BLK LP Index 2030 Fund: A Comprehensive Guide to ESG Investing

Related Articles: BLK LP Index 2030 Fund: A Comprehensive Guide to ESG Investing

- Porsche Macan 2025 Vs 2023: A Comparison Of Two Generations

- The Open Golf 2025: A Glimpse Into The Future Of Golf

- How Many Days Till 2025: A Comprehensive Countdown

- National Senior Games 2025: A Celebration Of Active Aging

- What Will Happen To Tax Rates In 2025?

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to BLK LP Index 2030 Fund: A Comprehensive Guide to ESG Investing. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about BLK LP Index 2030 Fund: A Comprehensive Guide to ESG Investing

BLK LP Index 2030 Fund: A Comprehensive Guide to ESG Investing

Introduction

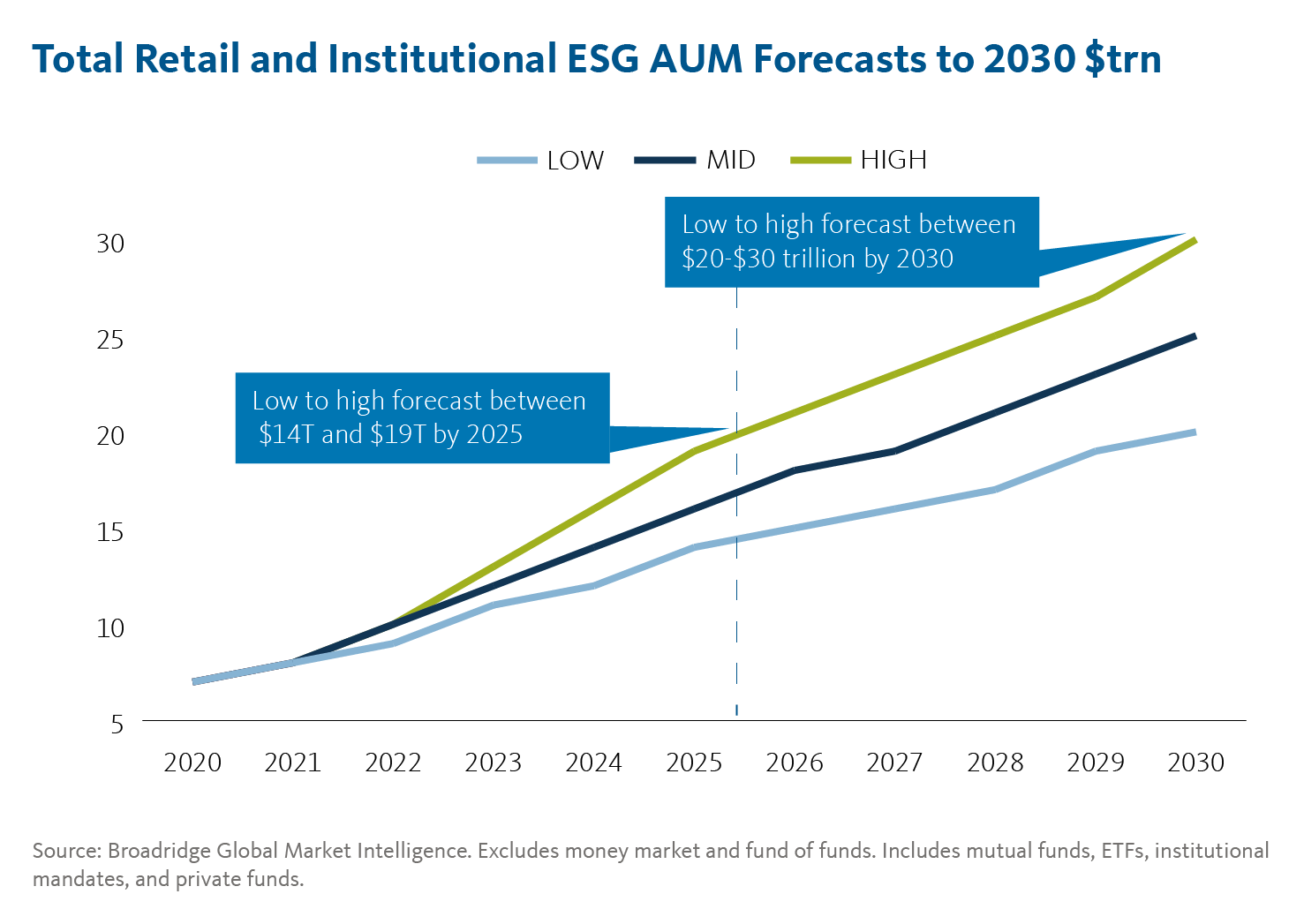

In the ever-evolving landscape of investing, environmental, social, and governance (ESG) factors are gaining increasing prominence. Investors are becoming more discerning, seeking investments that align with their values and contribute positively to society and the environment. The BLK LP Index 2030 Fund is a compelling option for investors seeking a diversified portfolio that integrates ESG considerations.

