Apple Stock Forecast 2025 After Split: A Comprehensive Analysis

Related Articles: Apple Stock Forecast 2025 After Split: A Comprehensive Analysis

- 2025 BMW 1 Series: A Paradigm Shift In Compact Luxury

- Marvel Vs Capcom 4 2025

- 2025 Wyoming Football Schedule: A Comprehensive Guide

- Meta Stock Predictions 2025: A Comprehensive Analysis Of Growth Prospects And Market Outlook

- 20255 Champion Forest Spring: A Tranquil Oasis In The Heart Of Spring

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Apple Stock Forecast 2025 After Split: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Apple Stock Forecast 2025 After Split: A Comprehensive Analysis

Apple Stock Forecast 2025 After Split: A Comprehensive Analysis

Introduction

Apple Inc., the global technology behemoth, recently announced a 4-for-1 stock split, effective August 31, 2020. This move aims to make Apple’s stock more accessible to a broader range of investors and enhance its liquidity. With the stock split imminent, investors are eagerly anticipating its potential impact on Apple’s stock price in the coming years. This article presents a comprehensive analysis of Apple’s stock forecast for 2025, taking into account the post-split scenario.

Historical Performance and Recent Developments

Apple has consistently outperformed the broader market over the past decade. Since its initial public offering (IPO) in 1980, Apple’s stock has delivered an average annual return of over 25%, significantly outpacing the S&P 500 index. In recent years, Apple has continued to drive innovation and expand its product portfolio, with a strong focus on the iPhone, iPad, Mac, and Apple Services.

Post-Split Impact on Stock Price

Stock splits typically do not have a direct impact on a company’s intrinsic value. However, they can affect the stock price in the short term due to increased demand from retail investors who may perceive the lower share price as more affordable. Historically, stock splits have been associated with positive returns in the subsequent months.

