Best 2025 Target Date Funds for Retirement Planning

Related Articles: Best 2025 Target Date Funds for Retirement Planning

- Which IIT Will Conduct JEE Advanced 2026: A Comprehensive Analysis

- Big Ten Football Schedule: September 30, 2025

- Is There Going To Be A Solar Flare In 2025?

- Milwaukee To Host 2025 NHL Winter Classic

- Electronic Diversity Visa Entry Form 2025: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Best 2025 Target Date Funds for Retirement Planning. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Best 2025 Target Date Funds for Retirement Planning

Best 2025 Target Date Funds for Retirement Planning

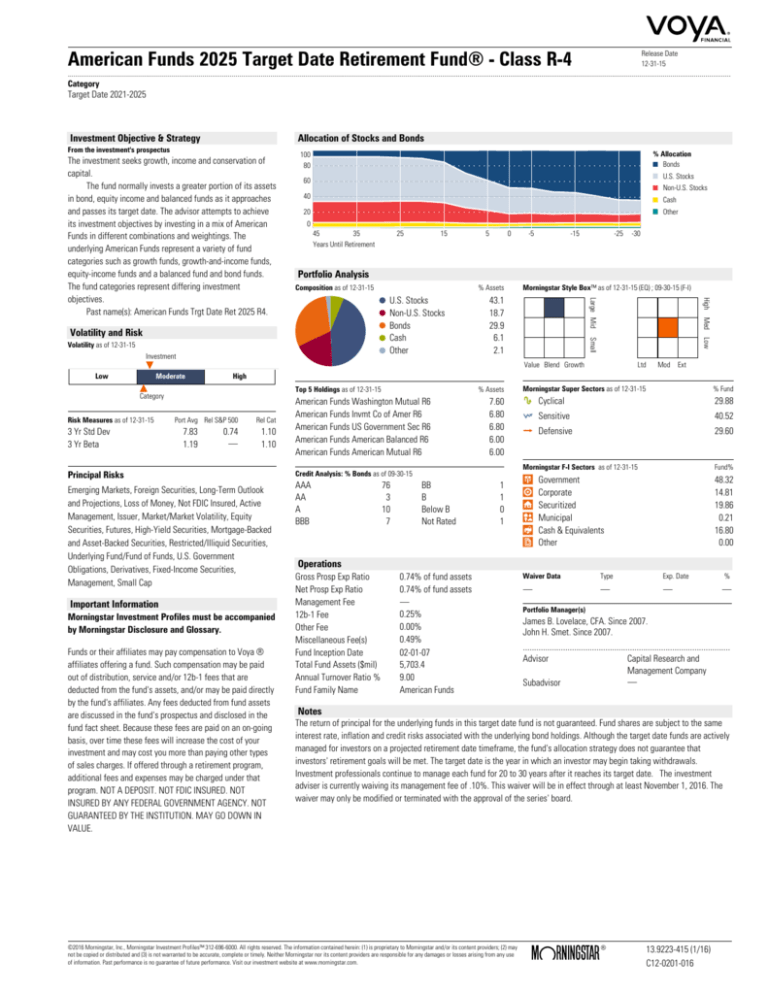

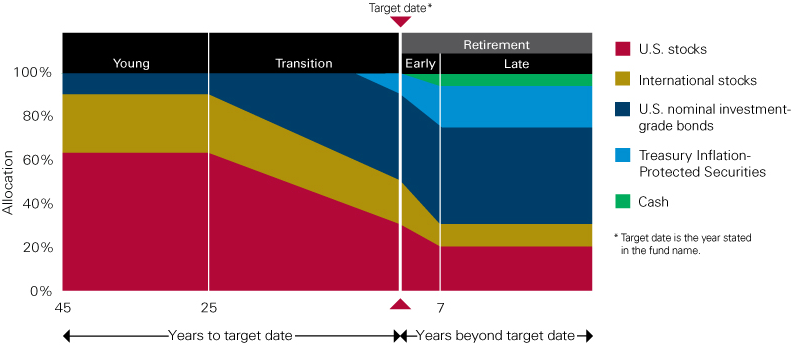

Target date funds are a type of mutual fund that automatically adjusts its asset allocation based on your expected retirement date. This makes them a popular choice for investors who want a hands-off approach to retirement planning.

Target date funds are typically invested in a mix of stocks, bonds, and other assets. The asset allocation of a target date fund will change over time as you get closer to your retirement date. For example, a target date fund for someone who is retiring in 2025 might have a higher allocation to stocks when they are younger and a higher allocation to bonds as they get closer to retirement.

There are many different target date funds available, so it’s important to compare them before you invest. Some of the factors you should consider include:

- Fees: Target date funds typically have lower fees than other types of mutual funds. However, it’s important to compare the fees of different funds before you invest.