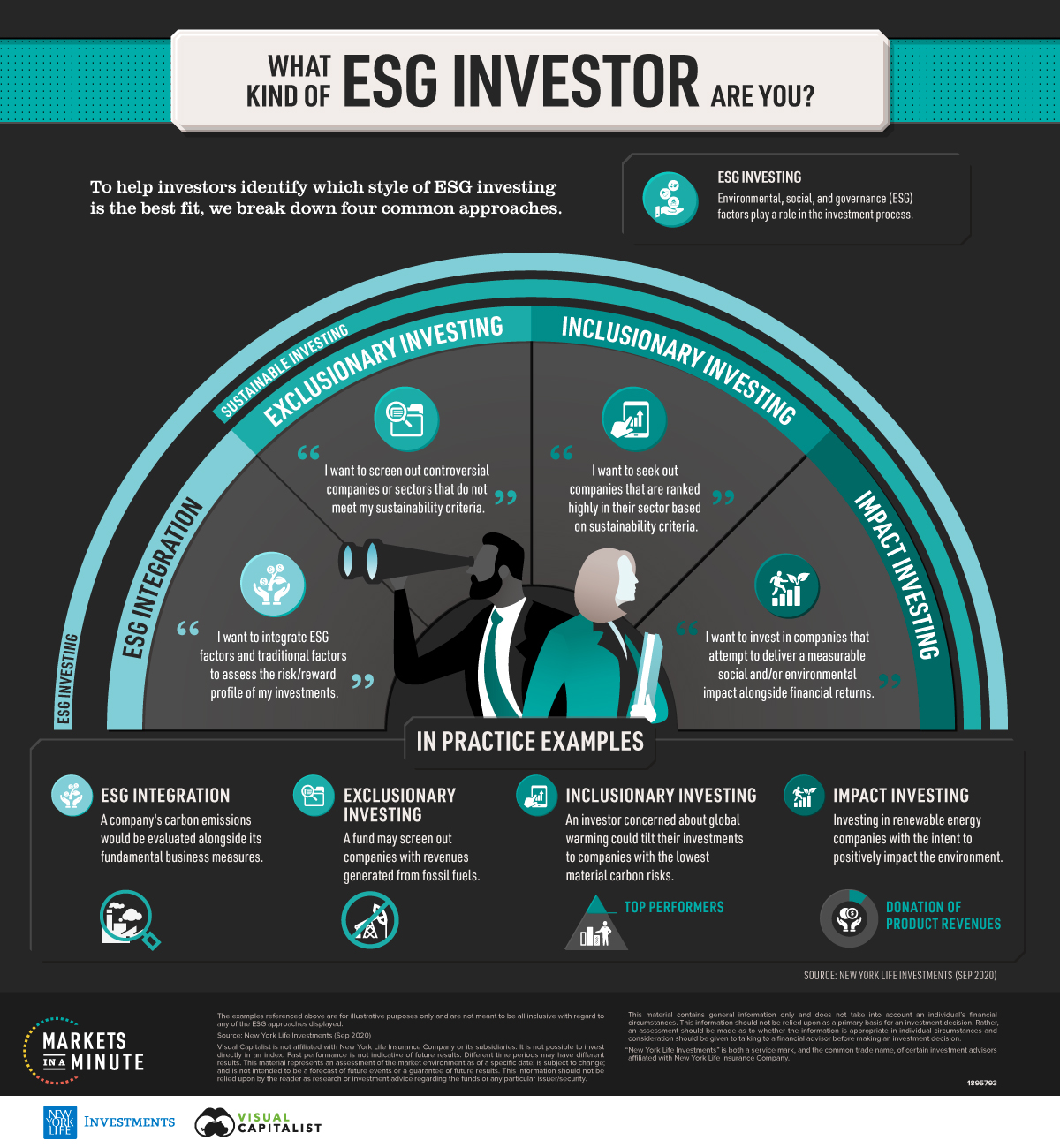

ESG Investing: A Primer

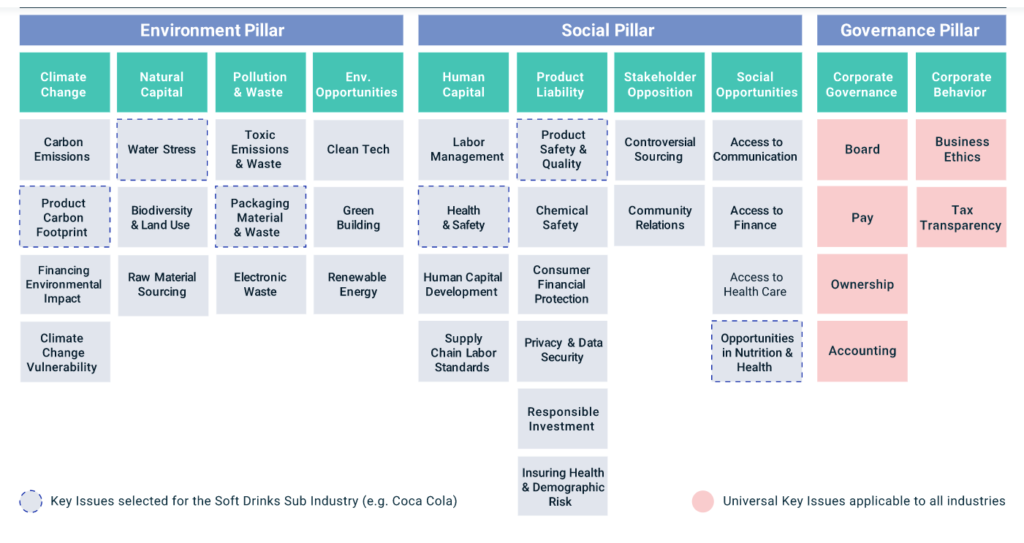

ESG investing involves considering the environmental, social, and governance factors of a company in addition to traditional financial metrics. These factors provide insights into a company’s long-term sustainability, resilience, and impact on stakeholders.

Environmental factors include a company’s carbon footprint, waste management practices, and water usage. Social factors encompass employee welfare, diversity and inclusion, and community engagement. Governance factors focus on board effectiveness, executive compensation, and risk management.

The BLK LP Index 2030 Fund

The BLK LP Index 2030 Fund is an actively managed exchange-traded fund (ETF) that invests in companies demonstrating strong ESG performance and alignment with the United Nations Sustainable Development Goals (SDGs). The fund’s objective is to provide long-term capital appreciation while promoting positive environmental and social outcomes.

Investment Strategy

The fund employs a multi-factor ESG screening process to identify companies that meet specific sustainability criteria. The fund’s investment universe comprises companies listed on the FTSE Global All Cap Index, which represents over 90% of global market capitalization.

The screening process evaluates companies based on their ESG scores, which are derived from a proprietary model developed by MSCI ESG Research. Companies must meet minimum ESG performance thresholds to be included in the fund’s portfolio.

Portfolio Construction

The fund’s portfolio is constructed to provide a diversified exposure to various industries and sectors. The fund’s top holdings include companies in technology, healthcare, consumer staples, and financials. The fund also invests in emerging market companies, which offer significant growth potential and alignment with SDGs.