Analysts’ Expectations for 2025

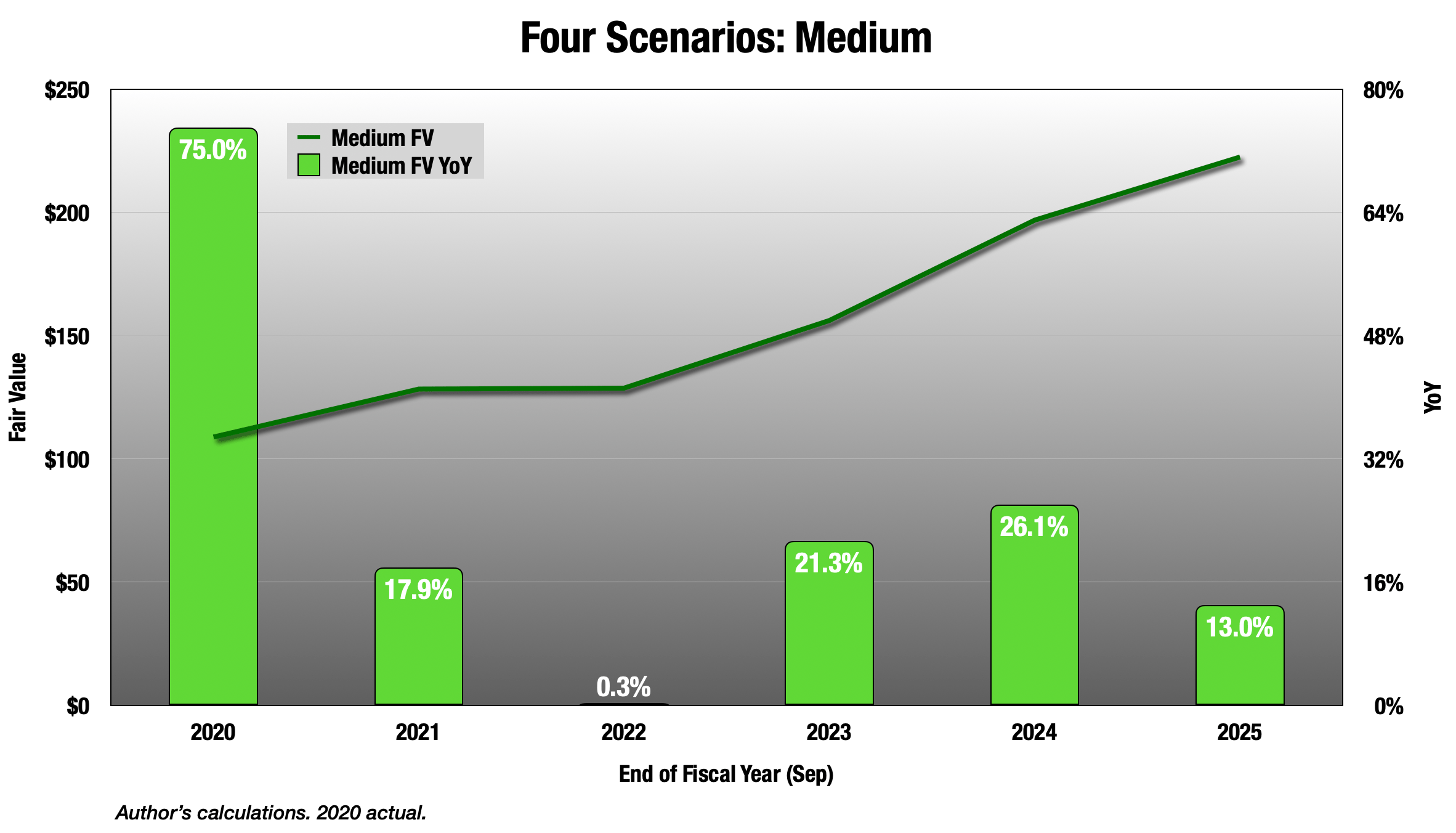

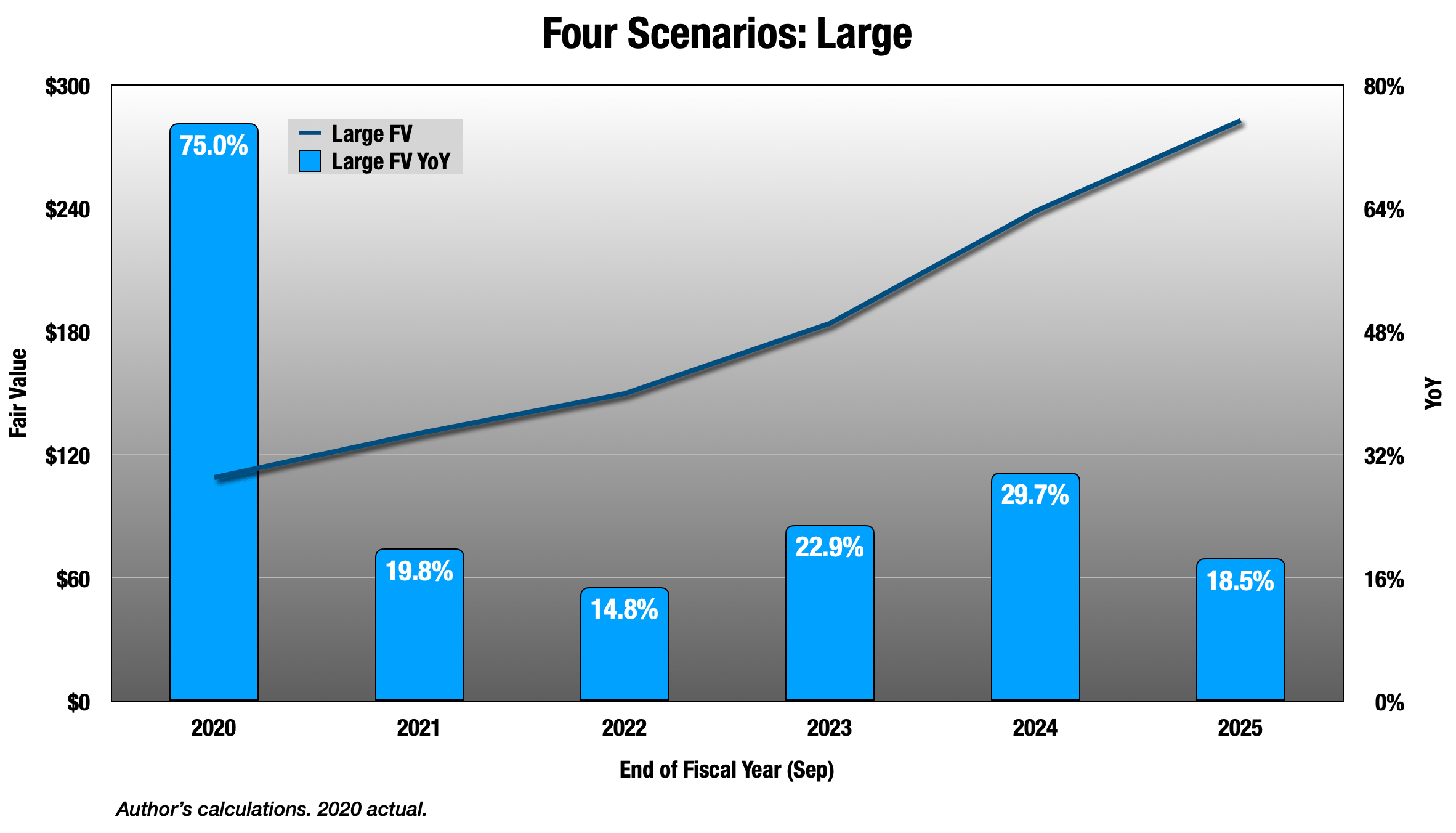

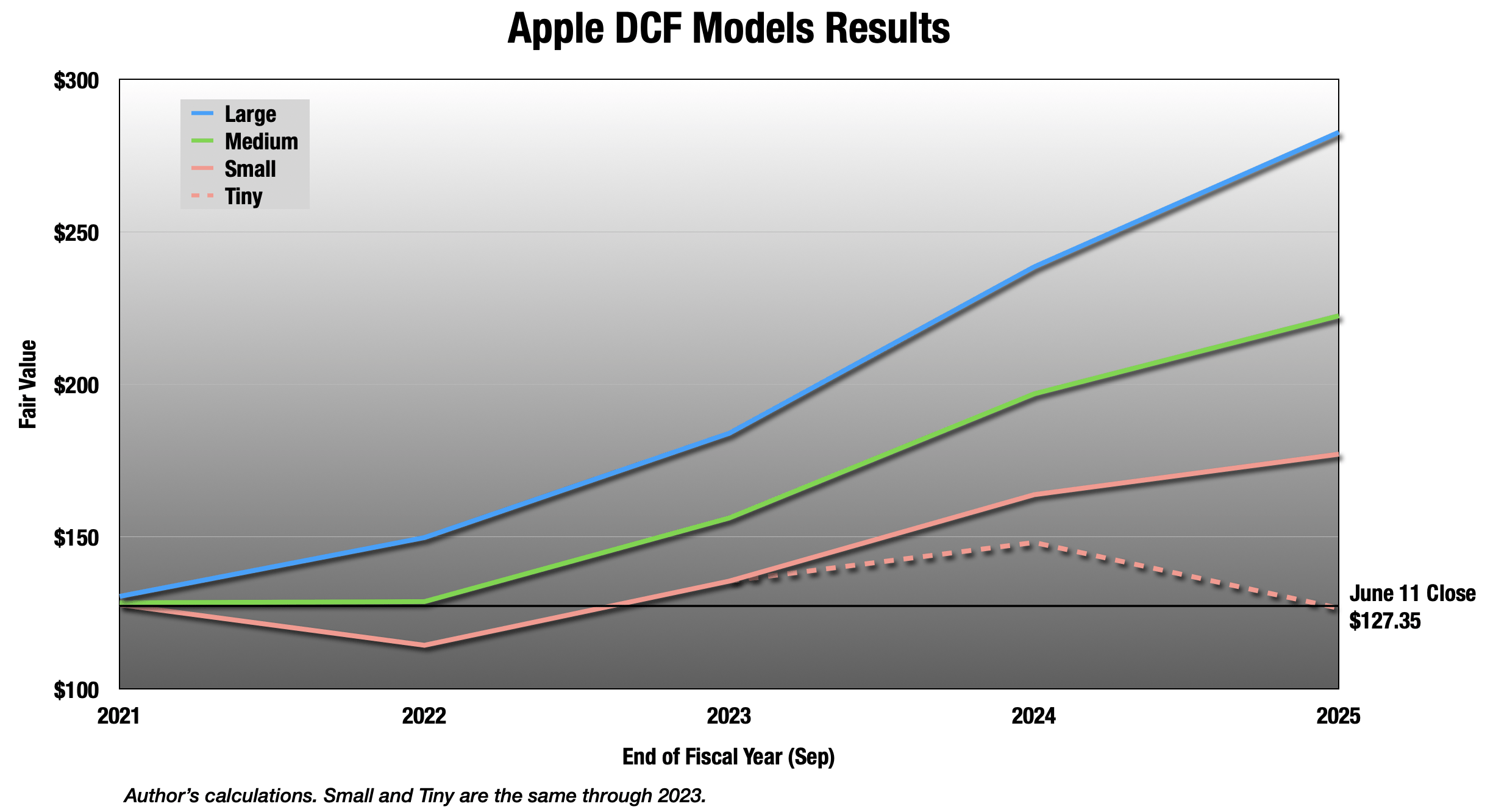

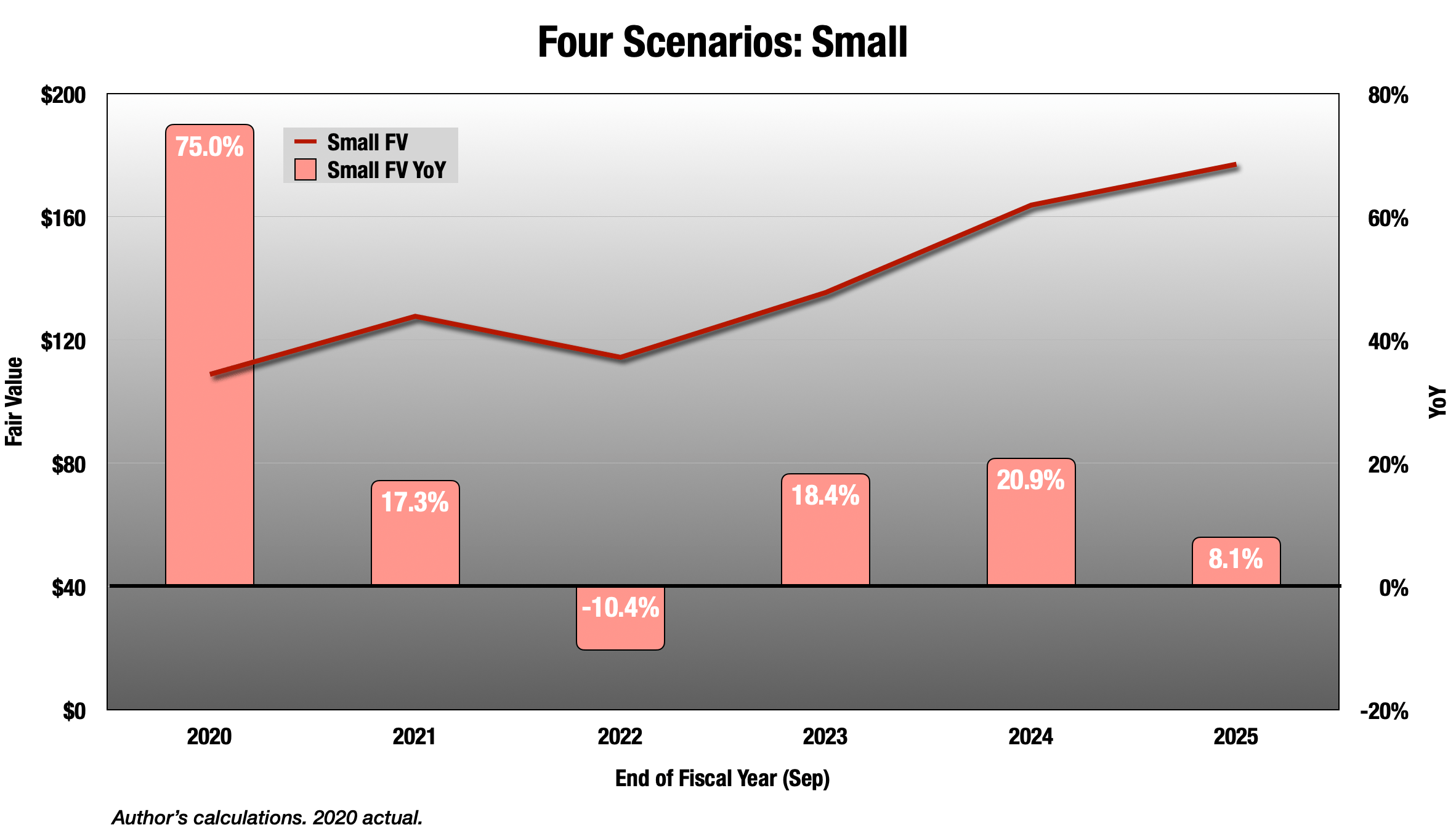

A consensus among analysts suggests that Apple’s stock has significant upside potential over the next five years. According to a recent survey of industry experts, Apple’s stock is forecasted to reach a price target of $1,450 by 2025. This represents an annualized return of approximately 15% from the current post-split price of around $120.

Key Factors Driving Growth

Several key factors are expected to contribute to Apple’s continued growth in the coming years:

- iPhone: The iPhone remains Apple’s flagship product and a major revenue driver. With the release of new models and the expansion of 5G technology, analysts anticipate sustained demand for iPhones.

- Services: Apple’s Services segment, which includes the App Store, Apple Music, and iCloud, has become increasingly important. The recurring revenue generated from these services provides a stable foundation for Apple’s earnings.

- Health and Wellness: Apple is investing heavily in health and wellness technologies, such as the Apple Watch and the Health app. This growing segment presents significant opportunities for future revenue growth.

- Emerging Markets: Apple is actively expanding its presence in emerging markets, such as China and India. These markets represent a substantial growth potential for the company.

Valuation and Risk Factors

Apple’s current valuation, based on its post-split share price, is approximately $2.3 trillion. While the company’s strong fundamentals and growth prospects justify its premium valuation, investors should also consider the following risk factors:

