2025 IRMAA Brackets for Married Filing Jointly

Related Articles: 2025 IRMAA Brackets for Married Filing Jointly

- 2025 Trucks: The Electric Revolution

- Virtus 2025: A Vision For The Future Of Europe

- 2025 Calendar June

- 2025 Toyota 4Runner: Unveiling A Legacy Of Adventure With Enhanced Efficiency

- Project 2025: NPR’s Ambitious Plan For The Future

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 IRMAA Brackets for Married Filing Jointly. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 IRMAA Brackets for Married Filing Jointly

2025 IRMAA Brackets for Married Filing Jointly

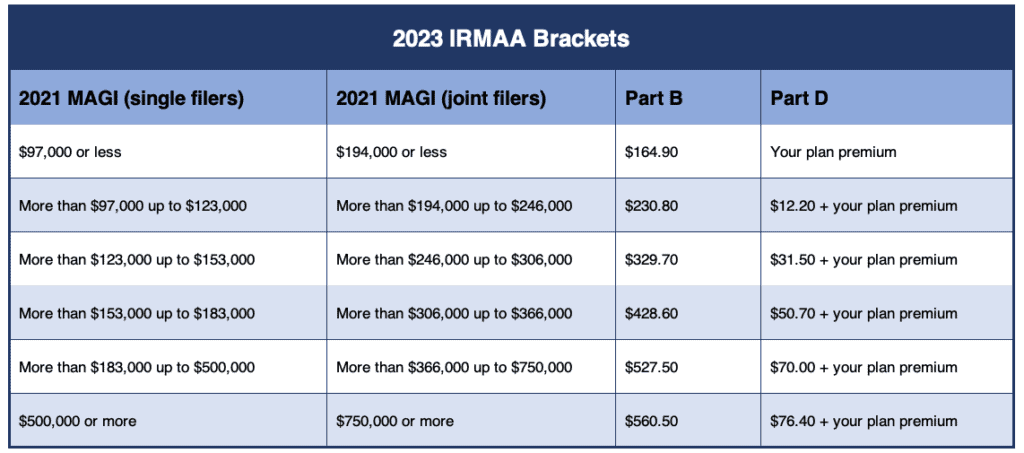

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge added to Medicare Part B and Part D premiums for individuals and couples with higher incomes. The IRMAA brackets are adjusted annually based on the Consumer Price Index (CPI). For 2025, the IRMAA brackets for married couples filing jointly are as follows:

| Modified Adjusted Gross Income (MAGI) | Part B Surcharge | Part D Surcharge |

|---|---|---|

| $194,000 – $224,000 | $135.50 | $36.50 |

| $224,000 – $254,000 | $189.60 | $52.30 |

| $254,000 – $284,000 | $243.70 | $68.10 |

| $284,000 – $314,000 | $297.80 | $83.90 |

| $314,000 – $344,000 | $351.90 | $99.70 |

| $344,000 – $374,000 | $406.00 | $115.50 |

| Over $374,000 | $460.10 | $131.30 |

How to Calculate Your MAGI

Your MAGI is your adjusted gross income (AGI) plus certain tax-exempt income, such as municipal bond interest and foreign income exclusions. To calculate your MAGI, follow these steps:

- Start with your AGI from your tax return.

- Add back any tax-exempt interest income.

- Add back any foreign income exclusions.

- Subtract any deductions for student loan interest, tuition, and fees.

Example

Suppose you are a married couple filing jointly with an AGI of $240,000. You also have $10,000 in tax-exempt municipal bond interest income. Your MAGI would be calculated as follows:

AGI: $240,000

+ Tax-exempt interest income: $10,000

= MAGI: $250,000Based on this MAGI, you would be subject to a Part B surcharge of $189.60 and a Part D surcharge of $52.30.

How to Avoid IRMAA Surcharges

There are several strategies you can use to avoid or reduce IRMAA surcharges:

- Reduce your income. This can be done by retiring, working part-time, or making charitable contributions.

- Increase your deductions. Deductions for student loan interest, tuition, and fees can reduce your MAGI.

- Delay claiming Social Security benefits. Social Security benefits are included in your MAGI. Delaying claiming benefits can reduce your IRMAA surcharge.

- Consider a Roth IRA. Contributions to a Roth IRA are not included in your MAGI.

Conclusion

The IRMAA brackets for 2025 are designed to ensure that individuals and couples with higher incomes contribute a fair share towards the cost of Medicare. By understanding the IRMAA brackets and implementing strategies to reduce your MAGI, you can minimize the impact of IRMAA surcharges on your Medicare premiums.

Closure

Thus, we hope this article has provided valuable insights into 2025 IRMAA Brackets for Married Filing Jointly. We appreciate your attention to our article. See you in our next article!