Bitcoin Price Prediction 2025: $50,000 with a Detailed Analysis

Related Articles: Bitcoin Price Prediction 2025: $50,000 with a Detailed Analysis

- Lithium Price Prediction 2025: A Comprehensive Analysis

- 2025 Nissan Murano: A Comprehensive Review

- How Many Days Until February 1, 2025: A Comprehensive Countdown

- Project 2025: Homeland Security Watch

- 2025 Porsche Macan: A Glimpse Into The Future Of Compact Performance SUVs

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Bitcoin Price Prediction 2025: $50,000 with a Detailed Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Bitcoin Price Prediction 2025: $50,000 with a Detailed Analysis

Bitcoin Price Prediction 2025: $50,000 with a Detailed Analysis

Introduction

Bitcoin, the world’s leading cryptocurrency, has witnessed a remarkable journey since its inception in 2009. From humble beginnings as a niche digital asset, it has evolved into a global phenomenon, attracting institutional investors, retail traders, and everyday users alike. As the cryptocurrency market continues to mature, analysts and investors are eagerly anticipating the future trajectory of Bitcoin’s price. This article delves into the factors that will shape Bitcoin’s price in the years to come, providing a comprehensive analysis and a price prediction for 2025.

Factors Influencing Bitcoin’s Price

Numerous factors influence the price of Bitcoin, including:

-

Supply and Demand: The fundamental principle of economics dictates that the price of an asset is determined by its supply and demand. Bitcoin has a limited supply of 21 million coins, which is gradually released through mining. As demand for Bitcoin increases, its price tends to rise due to its scarcity.

-

Adoption and Usage: The widespread adoption and usage of Bitcoin as a payment method, store of value, and investment vehicle will drive its price upwards. As more merchants and consumers embrace Bitcoin, its utility and value proposition will increase, leading to higher demand and prices.

-

Institutional Investment: The entry of institutional investors, such as hedge funds and pension funds, into the Bitcoin market has significantly boosted its credibility and legitimacy. These institutions bring substantial capital and expertise, which can positively impact Bitcoin’s price.

-

Regulatory Environment: Government regulations and policies can have a significant impact on Bitcoin’s price. Favorable regulations that provide clarity and legal protection for Bitcoin can encourage adoption and investment, while negative regulations can hinder its growth.