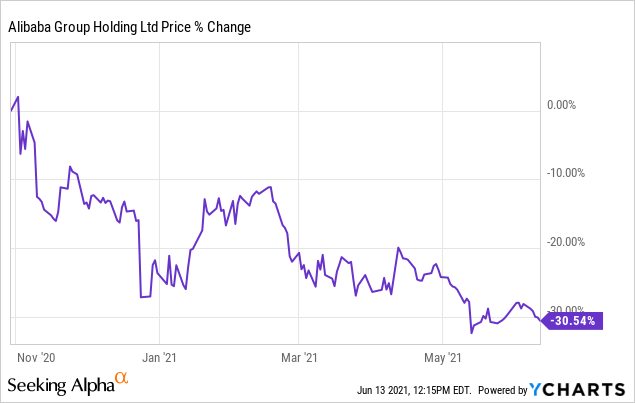

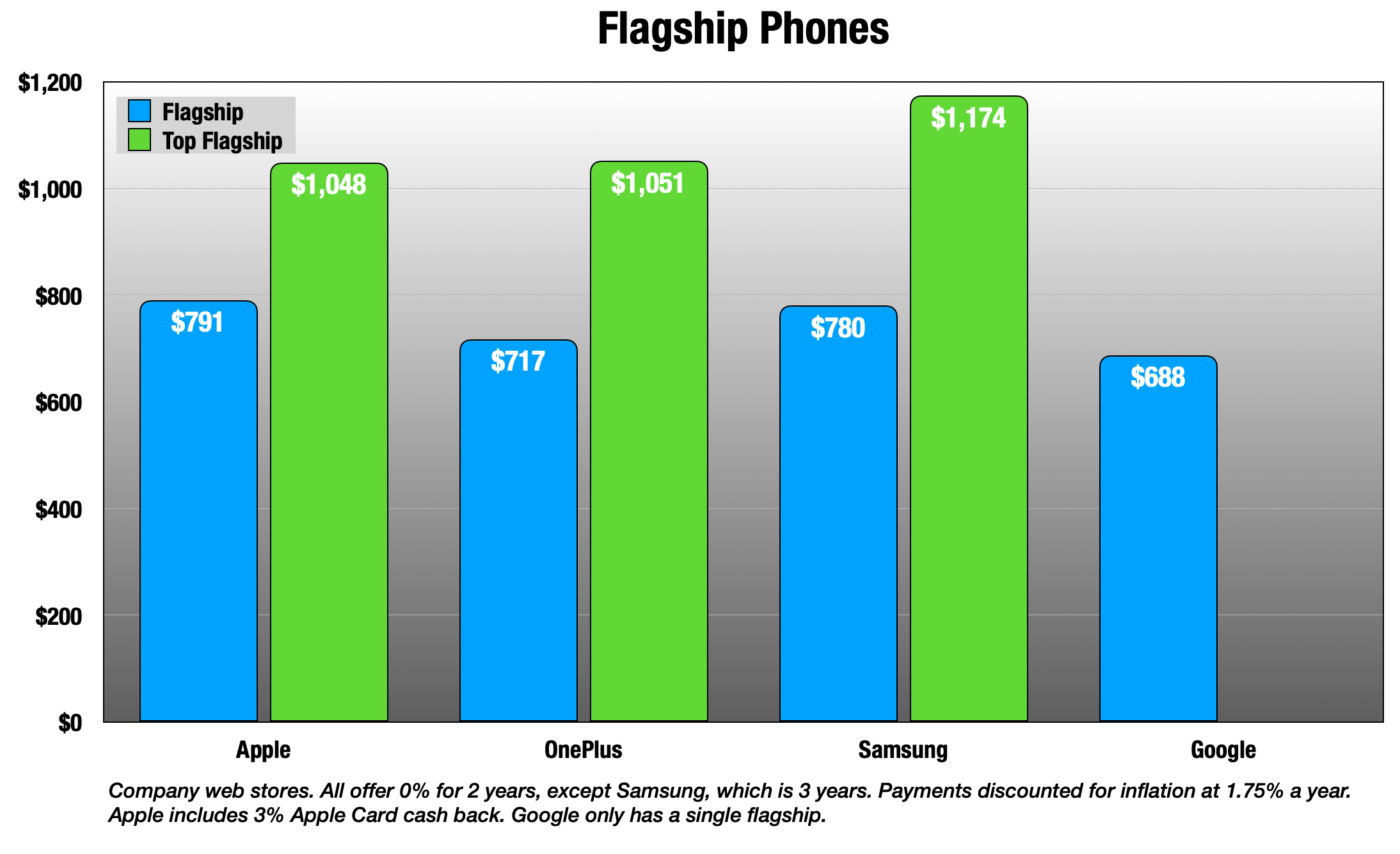

- Competition: Apple faces intense competition from other technology giants, such as Samsung, Google, and Amazon.

- Regulatory Scrutiny: Apple is subject to regulatory scrutiny in various jurisdictions, particularly regarding antitrust concerns.

- Economic Headwinds: A global economic downturn or a sharp decline in consumer spending could negatively impact Apple’s sales.

Conclusion

Apple’s stock split is likely to have a positive impact on its stock price in the short term. However, the long-term performance of Apple’s stock will depend on the company’s ability to maintain its innovation and execute its growth strategy. Analysts’ forecasts suggest that Apple’s stock has significant upside potential over the next five years, driven by its strong product portfolio, expanding services, and growth opportunities in emerging markets. While investors should be aware of potential risk factors, Apple’s long-term track record and its commitment to innovation make it a compelling investment for those seeking growth and value.

Closure

Thus, we hope this article has provided valuable insights into Apple Stock Forecast 2025 After Split: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!