Best Target Date Funds 2025: A Comprehensive Guide

Related Articles: Best Target Date Funds 2025: A Comprehensive Guide

- If I Was Born In 2007, How Old Am I In 2025?

- How Long Until October 9, 2025?

- The 2024 Winter Olympics: A Comprehensive Overview

- 2025-2026 School Calendar: A Comprehensive Guide

- Lifepath Index 2025 Fund: A Comprehensive Overview

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Best Target Date Funds 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Best Target Date Funds 2025: A Comprehensive Guide

- 2 Introduction

- 3 Video about Best Target Date Funds 2025: A Comprehensive Guide

- 4 Best Target Date Funds 2025: A Comprehensive Guide

- 5 How to Choose a Target Date Fund

- 6 Target Date Funds vs. Other Retirement Investments

- 7 Conclusion

- 8 Closure

Video about Best Target Date Funds 2025: A Comprehensive Guide

Best Target Date Funds 2025: A Comprehensive Guide

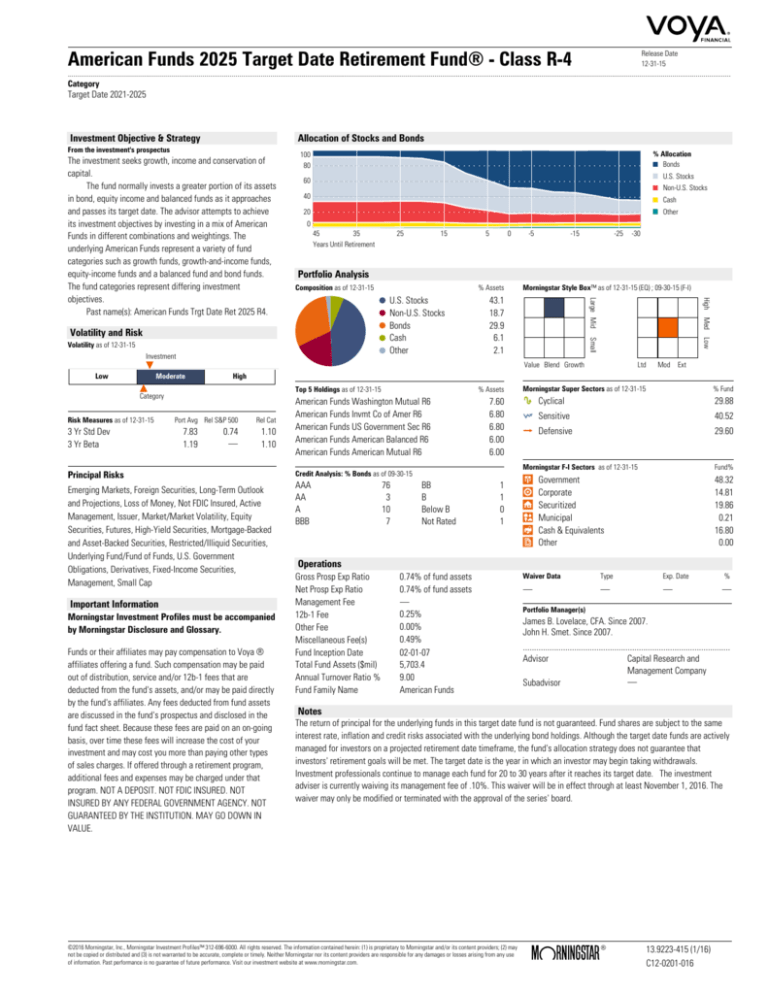

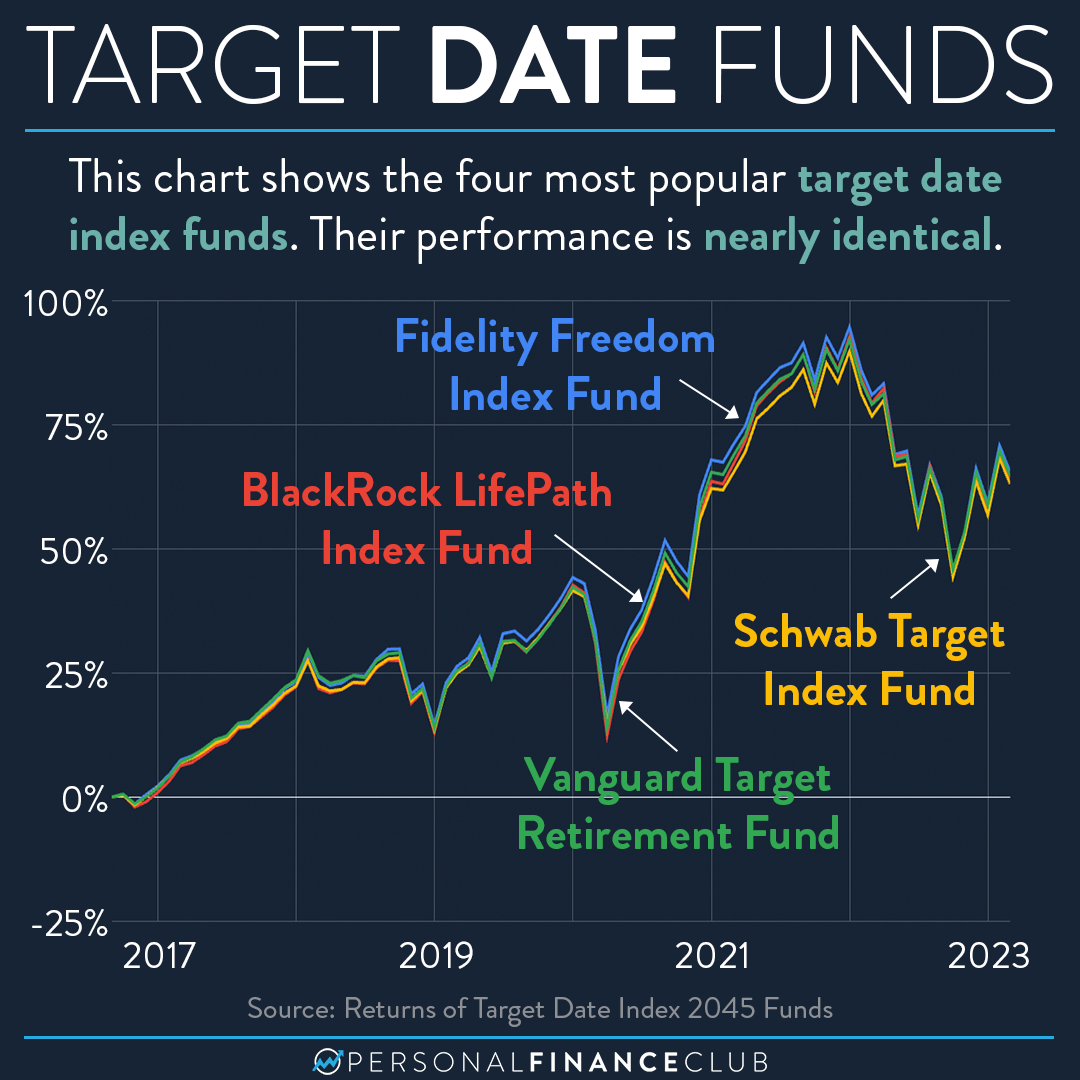

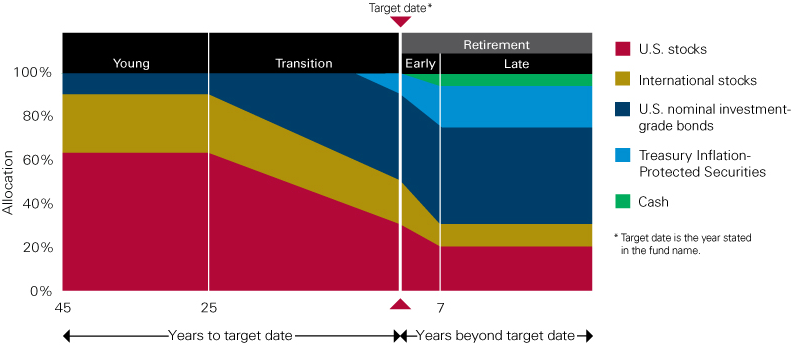

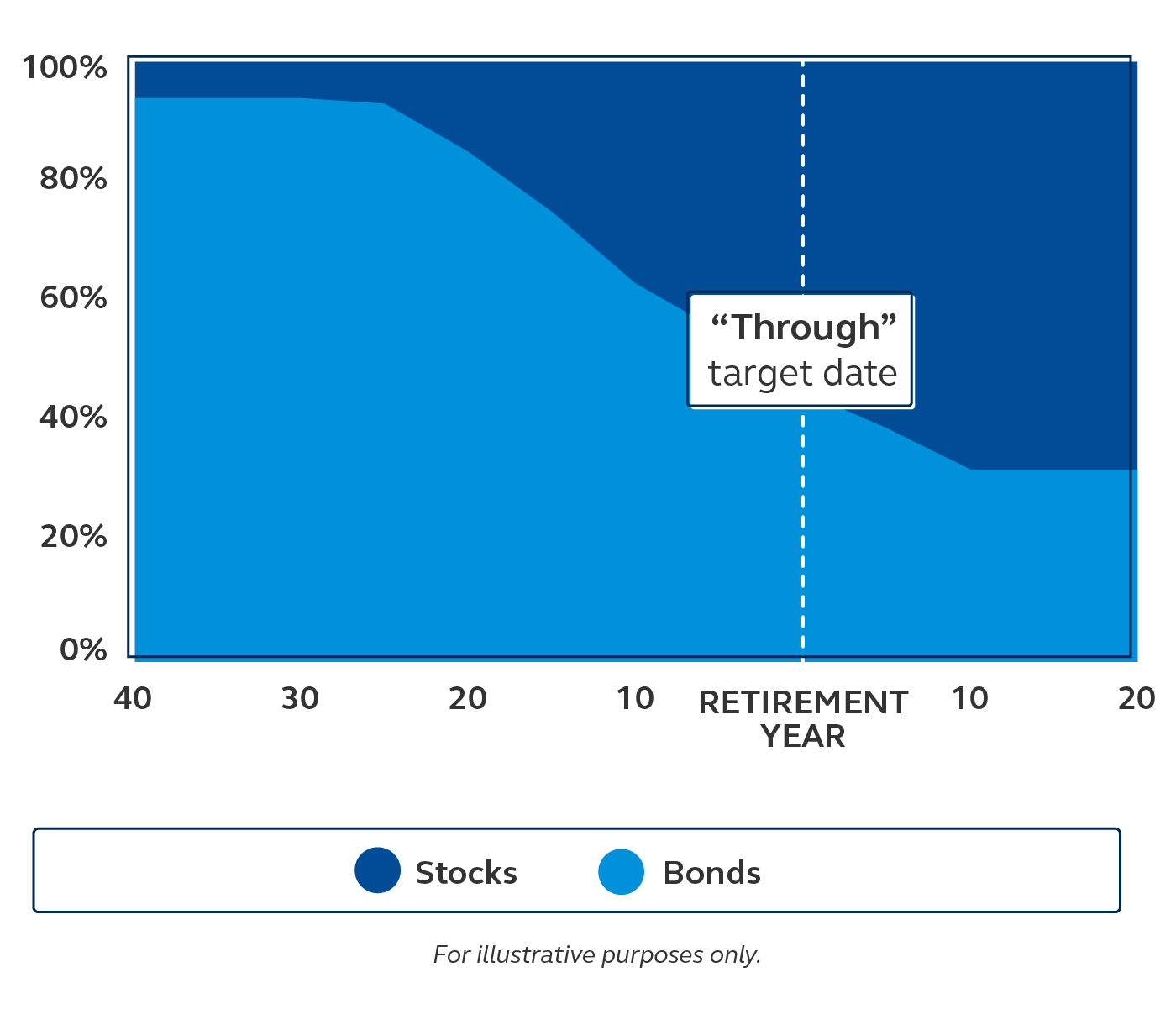

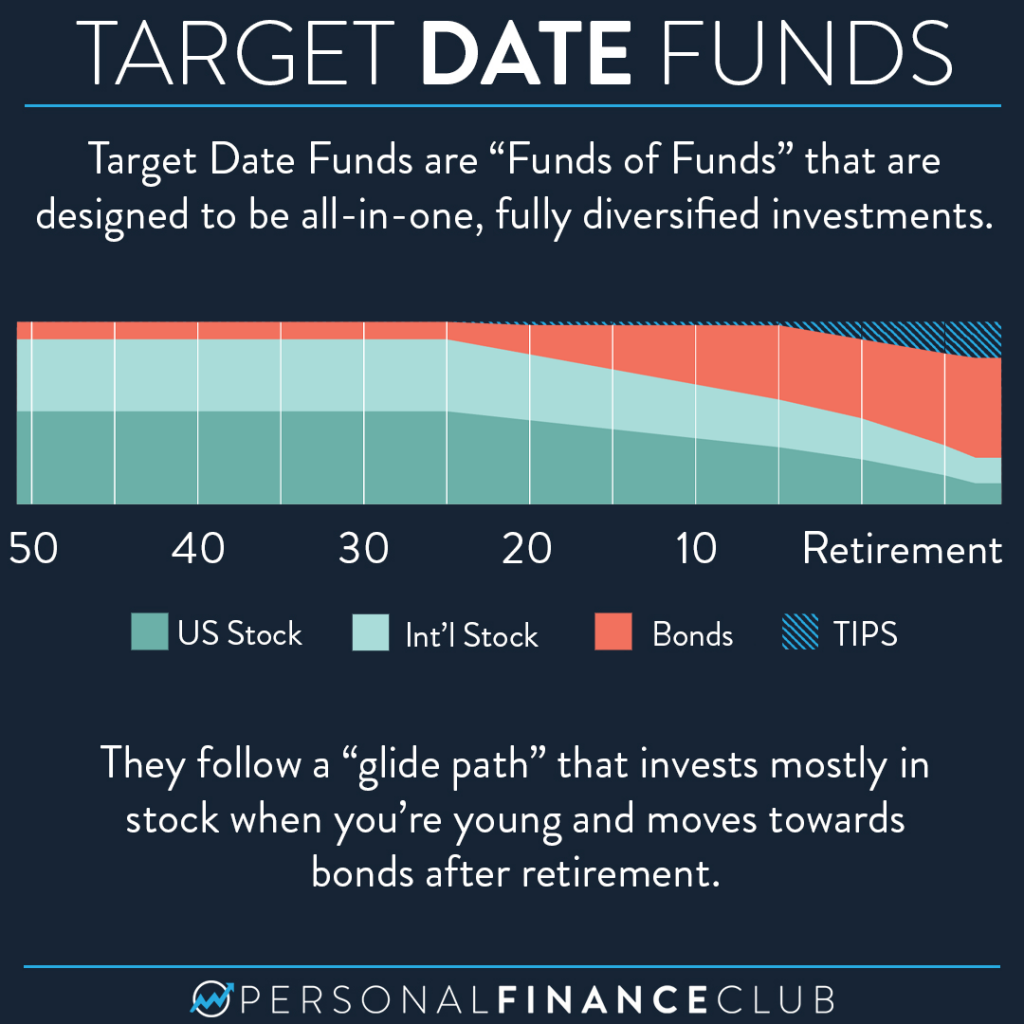

Target date funds (TDFs) are a type of mutual fund designed to simplify the investment process for investors nearing retirement. These funds are designed to adjust their asset allocation over time, gradually reducing exposure to risky assets like stocks and increasing exposure to less risky assets like bonds. This shift in asset allocation is intended to reduce the risk of losing money as investors approach retirement.

Target date funds are typically named after the year in which the fund manager expects the investor to retire. For example, a target date fund 2025 is designed for investors who plan to retire in 2025.

There are many different target date funds available, each with its own unique investment strategy. Some funds are more aggressive, with a higher allocation to stocks, while others are more conservative, with a higher allocation to bonds. It is important to choose a target date fund that is appropriate for your individual risk tolerance and investment goals.

Here are some of the best target date funds 2025:

- Vanguard Target Retirement 2025 Fund (VFFVX): This fund is a good option for investors who are looking for a low-cost, well-diversified target date fund. The fund has an expense ratio of 0.15%, and it invests in a mix of stocks, bonds, and other assets.

