2025-2026 Federal Income Tax Brackets: A Comprehensive Guide

Related Articles: 2025-2026 Federal Income Tax Brackets: A Comprehensive Guide

- The New Dodge Ram 2025: A Beast Reborn

- January 2025 Calendar: A Comprehensive Overview

- 2025 50th St N: A Modern Masterpiece Residing In The Heart Of Sarasota

- How Many Days Till 2025: A Comprehensive Countdown

- When Is GATE 2025: Important Dates And Application Process

Introduction

With great pleasure, we will explore the intriguing topic related to 2025-2026 Federal Income Tax Brackets: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025-2026 Federal Income Tax Brackets: A Comprehensive Guide

2025-2026 Federal Income Tax Brackets: A Comprehensive Guide

Introduction

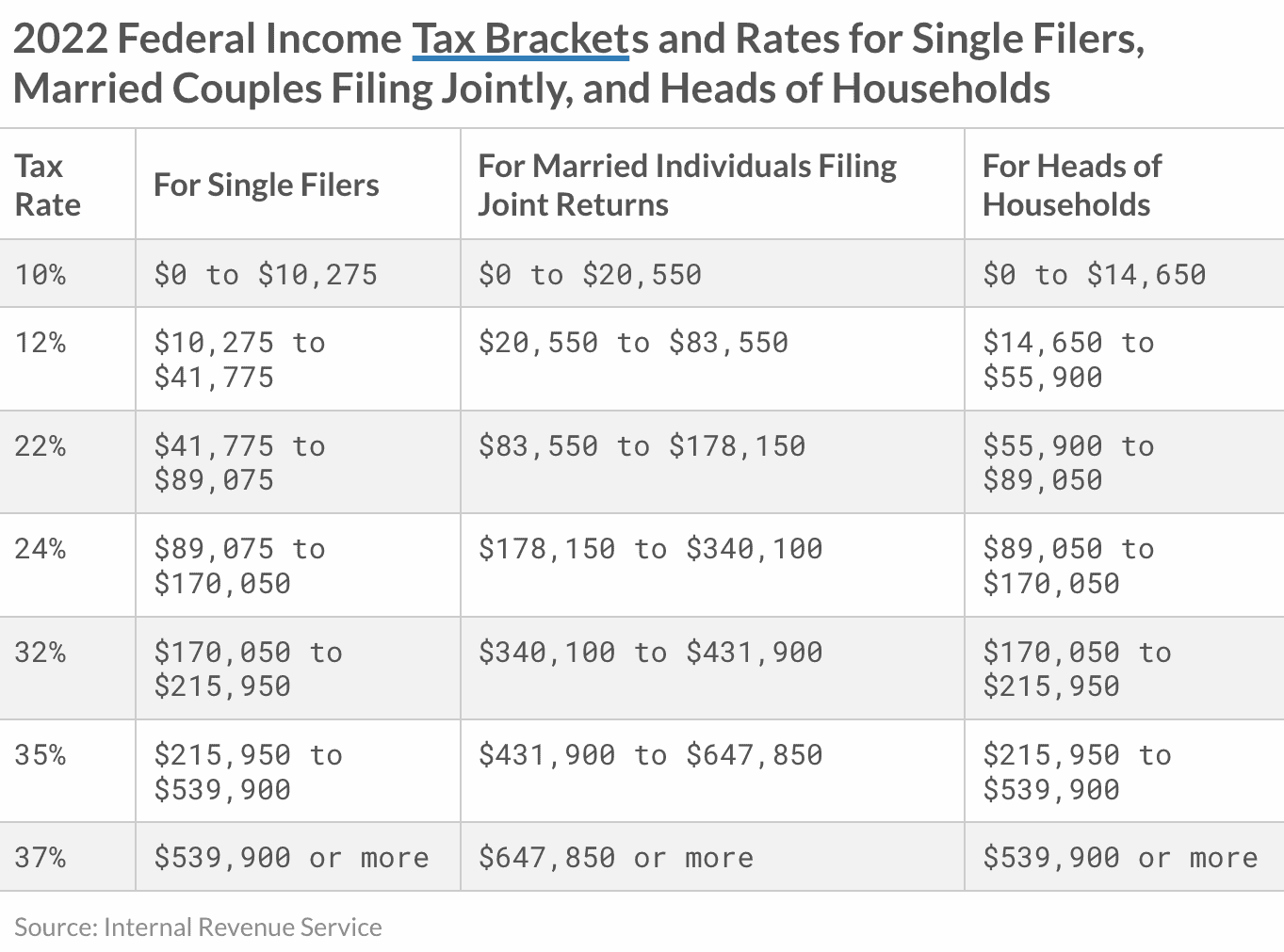

The United States federal income tax system is a progressive system, meaning that taxpayers with higher incomes pay a higher percentage of their income in taxes. The tax brackets for 2025-2026 have been released by the Internal Revenue Service (IRS), and they reflect a number of changes from the previous year. This article will provide a comprehensive overview of the 2025-2026 tax brackets, including the income ranges for each bracket, the tax rates for each bracket, and the standard deduction and personal exemption amounts.

Income Tax Brackets

The 2025-2026 federal income tax brackets are as follows:

| Filing Status | Taxable Income Range | Tax Rate |

|---|---|---|

| Single | $0 – $11,950 | 10% |

| Single | $11,951 – $44,725 | 12% |

| Single | $44,726 – $89,450 | 22% |

| Single | $89,451 – $178,900 | 24% |

| Single | $178,901 – $238,800 | 32% |

| Single | $238,801 – $539,900 | 35% |

| Single | $539,901 – $1,077,350 | 37% |

| Single | Over $1,077,350 | 39.6% |

| Married Filing Jointly | $0 – $23,900 | 10% |

| Married Filing Jointly | $23,901 – $89,450 | 12% |

| Married Filing Jointly | $89,451 – $178,900 | 22% |

| Married Filing Jointly | $178,901 – $357,750 | 24% |

| Married Filing Jointly | $357,751 – $476,700 | 32% |

| Married Filing Jointly | $476,701 – $1,077,350 | 35% |

| Married Filing Jointly | $1,077,351 – $2,154,700 | 37% |

| Married Filing Jointly | Over $2,154,700 | 39.6% |

| Head of Household | $0 – $19,900 | 10% |

| Head of Household | $19,901 – $79,550 | 12% |

| Head of Household | $79,551 – $162,550 | 22% |

| Head of Household | $162,551 – $325,150 | 24% |

| Head of Household | $325,151 – $446,550 | 32% |

| Head of Household | $446,551 – $1,077,350 | 35% |

| Head of Household | $1,077,351 – $1,353,400 | 37% |

| Head of Household | Over $1,353,400 | 39.6% |

Standard Deduction and Personal Exemption

The standard deduction is a specific amount of income that you can deduct from your taxable income before calculating your taxes. The personal exemption is a specific amount of income that you can exempt from taxation for each dependent. The standard deduction and personal exemption amounts for 2025-2026 are as follows:

| Filing Status | Standard Deduction | Personal Exemption |

|---|---|---|

| Single | $13,850 | $0 |

| Married Filing Jointly | $27,700 | $0 |

| Head of Household | $20,800 | $0 |

Conclusion

The 2025-2026 federal income tax brackets reflect a number of changes from the previous year. These changes include an increase in the standard deduction and a decrease in the personal exemption. Taxpayers should be aware of these changes when preparing their taxes for 2025 and 2026.

Closure

Thus, we hope this article has provided valuable insights into 2025-2026 Federal Income Tax Brackets: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!