Performance

Since its inception in 2020, the BLK LP Index 2030 Fund has outperformed the broader market. The fund has consistently delivered positive returns while maintaining a lower volatility profile compared to its peers.

Impact Reporting

The BLK LP Index 2030 Fund is committed to transparency and impact reporting. The fund publishes annual sustainability reports that provide investors with detailed insights into the fund’s ESG performance and impact on SDGs.

Fees and Expenses

The fund’s expense ratio is 0.50%, which is comparable to other ESG ETFs in the market. The fund’s fees cover the costs of management, administration, and marketing.

Suitability

The BLK LP Index 2030 Fund is suitable for investors seeking:

- Long-term capital appreciation

- ESG-aligned investments

- Diversification across industries and sectors

- Positive environmental and social impact

Conclusion

The BLK LP Index 2030 Fund is a compelling option for investors seeking a diversified portfolio that integrates ESG considerations. The fund’s rigorous ESG screening process, active management approach, and commitment to impact reporting provide investors with a comprehensive solution for responsible investing. By investing in the BLK LP Index 2030 Fund, investors can align their financial goals with their values and contribute to a more sustainable and equitable future.

Closure

Thus, we hope this article has provided valuable insights into BLK LP Index 2030 Fund: A Comprehensive Guide to ESG Investing. We hope you find this article informative and beneficial. See you in our next article!