- Fidelity Freedom Index 2025 Fund (FFTHX): This fund is a good option for investors who are looking for a low-cost, index-tracking target date fund. The fund has an expense ratio of 0.12%, and it invests in a mix of index funds that track the performance of the US stock and bond markets.

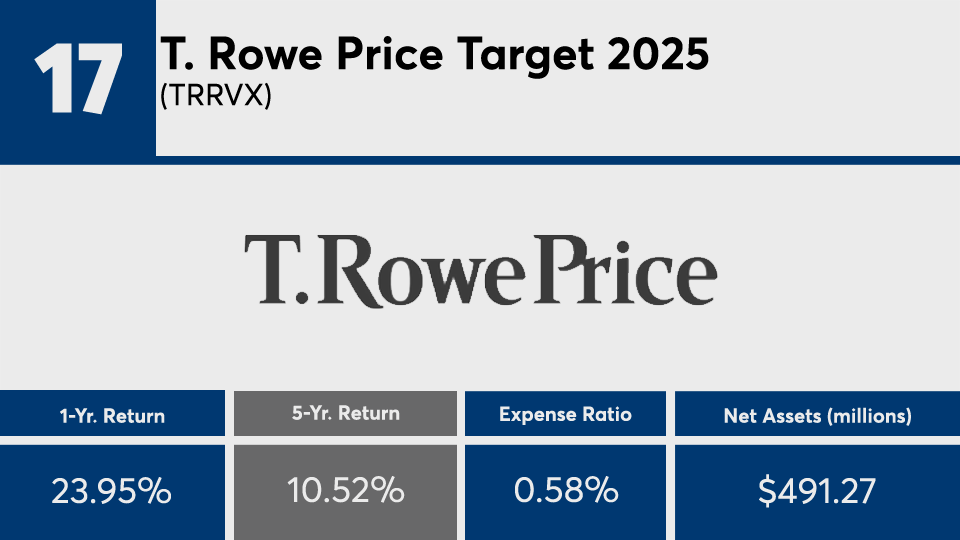

- T. Rowe Price Retirement 2025 Fund (TRRIX): This fund is a good option for investors who are looking for a target date fund with a strong track record. The fund has an expense ratio of 0.75%, and it has outperformed its benchmark by an average of 1% per year over the past 10 years.

It is important to note that target date funds are not a perfect investment. They can still lose money, and they may not be appropriate for all investors. It is important to speak with a financial advisor to determine if a target date fund is right for you.

How to Choose a Target Date Fund

When choosing a target date fund, there are several factors to consider:

- Your risk tolerance: How much risk are you willing to take? If you are nearing retirement, you may want to choose a fund with a more conservative asset allocation.

- Your investment goals: What are you hoping to achieve with your investment? Are you saving for retirement, or are you looking to grow your wealth?

- Your time horizon: How long do you plan to invest? If you are planning to retire in the next few years, you may want to choose a fund with a shorter time horizon.

- The fund’s fees: Target date funds have varying expense ratios. It is important to choose a fund with a low expense ratio to minimize the impact of fees on your investment returns.

Target Date Funds vs. Other Retirement Investments

Target date funds are just one of many different types of retirement investments available. Other options include:

- Individual stocks and bonds: Investing in individual stocks and bonds gives you more control over your investments, but it also requires more research and time.

- Mutual funds: Mutual funds are a good option for investors who want a diversified portfolio without having to pick individual stocks and bonds.

- Exchange-traded funds (ETFs): ETFs are similar to mutual funds, but they trade on exchanges like stocks. ETFs offer lower costs than mutual funds, but they may not be as diversified.

The best retirement investment for you will depend on your individual circumstances. It is important to speak with a financial advisor to determine which type of investment is right for you.

Conclusion

Target date funds can be a helpful tool for investors who are nearing retirement. These funds can help you simplify the investment process and reduce your risk of losing money. However, it is important to choose a target date fund that is appropriate for your individual risk tolerance and investment goals.

Closure

Thus, we hope this article has provided valuable insights into Best Target Date Funds 2025: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!