factors such as electric vehicles (EVs), autonomous driving, and ride-sharing services. These trends are creating both opportunities and challenges for automakers like Ford.

- Electric Vehicles: The transition to EVs is a major trend that Ford is embracing. The company has invested heavily in developing and producing EVs, including the Mustang Mach-E and the F-150 Lightning. The growing demand for EVs is expected to benefit Ford in the coming years.

- Autonomous Driving: Autonomous driving technology is another key trend that is shaping the automotive industry. Ford is actively developing autonomous driving systems, and it is expected to launch its first fully autonomous vehicle by 2025. This technology has the potential to revolutionize transportation and create new revenue streams for Ford.

- Ride-Sharing Services: Ride-sharing services, such as Uber and Lyft, are becoming increasingly popular. This trend could pose a challenge to traditional automakers, as it reduces the demand for personal vehicle ownership. However, Ford is exploring partnerships with ride-sharing companies to capitalize on this trend.

Analyst Predictions

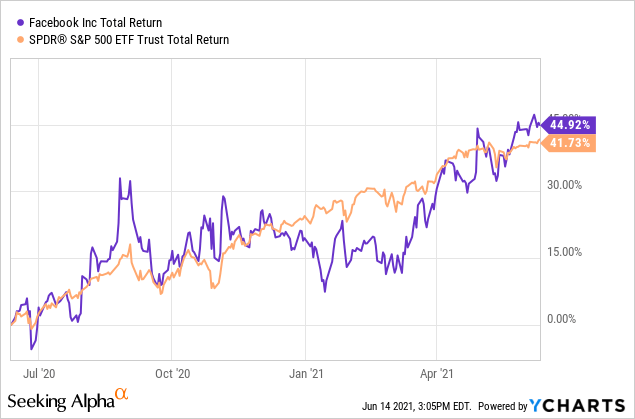

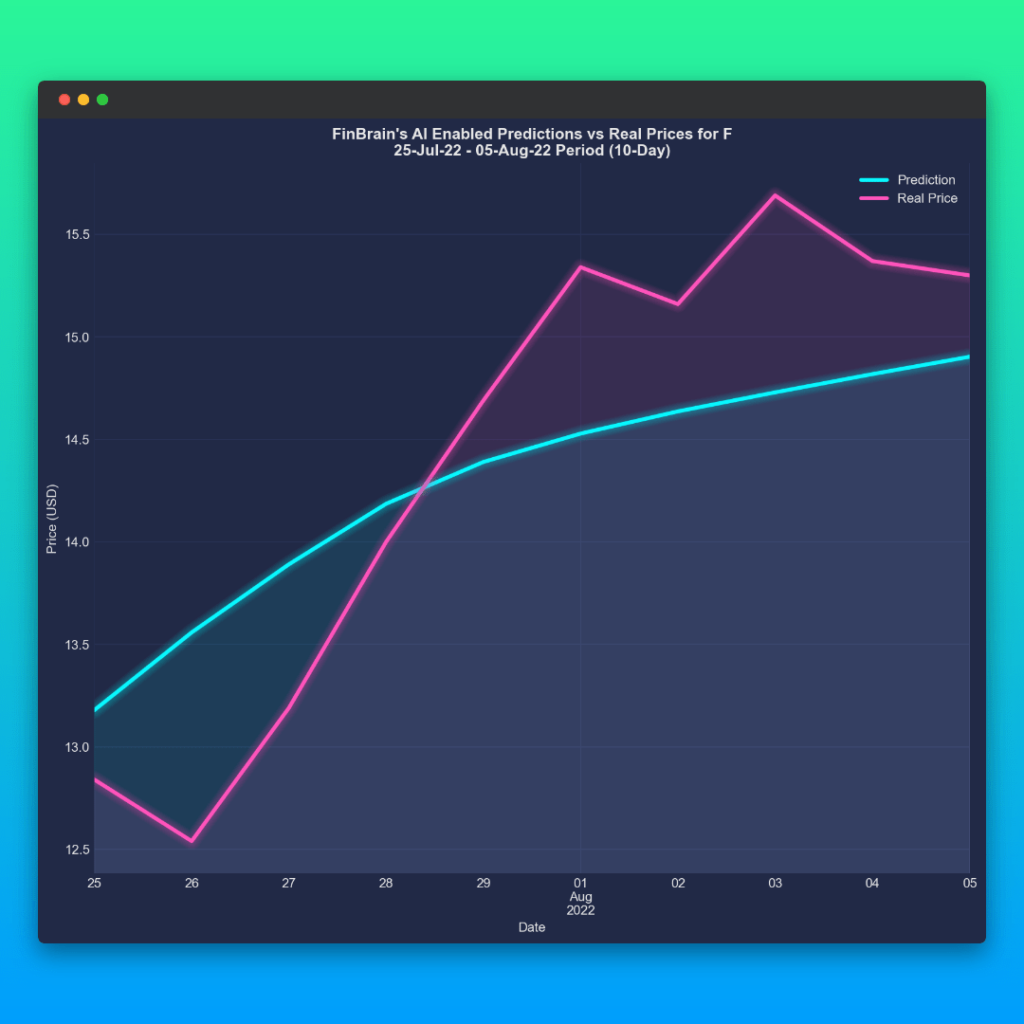

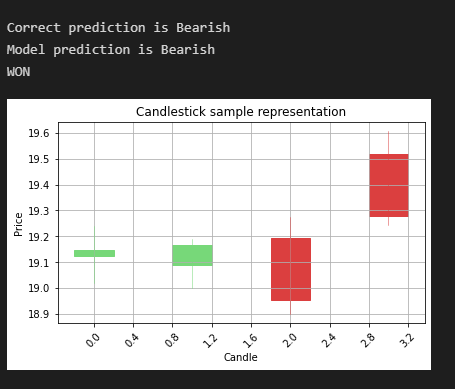

Analysts have varying predictions for Ford stock in 2025. Some analysts are optimistic about the company’s future, citing its strong brand, investment in EVs, and autonomous driving technology. Others are more cautious, expressing concerns about the competitive landscape and the potential impact of ride-sharing services.

- Bullish Predictions: Some analysts predict that Ford stock could reach $25-$30 per share by 2025. These analysts believe that the company’s investment in EVs and autonomous driving will drive growth in the coming years.