-

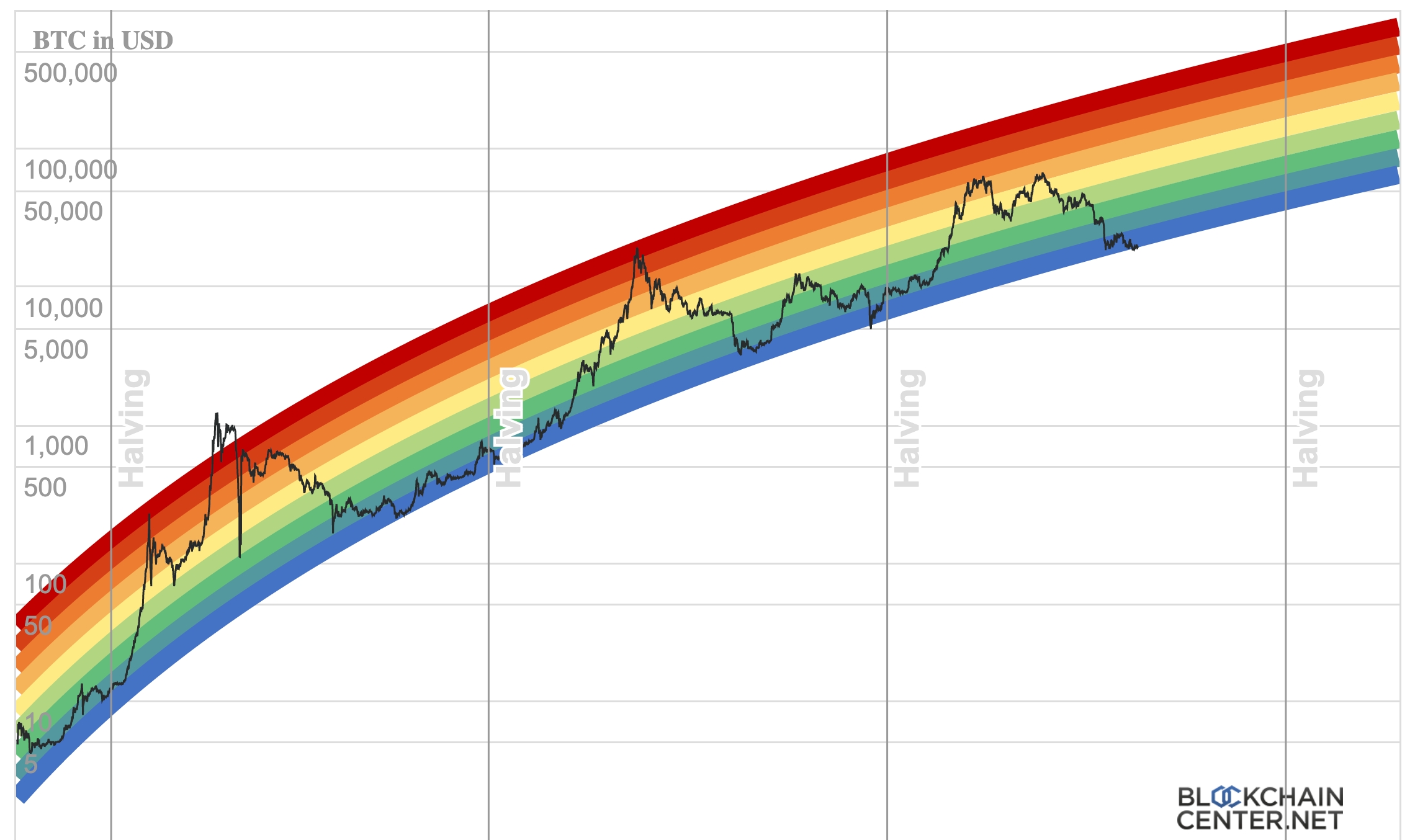

Halving Events: Bitcoin’s halving events, which occur approximately every four years, reduce the block reward for miners by half. These events limit the supply of new Bitcoins entering the market, potentially leading to price increases.

Historical Analysis and Trends

A review of Bitcoin’s historical price data reveals several key trends:

-

Exponential Growth: Bitcoin has experienced periods of exponential growth, with its price increasing by orders of magnitude over time. Major bull markets have been characterized by parabolic price movements.

-

Corrections and Bear Markets: Bitcoin’s price is also subject to corrections and bear markets, where its value undergoes significant declines. These periods often follow periods of rapid growth and are characterized by volatility and uncertainty.

-

Long-Term Trend: Despite short-term fluctuations, Bitcoin’s long-term price trend has been consistently upwards. This suggests that the underlying fundamentals of Bitcoin, such as its scarcity, utility, and adoption, are strong and continue to support its growth.

Bitcoin Price Prediction 2025: $50,000

Based on the analysis of the factors influencing Bitcoin’s price and the historical trends observed, a conservative price prediction for Bitcoin in 2025 is $50,000. This prediction is supported by the following reasons:

-

Continued Adoption and Usage: Bitcoin’s adoption and usage as a payment method and store of value are expected to continue growing in the years to come. As more businesses and individuals embrace Bitcoin, its demand will increase, driving its price upwards.

-

Institutional Investment: The trend of institutional investors entering the Bitcoin market is expected to continue. These institutions bring long-term capital and expertise, which can stabilize Bitcoin’s price and provide a solid foundation for growth.

-

Regulatory Clarity: Governments worldwide are becoming increasingly aware of Bitcoin and are exploring ways to regulate it. Clear and supportive regulations can provide a framework for Bitcoin’s growth and encourage adoption.

-

Halving Event in 2024: The next Bitcoin halving event is expected to occur in 2024. This event will reduce the supply of new Bitcoins entering the market, potentially leading to a price increase.

Risks and Considerations

While the price prediction of $50,000 for Bitcoin in 2025 is based on sound analysis, it is important to note that there are risks and considerations that could impact its accuracy:

-

Regulatory Uncertainty: Unfavorable or restrictive regulations can hinder Bitcoin’s growth and negatively impact its price.

-

Competition: The cryptocurrency market is constantly evolving, with new projects and technologies emerging. Competition from other cryptocurrencies or alternative assets could affect Bitcoin’s dominance and price.

-

Volatility: Bitcoin’s price is known for its volatility, and it can experience significant fluctuations in the short term. Investors should be prepared for price swings and should not invest more than they can afford to lose.

Conclusion

The Bitcoin price prediction for 2025 of $50,000 is based on a comprehensive analysis of the factors influencing Bitcoin’s price, historical trends, and future expectations. While there are risks and considerations to be aware of, the underlying fundamentals of Bitcoin suggest that it has the potential to continue its growth trajectory in the years to come. Investors should carefully consider their own risk tolerance and investment goals before making any decisions.

Closure

Thus, we hope this article has provided valuable insights into Bitcoin Price Prediction 2025: $50,000 with a Detailed Analysis. We thank you for taking the time to read this article. See you in our next article!