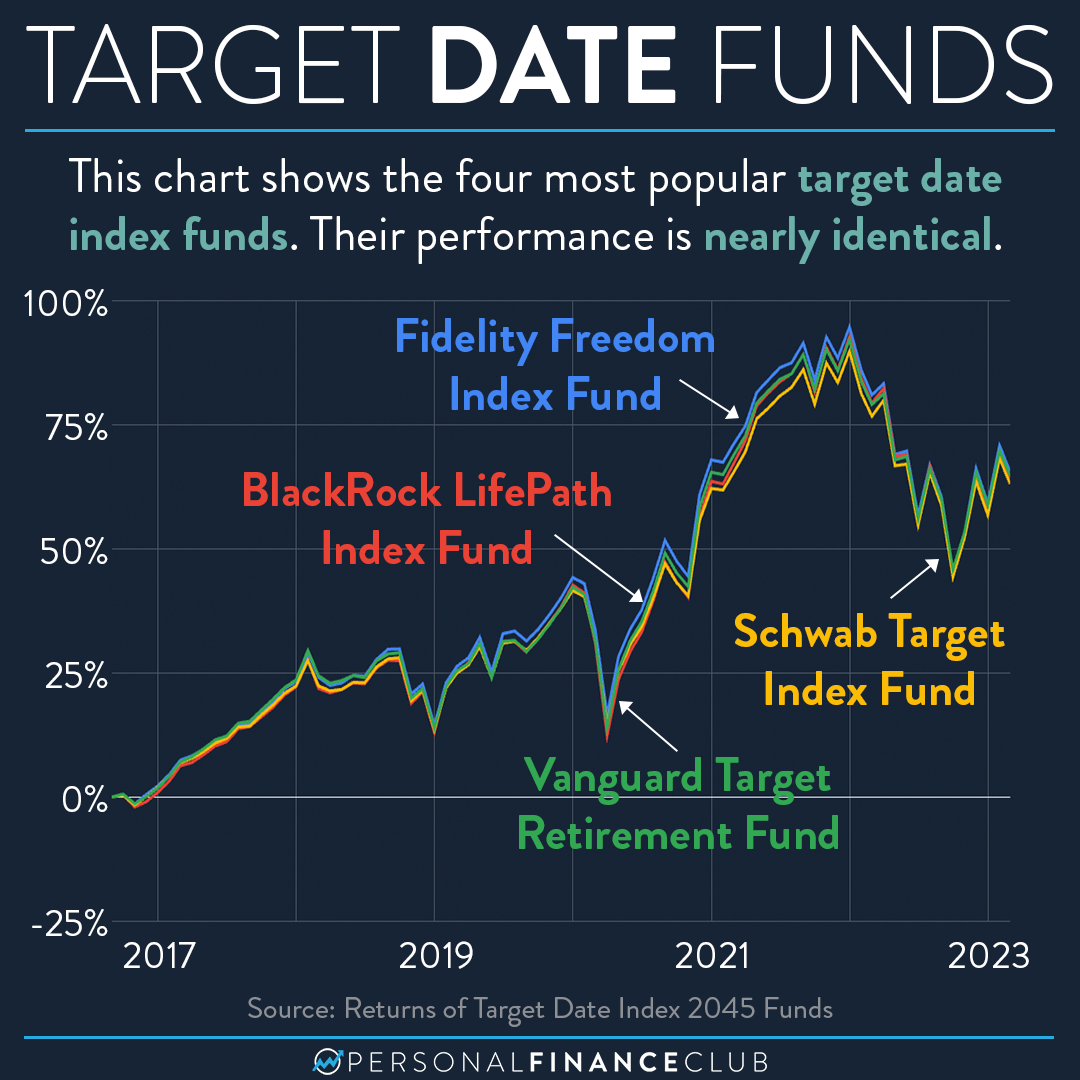

- Performance: The performance of a target date fund is determined by the performance of the underlying investments. It’s important to look at the historical performance of a fund before you invest.

- Risk tolerance: Target date funds are available with different risk levels. It’s important to choose a fund that is appropriate for your risk tolerance.

If you’re not sure which target date fund is right for you, you can talk to a financial advisor. A financial advisor can help you assess your risk tolerance and choose a fund that is appropriate for your individual needs.

Here are some of the best 2025 target date funds for retirement planning:

- Vanguard Target Retirement 2025 Fund (VFFVX)

- Fidelity Freedom Index 2025 Fund (FFFMX)

- T. Rowe Price Retirement 2025 Fund (TRRCX)

- American Funds Target Retirement 2025 Fund (AFTVX)

- Schwab Target Retirement 2025 Fund (SWTMX)

These funds have all performed well over the past 10 years and have low fees. They are also available in a variety of account types, including IRAs and 401(k)s.

How to Choose a Target Date Fund

When choosing a target date fund, it’s important to consider the following factors:

- Your age: Target date funds are designed for investors who are planning to retire in a specific year. It’s important to choose a fund that is appropriate for your age.

- Your risk tolerance: Target date funds are available with different risk levels. It’s important to choose a fund that is appropriate for your risk tolerance.

- Your investment goals: Target date funds can be used for a variety of investment goals, such as retirement, college savings, or a down payment on a house. It’s important to choose a fund that is aligned with your investment goals.

Once you’ve considered these factors, you can start comparing target date funds. Here are some of the things you should look for:

- Fees: Target date funds typically have lower fees than other types of mutual funds. However, it’s important to compare the fees of different funds before you invest.

- Performance: The performance of a target date fund is determined by the performance of the underlying investments. It’s important to look at the historical performance of a fund before you invest.

- Risk tolerance: Target date funds are available with different risk levels. It’s important to choose a fund that is appropriate for your risk tolerance.

If you’re not sure which target date fund is right for you, you can talk to a financial advisor. A financial advisor can help you assess your risk tolerance and choose a fund that is appropriate for your individual needs.

Closure

Thus, we hope this article has provided valuable insights into Best 2025 Target Date Funds for Retirement Planning. We appreciate your attention to our article. See you in our next article!