- Bearish Predictions: Other analysts predict that Ford stock could fall to $15-$20 per share by 2025. These analysts are concerned about the competitive landscape and the potential impact of ride-sharing services on the company’s revenue.

Key Factors to Consider

When evaluating Ford stock predictions, it is important to consider the following key factors:

- Economic Conditions: The overall economic conditions, including inflation, interest rates, and consumer spending, can significantly impact the automotive industry and Ford’s stock price.

- Competition: Ford faces intense competition from other automakers, both traditional and new entrants. The company’s ability to compete effectively will influence its future performance.

- Technological Innovation: Ford’s investment in EVs and autonomous driving technology will be crucial for its success in the coming years. The company’s ability to innovate and adapt to changing technologies will determine its long-term growth prospects.

- Regulatory Environment: Government regulations, such as fuel efficiency standards and emissions regulations, can impact the automotive industry. Ford must navigate the regulatory landscape effectively to ensure compliance and maintain profitability.

Conclusion

Ford stock predictions for 2025 vary widely, reflecting the uncertainties surrounding the automotive industry. However, the company’s strong brand, investment in EVs, and autonomous driving technology provide a solid foundation for future growth. By carefully considering the key factors discussed in this article, investors can make informed decisions about Ford stock. It is important to note that stock market predictions are inherently uncertain, and investors should always conduct their own due diligence before making investment decisions.

Closure

Thus, we hope this article has provided valuable insights into F Stock Prediction 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!